In an increasingly competitive healthcare insurance landscape, enterprises are evolving from traditional providers of financial coverage to strategic enablers of holistic, end-to-end healthcare experiences. This transformation is driven by rising member expectations for more personalized and seamless engagement. Alarmingly, 52% of members say they would switch to a competitor after just one poor interaction, underscoring the urgency for insurers to elevate the member experience journey.

A positive member experience not only improves retention but also enhances brand image, boosts operational efficiency, and contributes to the overall success of the enterprise. In this blog, we examine the significance of member engagement in healthcare insurance and outline leading strategies to deliver an outstanding member experience in 2025.

Why Is Member Experience So Crucial In Healthcare Insurance?

1. Retains Existing Members & Builds Loyalty

For healthcare insurers, retaining members is far more cost-effective than acquiring new ones. However, it’s the quality of the experience offered that ultimately drives renewal decisions. Given the complexity of healthcare insurance, members tend to stick with insurers who offer clarity, empathy, and support at every stage—from enrollment to claims processing. An exceptional member experience that consistently delivers on these expectations fosters loyalty that is hard to disrupt.

2. Attracts New Members

A Nielsen study reveals that 92% of consumers trust recommendations from friends and family more than any other form of advertising. This presents a significant opportunity for healthcare insurers to position member experience as a core component of their marketing strategy. By consistently delivering clarity, value, and empathetic support, insurers can turn satisfied members into loyal advocates—driving referrals and attracting new members. In a crowded and highly competitive market, this experience-focused marketing strategy becomes a powerful differentiator.

3. Enhances Member Engagement

A positive member experience fosters deeper healthcare member engagement with services such as preventive care and wellness initiatives. When members feel informed and supported, they’re more likely to take proactive steps to manage their health. This not only improves health outcomes but also reduces long-term costs for insurers by minimizing emergency care needs and improving the management of chronic conditions.

4. Builds Brand Reputation

In a digital-first world, every member interaction has the potential to shape public perception. Satisfied members often become brand advocates, sharing positive experiences across social and review platforms—helping insurers establish a credible, trusted brand. On the other hand, negative experiences can spread just as quickly, undermining reputation and trust. Delivering exceptional member experience is therefore essential to building and protecting brand equity.

5. Improves Operational Efficiency

Delivering a positive healthcare member experience yields significant operational benefits for an enterprise. When members receive timely, transparent, and empathetic support, the volume of complaints and repeat inquiries decreases. This alleviates the administrative burden on internal teams and frees up resources for other priorities. Moreover, feedback from engaged and satisfied members provides actionable insights that drive product refinement, workflow optimization, and continuous organizational improvement.

6. Ensures Regulatory Compliance & Improves Quality Of Care

Health insurance member experience isn’t just a competitive advantage—it’s a regulatory imperative.

Healthcare regulations often require timely communication, fair grievance handling, and consistently high service standards. Insurers that prioritize exceptional member experiences inherently align with these compliance mandates. Additionally, when members feel supported and engaged, they are more likely to adhere to treatment plans, participate in preventive care, and follow health management programs—leading to improved outcomes and reduced healthcare compliance risks.

6 Smart Approaches To Deliver A Superior Member Experience

Now that we’ve established the importance of a seamless member experience in healthcare insurance, let’s explore the key strategies to effectively deliver it

1. Offer Personalized Communication

To deliver a more effective member experience, insurers must tailor communication and services to individual needs & preferences. They should leverage data analytics to create targeted outreach strategies that ensure members receive timely, relevant, and actionable information about their health, benefits, and care journey. Examples includes personalized preventive care reminders, wellness tips aligned with medical history, and communications delivered through preferred channels.

Platforms like VIZCare Empower offered by AVIZVA help insurers achieve this level of personalization. By leveraging AI to analyze member data and deliver targeted customer service in insurance, the platform enables insurers to engage members in ways that feel personal and meaningful—leading to stronger satisfaction, deeper trust, and long-term loyalty.

2. Adopt User-Friendly Technology

Today, nearly 75% of members expect healthcare insurers to adopt modern technologies that streamline and personalize interactions. Notably, 71% of individuals aged 55 and older prefer managing claims through digital channels such as chat or voice—underscoring a growing demand for convenient, tech-enabled engagement across all age groups.

To meet these expectations, healthcare enterprises must elevate their digital landscape. Offering user-friendly digital solutions—such as mobile apps and web portals—allows members to easily access information, file claims, and schedule appointments with minimal friction. When digital tools function seamlessly, members feel more empowered and in control of their healthcare journey, which in turn drives engagement, health insurance customer satisfaction, and long-term loyalty.

3. Provide Proactive Support Services

About one in six members report that insurers never follow up after an initial conversation, leading to frustration and diminished trust. To improve member experience in healthcare, enterprises must provide proactive support services, such as wellness checks, regular follow-ups, and outreach programs.

Anticipating member needs and addressing concerns before they escalate demonstrates that the insurer truly values member well-being. This proactive approach not only prevents issues from growing but also saves time and resources. When members see their insurer actively involved in their care journey, it builds trust and strengthens long-term relationships.

4. Offer Comprehensive Education and Resources

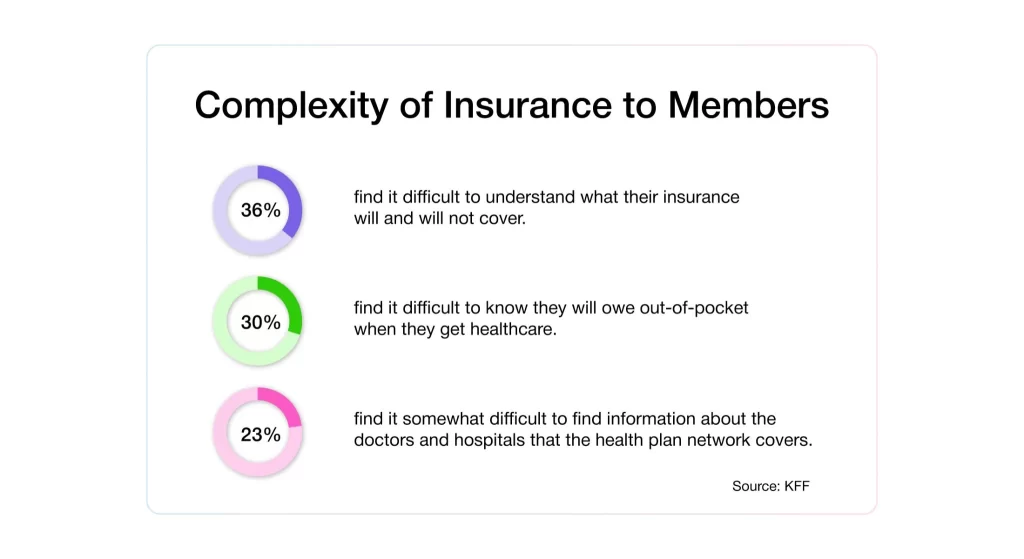

Understanding health insurance remains a major challenge for many members. According to recent findings, 51% of insured adults admit to struggling with at least one part of their insurance coverage. The following statistics highlight specific areas where members commonly face confusion.

This lack of clarity can lead to frustration, poor decision-making, and low engagement with available benefits. To address this, enterprises must integrate health insurance education as a part of their member experience journey. By offering accessible resources—such as clear guides, interactive webinars, and educational workshops—insurers can demystify key topics like coverage details, deductibles, claims processes, and benefit usage.

These efforts not only empower members with the knowledge they need but also encourage them to take a more active and confident role in managing their health.

5. Employ Feedback Mechanism

A superior member experience starts with truly understanding what members value most. Enterprises can gain this insight by establishing strong feedback channels—such as surveys, interviews, and focus groups—that allow members to share their needs, challenges, and expectations.

Analyzing this feedback enables enterprises to refine their services, adjust processes, and develop new initiatives that align with member priorities. Ultimately, a feedback-driven approach not only makes members feel heard and respected but also fosters trust and enables ongoing improvement across the enterprise.

6. Follow A Member-Focused Organizational Culture

Delivering a consistently superior member experience requires more than systems and workflows—it demands an organizational culture that puts members at the center of everything. A McKinsey study found that one insurer trained 35% of its employees and nearly all agents in customer experience best practices. As a result, the company doubled its CX scores, reduced processing times by 25%, and saw major gains in cross-sell and retention rates.

To achieve similar results, enterprises must ensure that every employee—regardless of function or role—understands the importance of the member experience and is equipped to support it. Training should focus on fostering empathy, clarity, and active listening, so that every member interaction builds trust, strengthens relationships, and reinforces the organization’s commitment to exceptional service.

VIZCare Empower: Driving a Seamless Member Experience from Start to Finish

VIZCare Empower is an AI-powered platform designed to help healthcare enterprises manage end-to-end business operations. It is a one-stop solution that brings internal teams together, equipping them with custom tools and intelligent workflows to enable seamless collaboration, enhance operational efficiency, and deliver exceptional consumer experiences

Below are some core capabilities of VIZCare Empower that help enterprises elevate the member experience:

1. AI-Assisted Contact Center: VIZCare Empower equips contact center teams with AI-driven assistance and automation to help them resolve member queries more quickly and accurately. Whether it’s explaining benefits or checking claim status, the platform provides agents with a centralized knowledge base, real-time guidance, and actionable insights. This not only shortens wait times but also ensures a smoother experience by eliminating the need for members to repeat information—enhancing satisfaction at every touchpoint.

2. Streamlined Workflows & Business Processes: VIZCare Empower streamlines essential healthcare operations through intelligent automation. With minimized manual work and accelerated routine processes, teams can work with greater speed and precision. A key example is claims management, where automation reduces processing times, improves accuracy, and ensures timely updates—resulting in a more transparent, responsive, and satisfying experience for members.

3. Single Pane To Service Members: VIZCare Empower provides a single, unified interface that consolidates all the tools, data, and context service teams need to support members effectively. By breaking down operational silos and enabling real-time access to relevant information, the platform empowers teams to deliver personalized, proactive, and efficient service. This results in faster query resolution, more consistent experiences, and stronger member satisfaction across every channel.

4. Timely Renewals: By sending out automated reminders, providing real-time data access, and streamlining workflows, VIZCare Empower enables teams to ensure timely, hassle-free renewals. This minimizes manual errors and enhances overall accuracy. Members are notified well in advance of renewal deadlines and receive benefit suggestions tailored to their individual needs—making the process smooth, personalized, and efficient.

5. Seamless Onboarding: VIZCare Empower simplifies onboarding for new members and groups by automating enrollment and setup tasks. With a guided, step-by-step journey, the platform reduces confusion and delays—ensuring a smooth and stress-free start to their healthcare insurance journey.

Conclusion

In today’s highly competitive healthcare insurance landscape, delivering an exceptional member experience is more than a priority—it’s a strategic necessity. A seamless, personalized, and proactive approach not only strengthens member loyalty but also builds lasting trust. By combining advanced technology with thoughtful strategy, enterprises can transform and elevate every aspect of the member experience.

VIZCare Empower, a next-generation platform offered by AVIZVA, empowers healthcare enterprises to achieve this transformation. It transforms every stage of the healthcare insurance journey, equipping teams to deliver consistent, high-quality member experiences across all touch-points.

If you’re ready to take member engagement in healthcare to the next level, it’s time to discover what VIZCare Empower can do. Start transforming your business operations—and the way your members experience healthcare—today.