Amid a rapidly evolving regulatory landscape and rising consumer expectations, healthcare insurance enterprises are under increasing pressure to enhance operational efficiency while maintaining consistently high service standards.

To meet these demands, leading healthcare insurers are leveraging artificial intelligence (AI) to transform traditional workflows and empower their internal teams. By embedding AI capabilities into their existing infrastructure, these organizations are automating time-consuming tasks, minimizing human error, and accelerating informed decision-making across the board.

In this blog, we explore the top five use cases where AI for business process automation is delivering significant enhancements in the operational efficiency of healthcare teams.

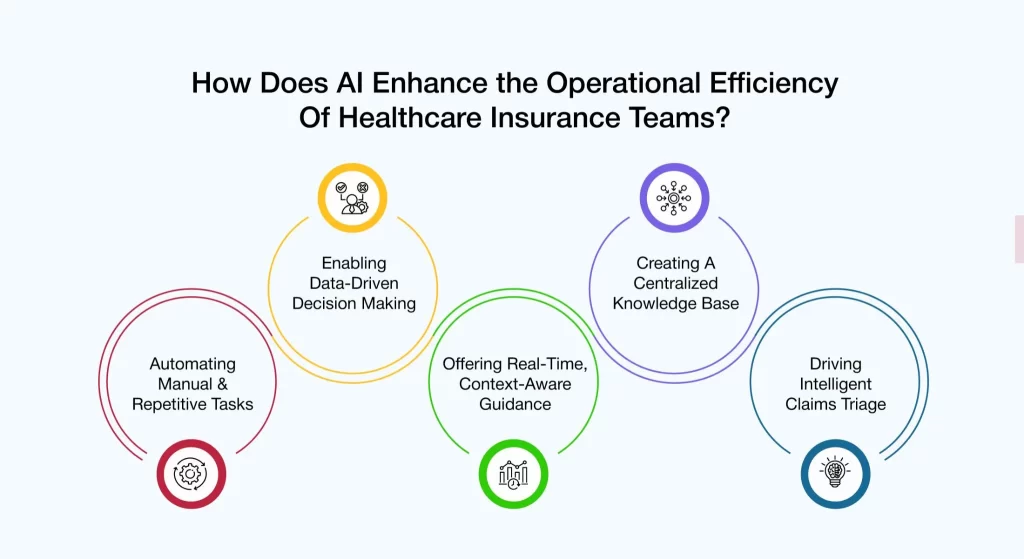

Top 5 Ways in Which AI Is Enhancing Operational Efficiency of Healthcare Insurance Teams

1. Automating Manual & Repetitive Tasks

Healthcare insurance teams dedicate substantial time and effort to manual, repetitive tasks across critical business functions, such as claims adjudication, enrollment, eligibility verification, prior authorizations, and provider relations. This operational burden often limits their ability to focus on more strategic, high-value priorities.

With AI tools for business automation integrated into their systems, enterprises are alleviating these routine workloads, allowing intelligent systems to perform these tasks swiftly and accurately.

Real-world applications include :

- Claims Adjudication Team: Automating claim intake, sorting, and preliminary adjudication to accelerate processing times

- Enrollment Team: Validating member data and triggering rule-based actions to ensure compliance and accuracy

- Provider Relations Team: Streamlining credentialing and onboarding workflows to reduce delays and enhance provider engagement

2. Enabling Data-Driven Decision Making

From fraud detection and coverage verification to claims approval and member engagement, health insurers must make countless decisions every day. And when these decisions are based on guesswork or incomplete data, it can result in delays, increased error rates, and compromised service quality.

By integrating AI-powered data analytics in their current systems, insurers are unlocking the full potential of enterprise data—such as historical claims, member behavior, and provider trends—and transforming it into real-time, actionable insights. These insights empower teams across functions to make faster, more accurate decisions, ultimately improving operational performance and service outcomes.

Some of the use cases include:

- Underwriting Team: Detecting pricing anomalies and fraudulent patterns to mitigate risk and refine pricing strategies

- Claims Management Team: Using predictive analytics to flag suspicious claims and accelerate approval of valid ones

- Member Relations Team: Analyzing member behavior to proactively resolve issues, personalize communication, and boost overall satisfaction.

3. Offering Real-Time, Context-Aware Guidance

Consumer servicing teams in healthcare insurance handle a high volume of queries from members, providers, brokers, and employers. These queries can range from coverage inquiries and claim status requests to prior authorization requirements and plan clarifications.

Traditionally, resolving such queries has required servicing teams to sift through lengthy documentation, navigate multiple systems, and collaborate with other teams – resulting in delays, inconsistencies, and suboptimal service experiences.

By integrating AI-powered virtual assistants into their existing systems, enterprises are equipping their servicing teams with real-time, context-aware guidance. These intelligent assistants utilize natural language processing (NLP), machine learning, and real-time data integration to comprehend user intent and provide accurate, timely responses—significantly enhancing resolution rates and reducing the need for escalation.

Here is how servicing teams can seamlessly resolve consumer queries by leveraging the power of AI-enabled virtual assistants :

- Member Queries: AI virtual assistants help servicing teams quickly access member-specific information—such as claim status, benefits, and eligibility—by pulling data from multiple systems in real-time. They also guide teams with contextual suggestions and standardized workflows, enabling faster and more accurate resolutions.

- Provider Queries: For provider-related questions, virtual assistants enable teams to instantly retrieve plan regulations, coding guidelines, and claim details. This reduces manual effort and ensures providers get consistent, compliant answers.

- Broker Queries: When brokers reach out, AI assistants equip agents with plan comparisons, enrollment procedures, and regulatory updates. They also help auto-complete or validate broker forms, minimizing errors and response times.

4. Creating A Centralized Knowledge Base

Healthcare insurance teams rely on vast volumes of data— spanning plan documentation, regulatory guidelines, member records, and procedural manuals—to carry out their responsibilities effectively. However, this critical information is often dispersed across siloed systems, making it difficult for teams to access timely and accurate insights. The resulting inefficiencies not only slow down operations but also increase the likelihood of errors, inconsistencies, and delays in service delivery.

By integrating AI-enabled knowledge management solutions in their digital ecosystem, enterprises are consolidating fragmented data and equipping all their teams with intelligent search and retrieval capabilities. As a result, teams gain access to a centralized knowledge base that enables them to quickly find the correct information at the right time—improving accuracy, boosting productivity, and enhancing overall service quality.

Here are some examples of how health insurance teams are leveraging AI tools for customer experience in insurance support:

- Consumer Servicing Teams: Using AI-driven search tools to instantly retrieve relevant plan details, coverage rules, or documentation requirements based on natural language queries—ensuring consistent and informed responses.

- Claims Processing Teams: Accessing up-to-date adjudication guidelines, medical coding standards, and documentation checklists from a unified knowledge repository—reducing turnaround times and errors.

- Compliance & Training Teams: Automatically surfacing regulatory updates and embedding them into training workflows—ensuring that teams are always aligned with the latest compliance requirements.

5. Driving Intelligent Claims Triage

Health insurance companies handle a wide range of claims with varying levels of urgency and complexity. To manage them well, it’s essential to sort and prioritize them quickly. Still, many of them often do this manually, leading to delays and errors.

AI-powered triage systems can automate this process by assessing urgency, complexity, past patterns, and risk. This not only speeds up claim handling but also reflects how customer service in health insurance can be strengthened by delivering faster, data-driven resolutions.

Here are a few capabilities of AI-enabled claims triage systems:

- Auto-Prioritization of Claims: Evaluates each claim based on complexity, potential value, member profile (e.g., chronic conditions, high-cost cases), and urgency to automatically prioritize processing, ensuring that critical claims are handled first and faster.

- Early Fraud Detection: Identifies and flags potentially fraudulent or non-compliant claims by detecting anomalies and matching patterns against known fraud indicators—enabling proactive investigation and reducing financial risk.

- Smart Claim Routing: Automatically assigns claims to the most appropriate processors based on skill set, claim type, and current workload—improving turnaround times and optimizing resource utilization.

AVIZVA Making Internal Teams Efficient With One Singular Platform

Ever wondered how some internal teams operate with unmatched speed, clarity, and precision – getting more done with fewer roadblocks?

The difference often lies in having a unified intelligence layer that streamlines workflows and eliminates operational chaos. In today’s fast-moving enterprise environment, teams are expected to manage rising workloads, patchy processes, and constant information that flows without compromise.

The Challenge: Disconnected Tools, Repetitive Tasks, and Information Bottlenecks

Internal inefficiencies often stem from:

❌Manual data entry and repetitive workflows

❌Lack of real-time collaboration tools

❌Siloed systems and delayed decision-making

❌Poor visibility into team productivity and KPIs

That’s where AI steps in as a true efficiency partner. From automating routine workflows to surfacing the right insights at the right time, AI helps teams collaborate better, make quicker decisions, and focus on what truly matters.

At AVIZVA, we’re bringing this transformation to life with VIZCare Empower – an AI-enabled platform designed to enhance AI for internal team management and supercharge productivity across healthcare and insurance teams.

How AVIZVA Elevates Internal Team Efficiency With AI

- End-to-End Sales Management: VIZCare Empower provides real-time visibility into broker activities, progress, and support requirements, enabling timely interventions, personalized assistance, faster deal closures, and enhanced broker satisfaction. The platform unifies the entire sales process, from quoting and contract execution to enrollment, within a single interface.

- Business Process Automation and Workflow Management: With an intuitive drag-and-drop interface, VIZCare Empower allows healthcare teams to design and adjust workflows without technical expertise. It integrates seamlessly with existing systems and scales with organizational growth. As business needs evolve, workflows can be updated quickly to maintain operational agility and efficiency.

- Seamless Onboarding for Groups and Individuals: VIZCare Empower simplifies the onboarding process for both individual members and employer groups. Automated configurations, intuitive tools, and streamlined workflows reduce manual tasks, shorten setup times, and ensure a smooth onboarding experience from the outset.

- Unified Service Interface for All Consumer Segments: The platform centralizes critical data, tools, and contextual insights required by service teams to manage interactions with members, providers, brokers, and employers. By eliminating data silos and unifying service operations, VIZCare Empower enables teams to deliver efficient, personalized, and proactive support through a single interface.

- AI-Enabled Contact Center Optimization: VIZCare Empower enhances both agent performance and customer satisfaction. It provides agents with real-time guidance, contextual insights, and intelligent prompts, improving the speed and accuracy of issue resolution. Whether handling provider claims, broker queries, or member concerns, agents receive instant access to knowledge resources and next-best-action suggestions.

- Streamlined Renewal Management: The platform simplifies renewal processes through automation, real-time data access, and optimized workflows. It reduces manual errors and enhances precision by consolidating all renewal-related activities—such as tracking due dates, managing communication, and updating plan details—into a unified system.

Conclusion

When teams spend less time on repetitive tasks, they can concentrate on the areas that really matter, which, in this case, is making an impact. VIZCare Empower is the solution that enables this transition through AI-driven business automation tools, enlightened insights, and linked workflows that change the way teams work completely.

VIZCare Empower not only eliminates the tasks but also incorporates AI collaboration tools for the teams, thus changing daily challenges into chances for growth and innovation. From simplifying processes to improving accuracy and speed, VIZCare Empower ensures your internal teams operate at their highest potential.

It’s not just about saving time—it’s about empowering people with smarter ways to work.Ready to transform how your teams perform? See how AVIZVA can help—let’s connect today!

FAQs

- Can team training be done with AI tools?

Yes. AI finds skill gaps and suggests the right training for each person, helping everyone learn so that they can grow faster and contribute better.

- What are the top use cases of AI for internal teams?

The top 5 include:

- Automating everyday work

- Making teamwork and communication easier

- Balancing workloads using smart predictions

- Personalizing training and development

- Speeding up internal support with AI-powered help desks

- Does AI help desks improve internal support?

Yes. AI chatbots quickly answer common HR, IT, or admin questions, saving time and letting teams focus on more important work.

- Can AI really help teams work better together?

Yes! AI makes communication easier by taking notes, summarizing messages, translating, and pointing out key tasks.

- How can AVIZVA help implement AI for internal efficiency?

AVIZVA’s tools—Empower, Connect, and Co-pilot—help automate tasks, improve teamwork, and use data to make better decisions, so teams can work smarter.

- What are the primary ways AI enhances internal team efficiency?

AI enhances internal team efficiency by supporting and augmenting complex, high-value processes – such as group enrollment and claims adjudication, rather than simply automating them. Subsequently, this technology facilitates data-driven decision-making via real-time analytics and predictive insights, and it also offers the context-aware guidance necessary for the quick resolution of queries.

- What types of internal teams benefit most from AI use cases?

AI-especially when delivered through a platform like VIZCare Empower – enhances efficiency across a wide range of internal teams by providing real-time guidance, unified data views, intelligent workflow automation, and context-aware insights. Key teams that benefit include:

- Account & Sales Teams (Agents Such as Sales Executives, Underwriters): Allows them to understand what is going on, and it makes it good for quick completion of quotation and enrollment workflows, etc., doing data-driven decision-making.

- Contact Center & Service Teams: Empower agents with AI-assisted insights for handling inbound inquiries, eligibility checks, notes, and task creation across channels.

- Group Onboarding / Configuration Teams: Support setup and configuration with automated workflow of groups and individual enrollments.

- Member Services Teams: Deliver personalized service with a 360° member view, faster case resolutions, and contextual insights.

- Provider Relations Teams: Accelerate provider onboarding, prior authorizations, and appeals with automated, AI-guided workflows.

- How do AI agents help in internal communications and collaboration?

AI agents support internal teams by assisting CSR and servicing teams with instant, context-aware answers, eliminating the need to manually search across systems or knowledge bases. They help teams respond faster, more accurately, and with greater consistency. Key ways AI agents help include:

- Instant, accurate responses to CSR queries using real-time data and contextual understanding.

- Reduced search time by surfacing relevant policies, procedures, and case details proactively.

- Guided next-best actions that help agents resolve issues faster and more consistently.

- Improved first-contact resolution by enabling confident, informed responses.

- Lower cognitive load on agents, allowing them to focus on judgment-driven tasks.