In today’s rapidly evolving healthcare insurance landscape, many enterprises invest in healthcare technology solutions with the hope of improving efficiency and streamlining operations. However, these tools often fall short of expectations, not because the technology is flawed, but because it’s selected without a clear strategy aligned to current workflows and long-term objectives.

When a digital solution doesn’t fit the way an enterprise operates, it can create more problems than it solves. From claims processing to regulatory compliance, a poorly matched system can introduce new bottlenecks and inefficiencies, undermining critical business functions.

Selecting the right software for health insurance companies goes far beyond checking off a list of features. It requires a thoughtful approach that prioritizes integration with existing processes, supports scalability, and aligns with the organization’s broader vision. With a crowded market of vendors, a wide range of price points, and an overwhelming number of options, choosing the software can quickly become complex and confusing.

This blog is designed to simplify that process. It outlines a step-by-step roadmap to help enterprises assess their needs, compare solutions, and make a confident, well-informed decision, one that delivers lasting value today and supports growth into the future.

Build Vs Buy: Which Is Best For Healthcare Insurance Enterprises?

Before choosing a digital solution, healthcare insurance enterprises should carefully assess whether to build a custom platform or invest in a ready-made product. Custom-built solutions offer greater flexibility, deeper data integration, and tailored functionality, while off-the-shelf platforms provide faster implementation and lower initial costs.

The following outlines the key advantages of each approach to help enterprises make a well-informed, strategic decision.

1. Building Custom Healthcare Insurance Solutions

Building a custom solution may be the best fit for enterprises with specialized requirements that standard, off-the-shelf platforms can’t fully address. Here are the key advantages of a custom-built approach:

- Tailored To Unique Operational Needs: Some healthcare insurance enterprises follow specialized processes or have complex workflows that off-the-shelf solutions can’t accommodate. A custom platform can be designed specifically around these unique business models and regulatory requirements.

- Greater Flexibility And Control: Building a solution in-house offers full control over design, functionality, data architecture, and customer experience. This is especially beneficial for large enterprises with specific internal standards, compliance needs, or preferences that require fine-tuned customization.

- Seamless Integration With Legacy Systems: Many insurers rely on existing legacy systems. Custom-built platforms can be developed to integrate seamlessly with these systems, allowing smoother transitions and consistent data flow without major disruptions.

- Complete Ownership and Intellectual Property Rights: When enterprises build their own solution, they retain full ownership of the product and its underlying technology. This removes long-term dependency on third-party vendors and offers greater strategic control over future enhancements, security, and scalability.

2. Buying Off-The-Shelf Healthcare Insurance Solution

Buying an off-the-shelf solution may be the best fit for enterprises looking to reduce time-to-market, minimize upfront investment, and leverage proven technologies. Here are the key advantages of a ready-made approach :

- Faster Deployment: Pre-built platforms can be implemented in weeks rather than months, dramatically shortening time-to-market.

- Lower Upfront Investment: Buying solutions reduces the financial burden of hiring developers, maintaining infrastructure, and managing the development cycle from scratch.

- Proven Reliability: Established technology solution vendors offer mature, tested products that have been widely used across the industry. This reduces risk and increases confidence in performance and compliance.

- Vendor Support and Maintenance: With a purchased solution, the burden of updates, bug fixes, and technical support lies with the vendor, freeing up internal resources for core business functions.

- Built-In Compliance Features: Most reputable vendors design their digital solutions to meet healthcare regulations such as HIPAA and ACA. Ongoing updates ensure continued compliance as regulations evolve.

While both technology investment approaches offer valuable advantages, the right choice ultimately depends on an enterprise’s goals, complexity, and available resources. Custom solutions provide unmatched control, flexibility, and the ability to tailor functionality to specific needs, but they often require significant time and investment.

In contrast, off-the-shelf solutions are typically more cost-effective, faster to deploy, and backed by ongoing vendor support and compliance features. For most healthcare insurance enterprises, buying a proven, ready-made solution is the more practical and strategic choice, enabling them to scale quickly, maintain regulatory compliance, and focus on delivering quality services to their members.

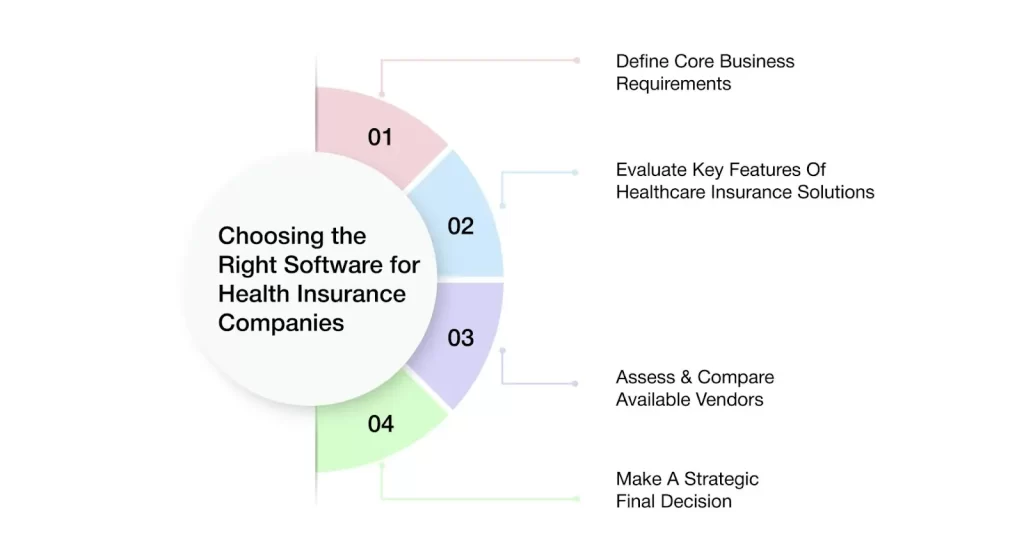

How To Select The Right Software for Health Insurance Companies?

1. Define Core Business Requirements

To select the right technology solution, a healthcare insurance enterprise must begin by clearly defining its core business processes, including claims handling, member management, compliance, and reporting. It should also assess the limitations of current systems to identify areas needing improvement. Focusing on the most critical features, rather than less essential ones—helps ensure the chosen solution meets key needs, improves efficiency, supports compliance, and reduces challenges during implementation.

2. Evaluate Key Features Of Healthcare Insurance Solutions

When reviewing potential technology solutions, enterprises should look for a set of critical capabilities tailored to the unique needs of the healthcare insurance industry :

- Compliance Management Tools: Compliance is non-negotiable in healthcare insurance. The selected solution should offer built-in support for major regulatory frameworks such as HIPAA, SOC 2, and HITRUST. These tools help secure sensitive data, mitigate legal risks, and avoid costly fines by ensuring continuous adherence to industry regulations.

- Real-Time Data Analytics and Reporting: Access to updated insights is essential for effective decision-making. Advanced analytics capabilities allow insurers to monitor claims activity, member behavior, and financial performance in real time. This supports proactive decision-making, early issue detection, and data-driven strategies.

- Workflow Automation And AI-Powered Decision Support: Automation reduces manual tasks and increases operational efficiency by streamlining processes like claims handling, member record management, and reporting. AI-powered tools enhance decision-making by analyzing large volumes of data to study trends, predict outcomes, and recommend actions.

- Seamless Integration With Existing IT Infrastructure: Most healthcare insurers operate within complex IT ecosystems. The ideal solution should integrate smoothly with existing platforms such as CRM, ERP, and document management systems. This ensures continuity, reduces errors, and eliminates redundant data entry.

- User-Friendly Interface And Role-Based Access Controls: A clean, intuitive user interface accelerates adoption and minimizes training time. Role-based access controls enhance data security by ensuring that only users who are authorized can get access to or modify specific information, supporting both usability and compliance.

3. Assess & Compare Available Vendors

Once core requirements are defined and essential features are identified, the next step is to evaluate technology solution vendors. A structured, criteria-based evaluation ensures that the selected vendor can meet both technical and operational expectations, while aligning with the specific needs of the healthcare insurance industry :

- Industry Experience and Reputation: It is essential to assess a vendor’s experience within the healthcare insurance sector. A vendor with a strong industry track record will better understand regulatory requirements and operational complexities, enabling them to deliver compliant, purpose-built solutions.

- Customizable & Scalability: Every healthcare insurance enterprise varies in size, structure, and workflow. The technology solution should offer customization options that allow the enterprise to tailor workflows, reports, and user interfaces to match specific processes. Scalability and flexibility ensure the solution continues to add value as the enterprise evolves.

- Support, Training, and Onboarding Services: Comprehensive vendor support services are key to a successful implementation. Vendors should provide full onboarding and training programs that accelerate user adoption and reduce downtime. Ongoing customer support ensures the system continues to function optimally after deployment.

- Case Studies And Client Testimonials: Real-world case studies and testimonials offer valuable insights into the vendor’s performance, customer service, and reliability. These resources demonstrate how the solution has been successfully implemented in similar healthcare insurance enterprises and help validate the vendor’s capabilities.

4. Make A Strategic Final Decision

When it’s time to make the final decision, healthcare insurance enterprises should weigh the balance between solution features, cost, scalability, and vendor support. The chosen solution must meet all essential needs while providing good value for the investment. It’s important to ensure that the vendor offers strong support after implementation to keep the system running smoothly.

The enterprise should also consider how well the solution can grow with the business and contribute to improving operations, reducing costs, and boosting overall efficiency. Ultimately, the final decision should align with both current needs and long-term business goals.

Why VIZCare Empower Is The Best For Health Insurance Enterprises In The U.S.

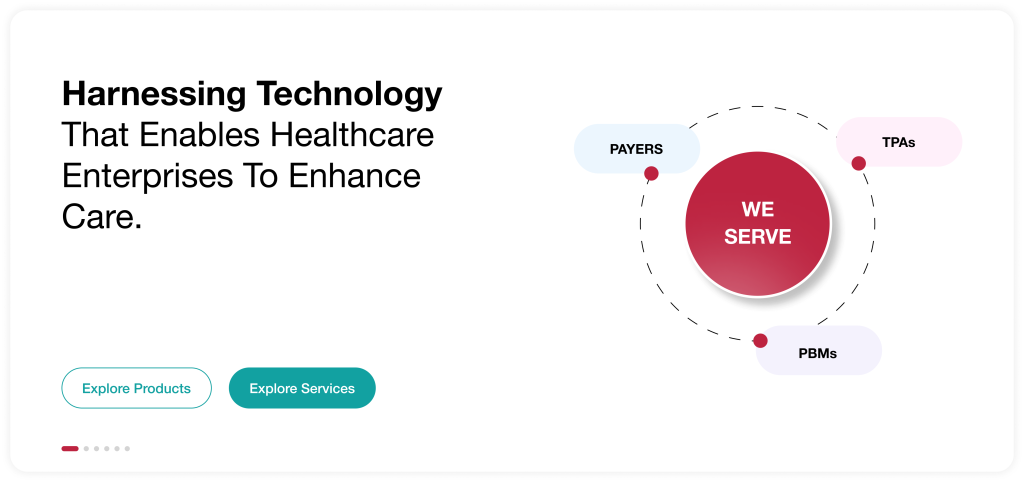

AVIZVA is a healthcare technology company that empowers payers, TPAs, and PBMs to enhance care delivery through a comprehensive suite of engineering products and services. With over 14 years of experience in leveraging technology to simplify, optimize, and accelerate care, AVIZVA has become a trusted technology partner to a wide range of healthcare enterprises.

AVIZVA’s healthcare offerings are grouped into two key categories: Engineering Services and its proprietary product suite, VIZCare. Each product within VIZCare is purpose-built to address specific business challenges in healthcare. A flagship product in this suite is VIZCare Empower, an AI-enabled, one-stop platform that automates and streamlines end-to-end healthcare business operations, enhancing efficiency, compliance, and scalability. Some of its core capabilities include:

- End-To-End Sales Management

VIZCare Empower gives teams real-time visibility into broker activities, progress, and support needs—enabling timely, personalized assistance, faster deal closures, and improved broker satisfaction. The platform streamlines the entire broker journey, from quoting and contract signing to enrollment, all within a single, unified interface.

- Business Process Automation and Workflow Management

VIZCare Empower offers an intuitive drag-and-drop interface, allowing healthcare teams to build and modify workflows without technical expertise. It integrates with existing systems and scales effortlessly with the business. As needs evolve, teams can quickly update workflows to stay agile and efficient.

- Seamless Onboarding of Groups and Individuals

VIZCare Empower streamlines end-to-end onboarding for new clients and employer groups. With intuitive tools, automated configurations, and seamless workflows, it eliminates manual steps, shortens setup time, and helps teams onboard clients smoothly from the start.

- Single Pane to Service All Consumers

VIZCare Empower centralizes all the critical data, tools, and context that service teams need to manage and support every consumer—whether they’re members, providers, brokers, or employers. It eliminates silos and unites all service teams in one place, enabling them to deliver personalized, efficient, and proactive assistance with ease.

- AI-Enabled Contact Center Management

VIZCare Empower creates a better experience for both contact center agents and customers. It equips agents with real-time guidance and intelligent insights, helping them resolve customer inquiries faster and more accurately. Whether they’re handling complex claims for providers, supporting brokers, or managing member issues, the platform delivers instant recommendations, knowledge base access, and next-best-action prompts.

- Timely and Hassle-Free Renewal Management

VIZCare Empower simplifies and streamlines the renewal process. With automated reminders, real-time data access, and optimized workflows, it enables teams to manage renewals more efficiently, reducing manual errors and enhancing overall accuracy. From tracking upcoming renewals to managing communications and processing plan updates, everything is seamlessly integrated in a single platform.

Conclusion

Selecting the wrong software for health insurance companies can significantly impact operational efficiency, reduce team satisfaction, and increase long-term costs. To make the right decision, healthcare insurance enterprises must begin by clearly defining their business needs and priorities. Essential features to look for include robust compliance management to keep pace with evolving regulations, and process automation to streamline workflows, reduce manual errors, and boost productivity.

The solution should also offer scalability and flexibility to support future growth and changing requirements, along with strong integration capabilities to ensure seamless connectivity with existing legacy systems and third-party tools. Just as important is choosing a vendor with deep healthcare insurance expertise and a track record of providing reliable, ongoing support. The right software used by health insurance companies should not only meet current operational demands but also align with long-term strategic goals.

AVIZVA’s VIZCare Empower is a reliable, intuitive technology solution built specifically for healthcare insurance enterprises. It simplifies operations, strengthens compliance, and helps enterprises deliver a superior service experience. Get in touch with AVIZVA to learn how VIZCare Empower can support your long-term success.

FAQs

1. What are the important features to look for when selecting health insurance software?

The key features to look for in software for health insurance companies include compliance management, real-time analytics, automation of workflows, and integration with existing systems. A simple interface and role-based access controls are also important for usability and security.

2. How can insurance companies evaluate software options based on their specific needs and budget?

Insurance companies can evaluate options by first defining their business priorities and existing gaps. Then, they should compare features, costs, and vendor support to see which solution best fits both their current needs and long-term goals.

3. What challenges do health insurance providers face when migrating to new software?

The main challenges while integrating a new software include integrating with legacy systems, migrating data accurately, training staff, and avoiding operational disruptions. Choosing a vendor with strong onboarding and support can help manage these issues.

4. What security and compliance features are essential in health insurance software?

Essential features to look for in Software for health insurance companies in the USA include HIPAA-compliant data handling, encryption, access controls, and built-in tools to meet changing regulations. These are necessary to protect sensitive information and avoid compliance risks.

5. How can software solutions improve data accessibility and integration with other healthcare systems?

Software solutions improve data accessibility by integrating with core insurance systems like claims, enrollment, and member management platforms. This ensures real-time data flow, reduces manual work, and helps teams deliver faster and more accurate member services.