Health insurance today isn’t what it used to be. With rising costs, mountains of data, and customers expecting quick, personalized service, insurers are under pressure like never before. Traditional systems just can’t keep up with the speed and complexity of modern healthcare demands.

That’s where Artificial Intelligence comes in.

Artificial intelligence in health insurance is no longer a futuristic concept—it’s already helping health insurance companies work smarter and faster. Whether it’s streamlining claims, answering member queries in real time, or spotting fraud before it happens, AI is quietly reshaping how the industry operates. In fact, around 75% of insurers are already using AI for customer service, and 50% are applying it to claims management.

In this blog, we’ll explore how AI is making a real difference—where it’s being used, the challenges that come with it, and a few success stories along the way. If you’re in the business of health insurance or simply curious about how tech is improving care delivery, this is a read for you.

How is AI Used in Health Insurance?

The world of health insurance is undergoing a dramatic shift—and artificial intelligence (AI) is at the heart of this transformation. From streamlining operations to delivering personalized support, AI is redefining how insurers serve members, brokers, and providers alike.

Let’s explore how AI is powering smarter, faster, and more human-centered health insurance experiences.

- Transforming Contact Centers with Real-Time AI Assistance

Health insurance contact centers face immense pressure. Agents must juggle complex member queries—often under tight deadlines—leading to prolonged call times and inconsistent service.

AI is changing the game by offering agents real-time, intelligent support:

- Unified Access to Member & Provider Information: AI integrates data across systems to give agents a complete, contextual view of members, employers, and providers—reducing time spent switching screens or searching.

- AI-Enhanced Call Summaries & Documentation: During live calls, AI captures notes, creates summaries, and generates transcripts—streamlining compliance and letting agents stay focused on helping members.

- Automated Follow-Ups & Intelligent Routing: AI systems auto-generate tasks based on call outcomes and route them to the appropriate team—reducing manual effort and enhancing responsiveness.

- Accelerating Sales with AI-Driven Automation

Health insurers need to move fast—especially when it comes to quotes, contracts, and renewals. But manual processes often slow things down and introduce errors.

Artificial intelligence improves these areas by automating and streamlining important steps in the sales process.

- Instant Generation Of Quotes, Proposals and Contracts : AI uses templates and rule engines to quickly produce accurate, tailored documents—saving time and reducing compliance risk.

- Streamlined Approvals with Smart Workflows: Automated decision-making ensures quick reviews, reducing bottlenecks and enabling faster deal closures.

- Predictive Renewal Insights : AI analyzes historical data to flag renewal opportunities and recommend optimal plan options – empowering brokers and employers to act proactively.

- Smarter Underwriting and Risk Assessment for Fair Pricing

Underwriting and risk assessment are important steps in health insurance, but often require a lot of time and resources. These processes can lead to delays and make it harder to offer policies that match individual needs. Traditional methods depend on limited data and manual reviews. This creates inefficiencies, uneven risk evaluations, and pricing that may not be fair.

Artificial intelligence provides a strong solution by using a wide range of data, including clinical records and social factors, to build detailed and accurate risk profiles.

- Data-Driven Risk Profiling: AI evaluates vast, diverse data sets—from clinical records to social determinants—to deliver nuanced, predictive risk insights.

- Automation of Routine Tasks: From data ingestion to initial scoring, AI automates much of the underwriting workflow—improving speed without sacrificing accuracy.

- Enhancing Customer Support with AI-Powered Assistants

In the dynamic world of healthcare insurance, call centers are often overwhelmed—flooded with high volumes of inquiries and complex member questions. Traditional IVR systems and rudimentary chatbots struggle to keep pace, frequently falling short of delivering the quick, personalized assistance that today’s members expect. The result? Frustration, long wait times, and a deteriorating member experience.

Enter AI-powered virtual assistants—transformative tools that bring always-on, intelligent self-service across channels. These digital assistants are redefining how insurers engage with their members, offering faster resolutions and more satisfying interactions.

- Simplifying Plan Details with Conversational Guidance : AI assistants make it easier for members to navigate the complexities of their health plans. By offering clear, conversational explanations of benefits, coverage, and policy rules, they reduce the need for live-agent intervention—freeing up human support for higher-priority issues while improving overall satisfaction.

- Providing Instant, Transparent Claim Updates : No more guessing games or long wait times. AI-powered tools deliver real-time claim status updates, complete with simple, easy-to-understand explanations. This boosts transparency, builds trust, and empowers members with timely information—all without the need for a support call.

5. Predictive Analytics: Proactively Managing Risk and Enabling Preventive Care

In the pursuit of better outcomes and cost-effective care, timing is everything. Yet, traditional risk management approaches often rely heavily on retrospective data—limiting their ability to anticipate health challenges before they escalate. The result? Missed opportunities for early intervention and rising avoidable costs.

AI-powered predictive analytics is changing that paradigm. By analyzing vast and diverse datasets—including clinical histories, lifestyle patterns, behavioral signals, and social determinants of health—these advanced models empower insurers to move from reactive care to proactive engagement.

- Early Identification of High-Risk Members: Predictive systems flag individuals who may be at risk of developing chronic conditions or experiencing acute medical events. With these insights, care managers and health coaches can intervene earlier—targeting support where it’s most likely to drive impact.

- Personalized, Preventive Care Pathways: Leveraging predictive data, health plans can design and deliver care programs tailored to individual risk profiles. From nudging members toward preventive screenings to enrolling them in disease management programs, the experience becomes timely, relevant, and personal—boosting engagement and improving long-term outcomes.

6. Health Insurance Claims Automation: Cutting Delays, Errors & Operational Waste

Claims processing has long been a bottleneck for health insurers—mired in manual reviews, multi-step approvals, and data entry tasks. These inefficiencies not only delay reimbursements but also frustrate members and inflate administrative costs.

Enter intelligent claims automation—a game-changer in transforming how payors handle high-volume workflows.

- Consistent Compliance, Every Time: AI-powered systems automatically apply up-to-date regulatory rules and policy parameters to each claim. This ensures consistent and accurate adjudication, reducing human error and reinforcing compliance without the need for constant manual oversight.

- Early Detection of Fraud and Irregularities: With machine learning models continuously scanning for anomalies, insurers can flag suspicious activity early—before it results in costly overpayments or abuse. Whether it’s duplicate billing, inflated procedures, or identity mismatches, these smart systems enhance operational integrity while protecting margins.

By digitizing and automating core claims workflows, insurers can streamline operations, accelerate resolutions, and improve member satisfaction—all while tightening compliance and fraud protection.

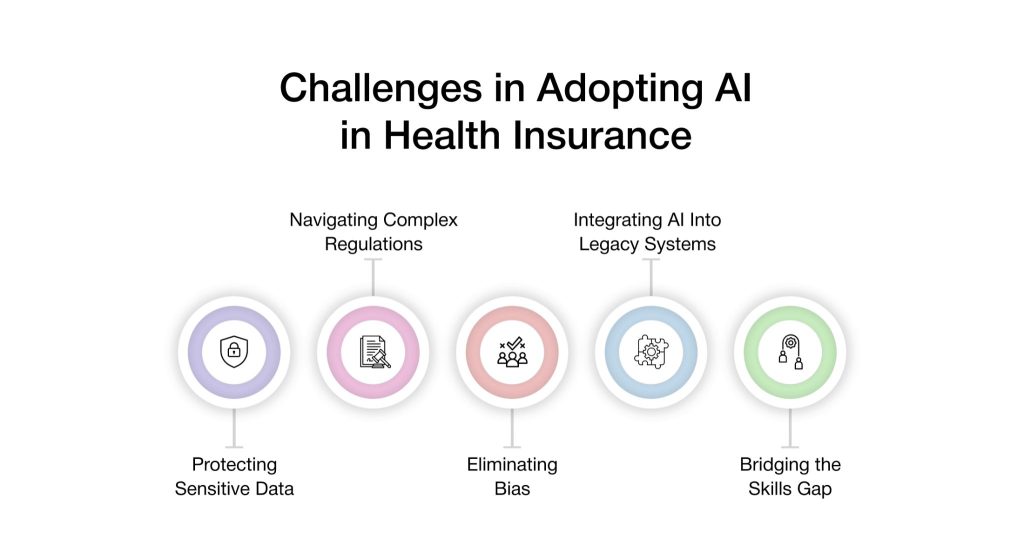

Top Challenges in Adopting AI and How to Overcome Them

Artificial Intelligence promises transformative value in health insurance—from automating repetitive tasks to powering personalized care journeys. But adoption is rarely smooth. As insurers scale AI initiatives, they must navigate a series of strategic, operational, and ethical hurdles. Tackling these challenges head-on is essential to unlock sustainable impact and maintain stakeholder trust.

1. Data Silos and Poor Data Quality

AI systems thrive on clean, connected, and comprehensive data. But many insurers still operate in fragmented environments where member, claims, and provider data live in separate systems.

How to Overcome:

Invest in data integration frameworks and APIs that unify disparate systems. Data governance initiatives—focused on standardization, quality control, and lineage tracking—should be prioritized from the start.

2. Compliance and Privacy Concerns

AI needs access to sensitive personal health information (PHI). That raises red flags around HIPAA compliance, consent management, and auditability.

How to Overcome:

Deploy privacy-first architectures. Choose AI solutions with built-in HIPAA safeguards, role-based access controls, and transparent audit trails. Emphasize ethical AI practices that align with regulatory expectations and member trust.

3. Resistance to Change Among Internal Teams

Frontline teams may view AI as disruptive—or even as a threat to job security. Without buy-in, adoption stalls and ROI suffers.

How to Overcome:

Position AI as a co-pilot, not a replacement. Provide clear communication on how AI enhances roles rather than replaces them. Invest in change management programs and upskilling to empower teams, not displace them.

4. Lack of Explainability in AI Decisions

Black-box models that deliver decisions without context can erode confidence—especially when used in clinical or claims-related decisions.

How to Overcome:

Favor explainable AI (XAI) frameworks that offer transparent reasoning behind every outcome. This builds trust with both internal teams and regulators.

5. Unclear ROI and Use Case Prioritization

Insurers often struggle to measure AI’s impact or determine where to begin. Without clarity, pilot programs fizzle out or fail to scale.

How to Overcome:

Start with high-impact, low-complexity use cases—like claims triage, member inquiry automation, or fraud detection. Tie each initiative to clear KPIs (cost savings, time-to-resolution, member satisfaction) to demonstrate value early.

VIZCare Empower: Enabling Smarter, Safer Artificial Intelligence in Health Insurance

VIZCare Empower is an AI-based platform built to improve how health insurers run key business functions. It brings automation, better operations, and stronger engagement through one easy-to-use platform.

- AI-Driven Sales Enablement: Empower helps sales teams by automating important tasks like quote creation, proposal building, and contract handling. Brokers get AI suggestions and ready documents that speed up the process and improve their experience. Real-time tracking keeps everyone informed and supports smooth teamwork.

- Intelligent Workflow Automation: With a low-code or no-code setup, Empower makes it easy to automate work. This cuts down on live agents’ tasks and speeds up operations. Insurers can use built-in or custom workflows to scale up while keeping accuracy and meeting compliance needs. The platform also connects well with other systems for smooth business handling.

- Seamless Enrollment and Onboarding: Empower makes it easier to bring on new groups or individuals by setting up workflows and rules automatically based on sales data. This shortens enrollment time, keeps everything consistent with brand standards, and reduces delays.

- Stakeholder and Consumer Servicing: The platform brings together data for members, providers, brokers, and employers in one place. This allows teams to deliver more personal and helpful service. AI tools help predict needs and offer the right support quickly.

- Contact Center Management: Empower improves contact center work with AI tools that guide agents in real time. It provides live transcripts and context that help agents answer questions faster and more accurately. This leads to shorter wait times and better service.

Conclusion

Artificial intelligence in health insurance is changing how insurers think about service, speed, and scale. Instead of relying on slow, manual systems, insurers now use artificial intelligence health insurance solutions to make faster decisions, reduce repetitive tasks, and deliver better service across every channel.

VIZCare Empower takes this further by helping insurers unlock value hidden in their everyday operations. It simplifies complex processes, connects teams, and gives smart insights when they are needed most.

AVIZVA stands out for building tools that are easy to adopt and built to last. VIZCare Empower is built for those ready to lead.

FAQs

1. What are the main barriers preventing the widespread adoption of AI in the health insurance sector?

Many health insurers struggle with fragmented data, outdated systems, and concerns around privacy and compliance. On top of that, some teams resist change, unsure how artificial intelligence health insurance solutions will impact their roles. These hurdles make it tough to scale AI smoothly across the organization.

2. How does AI address fraud detection in health insurance claims?

AI flags suspicious patterns like duplicate claims, inflated charges, or identity mismatches by scanning massive volumes of data in real time. This allows insurers to catch fraud early and protect both margins and member trust. In artificial intelligence health insurance workflows, this means faster, smarter fraud prevention without slowing down legitimate claims.

3. What are the challenges in integrating AI with existing health insurance systems?

Legacy systems often lack the flexibility needed for modern AI tools, making integration slow and complex. Data silos and inconsistent formats also make it harder for artificial intelligence health insurance platforms to work effectively. Overcoming this requires strong APIs, clean data, and cross-team alignment.

4. How can AI improve personalized health insurance plans for customers?

AI analyzes member behavior, health history, and preferences to recommend plans that truly fit individual needs. This helps insurers offer more tailored coverage, better benefits, and proactive support. Artificial intelligence health insurance tools make personalization easier and more scalable than ever.