Once a buzzword, Generative AI is now a strategic imperative—especially in healthcare insurance. With the market expected to grow at an impressive 33.2% CAGR through 2032, the role of generative AI in driving innovation and operational efficiency is only just beginning to unfold.

Healthcare enterprises are quickly recognizing this shift. They’re moving beyond experimentation to real-world execution—leveraging AI not just to automate, but to innovate, differentiate, and enhance member engagement. From eliminating administrative bottlenecks to delivering hyper-personalized experiences, Generative AI is no longer optional—it’s a critical driver of success in today’s healthcare insurance landscape.

In this blog, we will look into the game-changing use cases of generative AI in healthcare insurance, and highlight how AVIZVA’s AI-powered product ecosystem is uniquely designed to help enterprises lead this transformation with confidence.

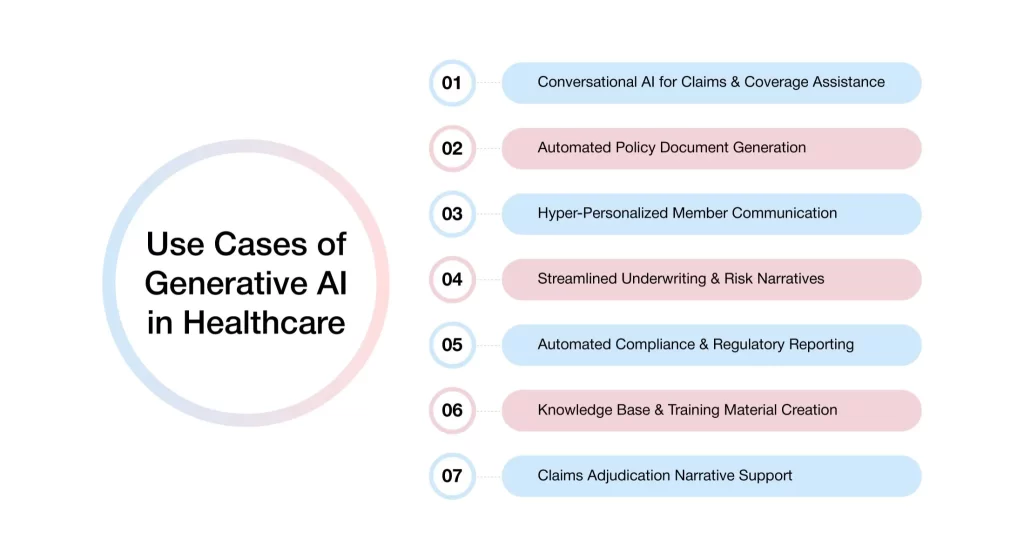

What Are The Use Cases Of Generative AI In Healthcare Insurance?

Generative AI in healthcare industry is transforming operations with its diverse applications. From improving member experience to streamlining administrative processes, it’s driving operational efficiency and better health outcomes across the board. The following are generative AI use cases in healthcare.

1. Conversational AI for Claims & Coverage Assistance

Navigating insurance can often be a frustrating experience for policyholders, particularly when dealing with complex claim scenarios or understanding the nuances of coverage. Conversational AI presents a transformative solution, offering round-the-clock virtual assistants that can handle these challenges effectively.

These assistants understand medical and insurance terminology, enabling them to :

- Answer queries on benefits, deductibles, and out-of-pocket limits: Conversational AI can instantly retrieve and present detailed policy information. It uses natural language processing to understand and respond to member inquiries accurately. This reduces the need for human agents, providing members with immediate and precise answers at any time.

- Walk members through the claims submission or appeals process: AI-driven virtual assistants guide members step-by-step through complex claims or appeals procedures, offering tailored instructions based on the individual’s specific situation. By automating this process, health insurers ensure consistency, reduce human error, and expedite processes, which in turn improves the overall customer experience.

- Reduce wait times while enhancing customer satisfaction: With AI handling routine inquiries and tasks, policyholders experience minimal wait times. The system is available 24/7 to assist with their needs. This leads to quicker response times, higher customer satisfaction, and more effective resource allocation for insurance companies.

The result? A self-service experience that delivers quick, accurate responses tailored to each member’s needs. This human-like interaction enhances efficiency and ensures a seamless experience for policyholders.

2. Automated Policy Document Generation

Creating, updating, and managing policy documentation has traditionally been a time-consuming task. Generative AI now enables insurers to automatically generate tailored documents at scale, ensuring speed, accuracy, and compliance.

- Customized plan guides and Explanation of Benefits (EOBs): These documents help members clearly understand their plan details, coverage limits, and out-of-pocket costs. Automated generation ensures every document is personalized, accurate, and delivered without delays.

- Onboarding kits for new members and employer groups: Onboarding kits and benefit overviews are automatically compiled with relevant plan details, enrollment steps, and contact information. This reduces administrative effort and ensures a seamless onboarding experience for all stakeholders.

- Policy summaries that adapt to regulatory updates: Whenever policy terms or regulatory requirements change, AI in insurance automatically updates summaries to reflect the latest information. This keeps insurers compliant while minimizing the risk of outdated or inconsistent documentation.

These documents are generated in real time, multilingual when required, and always aligned with regulatory standards. The result? It eliminates bottlenecks, formatting errors, and manual rework.

3. Hyper-Personalized Member Communication

Mass emails and generic messages no longer meet the expectations of today’s healthcare members. By making interactions context-aware and actionable, insurers can guide members through coverage navigation, preventive care, plan recommendations, and network updates – creating a more personalized, engaging, and trust-driven experience.

- Send timely care reminders and preventive nudges: AI analyzes historical data and health records to identify when members are due for screenings, checkups, or vaccinations. These proactive reminders improve preventive care adherence and reduce long-term healthcare costs.

- Generate personalized plan recommendations: Based on member usage patterns, health conditions, and eligibility, AI can suggest the most suitable plans during renewal or life changes. This ensures better plan alignment, reduces confusion, and improves member satisfaction.

- Analyze member impact and suggest notifications : Generative AI in healthcare can analyze claims data and network updates to identify situations that may impact members. It can then generate personalized alerts and recommendations, which can be delivered through integrated communication channels, helping members stay financially aware, prepared, and informed—reducing surprise bills and improving engagement.

What does that translate to? Informed, engaged members who feel supported throughout their journey without adding to the workload of administrative teams.

4. Streamlined Underwriting & Risk Narratives

Underwriting remains one of the most data-intensive and judgment-driven processes in the insurance industry. This is especially true when evaluating group plans or applicants with complex risk profiles. Generative AI in healthcare industry introduces a new level of efficiency, accuracy, and clarity to underwriting workflows by analyzing complex data, generating actionable insights, and supporting decision-making processes.

- Analyze applicant data and generate narrative summaries: AI reviews medical histories, claims records, and application data to produce clear, structured risk narratives. These summaries provide underwriters with a comprehensive, unbiased view of applicant risk in a fraction of the time.

- Auto-draft underwriting notes and justifications: Instead of writing manual notes, underwriters can rely on AI to generate consistent, audit-ready justifications for coverage decisions. This ensures alignment with underwriting guidelines and reduces documentation gaps.

- Reduce time-to-quote while improving transparency with brokers and employers: Faster processing and clearer risk communication translate into quicker quotes and better-informed stakeholders. Brokers and employer groups benefit from transparency and trust in the decision-making process.

The result? A faster, more consistent underwriting cycle that improves decision quality while significantly reducing manual effort and turnaround times.

5. Automated Compliance & Regulatory Reporting

Regulatory reporting in healthcare insurance is time-consuming, complex, and unforgiving. Generative AI can support compliance operations by enabling report generation, ensuring standardization of formats, and highlighting inconsistencies to speed up the regulatory workflows, thus improving speed, efficiency, and accuracy.

- Auto-create reports from claims, grievance logs, and utilization data: AI scans and extracts structured insights from large datasets across systems. With that, it generates detailed reports on member activity, claims trends, and service utilization.

- Draft summaries that are audit-ready and regulation-compliant: Generative AI can generate clear, structured narratives that align with federal and state regulations. This includes summarizing grievance cases, denial patterns, or network adequacy.

- Reduce manual oversight and compliance errors: By automating repetitive reporting tasks, AI minimizes human error and ensures documentation is consistently accurate. This reduces the risk of non-compliance and frees teams to focus on strategic priorities.

What follows? Faster turnaround, fewer compliance gaps, and complete readiness for audits—without slowing down core operations.

6. Knowledge Base & Training Material Creation

Internal knowledge systems often struggle to keep pace with new policies, product updates, and compliance requirements. Applications of generative AI in healthcare also include building and maintaining dynamic knowledge assets that are continuously updated, helping ensure relevance and supporting accurate decision-making.

- Standard operating procedures (SOPs): AI can generate and update SOPs by pulling from regulatory updates, policy changes, and operational guidelines. This ensures that every team—across claims, underwriting, or customer service—follows consistent, current workflows.

- Internal training decks and onboarding content: From department-specific modules to enterprise-wide onboarding kits, Generative AI can produce training material tailored to each role. This speeds up ramp-up time and equips teams with exactly what they need, right when they need it.

- Real-time FAQs for customer service or broker desks: AI-curated FAQs adapt to live queries, past interactions, and new plan changes, keeping frontline teams informed. This enables faster, more accurate responses for members, brokers, and employers.

Where does this lead? Well-informed and confident teams that deliver consistent experiences.

7. Claims Adjudication Narrative Support

Generative AI helps insurance firms make claims adjudication smoother by analyzing complex claim data, identifying patterns or anomalies, and generating clear, well-structured narratives that support claims processors and underwriters. Insurers use this approach to expedite and improve accuracy in adjudication workflows.

- Summarize complex claim outcomes in simple, member-friendly language: AI can translate dense claims data and adjudication logic into plain-language summaries tailored for each member. This removes confusion and reduces the need for follow-up clarification.

- Provide clear reasons for approvals or denials: Generative AI ensures that every claim response includes a specific, easy-to-understand justification aligned with policy terms. This improves transparency and supports fair, consistent decision-making.

- Suggest next steps, such as appeal options or alternative care: When claims are denied or partially paid, AI can recommend the next steps members can take. It doesn’t matter whether you are filing an appeal, seeking preauthorization, or exploring covered alternatives.

What’s the impact? Stronger member trust, fewer escalations, and more efficient claims communication. It is all driven by accurate, AI-generated narratives.

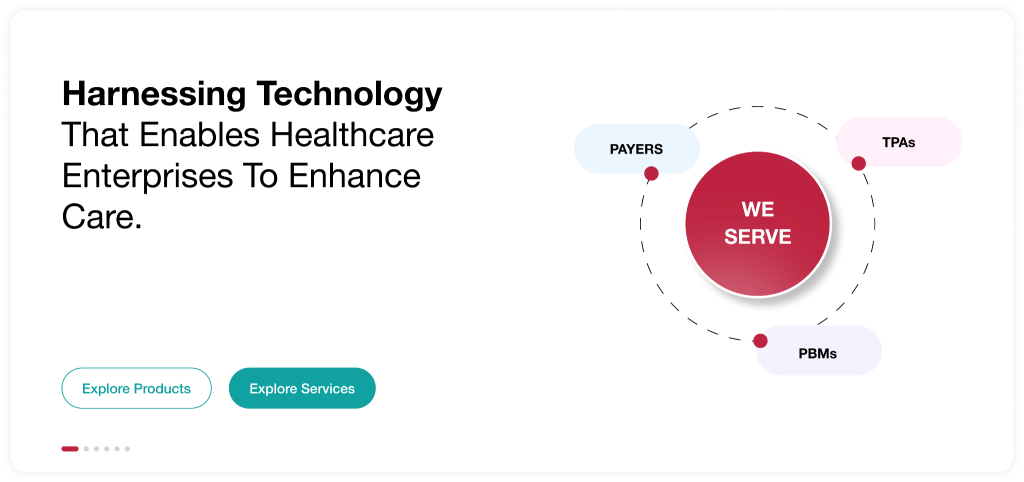

AVIZVA: Offering AI-Powered Healthcare Technology Solutions

AVIZVA is a healthcare technology solutions company that empowers payers, TPAs, and PBMs to simplify, accelerate, and optimize care delivery through a variety of AI-powered solutions. Backed by over 14 years of deep healthcare expertise and a proven track record of 150+ bespoke product deliveries, AVIZVA offers a rich portfolio of healthcare solutions categorized into Engineering Services and Proprietary Products. At the core of these offerings is the VIZCare product suite, purpose-built to transform payer operations with intelligent automation, seamless interoperability, and data-driven decision-making.

As AI continues to transform the healthcare insurance industry, VIZCare AI, offered by AVIZVA, stands out as the enterprise-ready platform that addresses the unique challenges of healthcare enterprises. With growing concerns about data security, regulatory compliance, and limitations of AI tools, VIZCare AI is purpose-built to overcome these barriers and revolutionize healthcare delivery.

Core features of the platform include:

- Private, Secure, and Compliant:

VIZCare AI is deployed in a dedicated private environment, ensuring complete data security and compliance with HIPAA, SOC 2, and GDPR standards. This gives enterprises full control over data residency and access, ensuring no sensitive data ever leaves the infrastructure. - Deep Understanding of Healthcare Insurance:

Pre-trained on real-world healthcare payer operations, VIZCare AI is embedded with intelligence across critical entities, including members, providers, brokers, employers, and enterprise organizations like payers, TPAs, and PBMs. From simplifying coverage navigation and streamlining care coordination to accelerating claims processing and optimizing benefits management, AI ensures accuracy, speed, and relevance at every step. - Agentic Architecture with Full Functional Coverage:

Built on a proprietary Presentation Context Protocol (PCP), VIZCare AI delivers comprehensive orchestration across payer-facing workflows. It is fully compliant with MCP standards, providing context-aware reliability and scaling across the enterprise. With structured data ingestion minimizing hallucinations and maintaining accuracy, PCP demonstrates how AI can transform healthcare operations into highly intelligent, efficient, and trustworthy experiences. - Data Accuracy with Granular Access Control:

VIZCare AI guarantees accurate data delivery to the right users, every time. With RBAC and ABAC authorization models, enterprises can maintain precision-level data access control for each record, ensuring compliance and operational integrity. By infusing fine-grained authorization and contextual intelligence directly into its workflows, AI makes data delivery not only scalable but also trustworthy, compliant, and audit-ready—a true game-changer for complex healthcare operations.

Conclusion

Generative AI is reshaping the healthcare landscape by elevating care delivery for consumers and enhancing operational efficiency for healthcare teams. From automating routine administrative tasks to generating insights that aid personalized treatment planning,it empowers healthcare enterprises to provide faster, more effective care.

As the technology evolves continuously, generative AI in healthcare industry will drive further innovation in diagnostic support, member engagement, and healthcare management. At the forefront of this transformation are technology leaders like AVIZVA, delivering AI-powered solutions that improve interoperability, streamline operations, and ensure regulatory compliance across healthcare systems.

If your organization is ready to harness the full potential of AI to transform healthcare delivery, AVIZVA offers the tools, expertise, and vision to help you succeed. Get in touch today!

FAQs

1. How do health insurers use AI to streamline operations?

Health insurers utilize AI to automate time-consuming and tedious processes, streamline claims, and enhance customer support experiences through the use of conversational AI. By implementing AI-based technologies in document generation, underwriting, and regulatory reporting, insurers can reduce manual tasks, ensure compliance, and deliver quicker and more accurate services to their members.

2. What platforms include built-in apps for different industries’ AI optimization workflows?

One such platform is AVIZVA’s VIZCare, a healthcare insurance solution with in-built AI apps and also gives the flexibility to build your own applications. The primary functions of these industrial apps in the context of healthcare enterprises are to automate and optimize key workflows, such as claims processing, risk analysis, compliance management, and member communication, thereby enabling more efficient operations and improved service delivery.

3. What are the benefits of generative AI in healthcare?

Healthcare insurance providers greatly benefit from the use of generative AI in healthcare, as it leads to several advantages, including increased operational efficiency, faster claims processing, and more personalized member interactions. By assisting with documentation, underwriting, and compliance workflows, generative AI enhances accuracy, supports hyper-personalized communication, and streamlines operations – all of which contribute to cost reduction and improved service quality.