In the age of accelerated innovation, technology decisions are no longer just about what to implement – they’re about how to implement it best.

For any industry right now, technology has become a core strategic virtual asset, and the question of whether to build, buy, or partner has become ever more critical for enterprises, especially for the U.S. healthcare insurance industry. This decision-making process is not only about choosing the best technology but ensuring the right long-term pathway for process optimization, customer experiences, and competitiveness.

For healthcare insurance companies, their mode of building, buying, or partnering essentially dictates their ability to respond to ever-changing market conditions. Whether it is a claims system with AI, a telemedicine platform, or simply a new member engagement portal, you must comprehend the very core principles underlying this decision.

Below, we dive deep into the three approaches and their impact on healthcare insurance companies. Let’s guide you through key considerations that will drive informed choices.

How to Align Your Technology Strategy with Business Goals: Build, Buy, or Partner?

When it comes to decisions about building, buying, or partnering, strategic alignment is one of the most critical factors. Healthcare insurance companies must assess how the technology will support their competitive differentiation and long-term roadmap.

Build if the technology is central to your core business and represents a competitive edge. For instance, an insurance company may have software custom-built for claims processing, or a unique data analytics engine that supports predictive modeling for better risk management.

Buy if the technology is a commodity, i.e., essential for your operations but not a key differentiator. For example, health insurance companies may get their CRM software off the shelf, obtain a video conferencing tool to support their telemedicine, or choose a payment gateway that does its job without bells and whistles. The benefits of buying include speed, lower risk, and vendor support.

Partner if the technology complements your core business without requiring full ownership or control. A fine example of this would be the integration of a third-party specialized telemedicine platform into your insurance ecosystem, especially in the lack of in-house capability to build it from scratch.

Navigating the Build vs. Buy vs. Partner Dilemma: A Real-Life Example

Let us run through an example for a hypothetical healthcare tech company, namely, CareBridge Health, which is creating a Virtual Care Platform. They need several pieces of technology:

- A Telehealth Video System

- Patient EHR Integration

- AI-Based Symptom Checker

- HIPAA-Compliant Cloud Infrastructure

- Analytics Dashboard for Providers

Here’s how the company might approach these requirements:

- Build: CareBridge Health might build a custom AI engine that tailors care plans based on patient behavior—this could be their “secret sauce” for standing out in the market.

- Buy: The company could buy a HIPAA-compliant video system from Twilio and purchase an EHR integration tool from Redox to connect patient data across platforms seamlessly.

- Partner: They could partner with a mental health startup to integrate Cognitive Behavioral Therapy (CBT) modules into their app, sharing revenue from the subscription model.

This combination of building, buying, and partnering allows CareBridge Health to focus on what differentiates them, while also leveraging external resources to reduce development time, engineering risk, and compliance complexity.

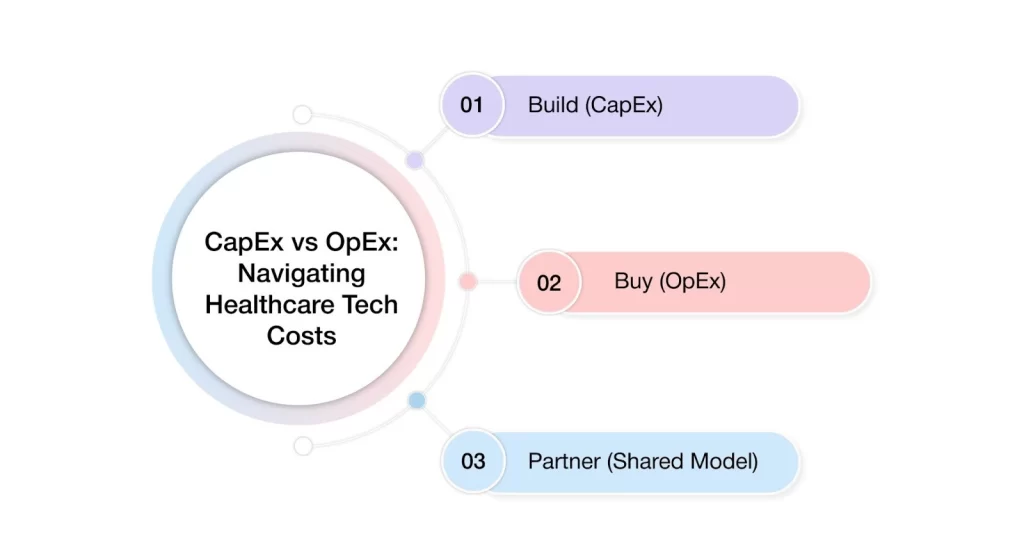

Understanding the Cost Impact: CapEx vs. OpEx in Healthcare Technology Decisions

Cost is a significant consideration in the build vs buy vs partner decision, especially for healthcare insurance companies that deal with large-scale systems and sensitive data. This section provides a practical cost analysis for building, buying, or partnering with technology in healthcare insurance.

- Build: Custom development often involves high upfront costs (CapEx) because you are developing a unique solution. However, over the long term, building can be more cost-efficient, with the possibility of lower total cost of ownership (TCO). In such a case, you are now in control of maintenance and upgrades.

- Buy: When you purchase a solution, the costs are typically structured as subscription-based technology services or licensing fees (OpEx). They provide faster deployment with immediate functionality, though one may face higher recurring costs in the long term.

- Partner : Partnerships can offer a shared investment model, which can be cost-efficient upfront; however, there could be a revenue-sharing angle or a need to sacrifice profit margins.

For healthcare insurance companies, an important decision depends on balancing costs against operational goals and budget constraints.

How Quickly Can You Implement Healthcare Technology?

Time is a critical factor in healthcare, especially with fast-moving regulatory changes and market competition.

- Build: The custom-building solution also takes time; a longer development timeline to meet internal specifications will slow market entry. It is, however, fully customizable.

- Buy: Buying an existing solution proves faster to launch. The new system can be fully deployed within weeks or months, making it particularly suitable for industries that require extremely tight timelines, such as healthcare insurance.

- Partner: Partnering becomes a medium-term timeline. Although it’s not as fast as buying, it can certainly be faster than building from scratch. This approach is beneficial when expertise is needed that cannot be provided promptly by the custom development method.

Healthcare insurance companies operating in regulated environments or facing urgent market pressures may need to lean toward buying or partnering to speed up the implementation process.

Achieve the Perfect Fit with Customization and Control

Customization and control over the technology are vital for ensuring that a solution fits the exact needs of your healthcare insurance business.

- Build: Any development can allow complete specification of any feature, process, or system integration. Customization is made to match the unique requirements of the clients, be it claims, workflows, payments, or member communications.

- Buy: Usually, customization options are limited in a purchased application. Updates and new features depend on the vendor being distributed by the vendor, while the vendor may not make any alterations and may rather refer you to their in-house development team, or worst, third parties whose costs may be high.

- Partner: Partnering eases some level of co-creation, but it puts control in both of your hands. For example, partnering with a telemedicine platform may give you the ability to customize certain features, but the overall system would be under the control of your partner.

For healthcare insurance companies with complex requirements or highly specific workflows, building or partnering may offer more flexibility.

Ensuring Healthcare Data Safety Through Security and Compliance

For healthcare insurance companies, keeping data secure and attaining compliance are of the utmost importance, considering the sensitive nature of healthcare data. HIPAA compliance is a must, as are GDPR and other data protection regulations.

- Build: When you build something internally, the organization is in control of the security and compliance issues, so you have a responsibility to implement safeguards and guarantee adherence to the standards.

- Buy/Partner: In buying or partnering scenarios, due diligence should be conducted with the vendor’s security features, SLAs, and compliance posture to make sure that their security standards are at par with those accepted in the industry. For example, consider purchasing a telehealth platform or partnering with a vendor that processes claims while ensuring their infrastructure is HIPAA-compliant.

Data security and regulatory compliance must weigh heavily in your decision-making concerning building, buying, or partnering, as the consequence of failing to meet these standards can result in crippling financial penalties and intense reputational damage.

Scalability and Maintainability to Power Sustainable Growth

As healthcare insurance companies grow and scale, they need systems that can handle increased data volumes and more complex workflows.

- Build: A custom solution is scalable depending on your needs. However, it will require long-term resources to support and grow alongside the business, which means constant spending on talent, infrastructure, and technology.

- Buy: If you purchase a solution, vendor-side scalability usually comes into play. The vendor should support the growth of your system, but their costs to you may eventually rise as you scale.

- Partner: Scalability in a partnership depends on the partner’s abilities and how you define this in your agreement. If, for example, you partnered with a claims engine, then how well they could scale would be directly related to your ability to grow.

For any insurance company, scalability should be included in the considerations for future growth and the increasing complexity of healthcare data.

How Talent Availability Impacts Your Build, Buy, or Partner Decision?

Another point of consideration in the decision-making process involves whether one has access to the talent for building or maintaining a custom solution.

- Build: To build a custom solution, the company must have an internal technical team with the requisite expertise, including developers, security specialists, and data architects.

- Buy: Buying off-the-shelf solutions minimizes the need for internal deep technology expertise, as vendors handle development, maintenance, and upgrades.

- Partner: With partnerships, the technical burden is shared. You can leverage your partner’s expertise to reduce your reliance on internal teams.

For healthcare insurance companies with limited internal technical expertise, buying or partnering may be more feasible than building from scratch.

Do Ecosystem Relationships Influence Your Strategy?

If your organization is entering a new domain or geography, choosing the right approach can help you leverage an established ecosystem.

- Build: Building your solution can be hard with external ecosystems as it necessitates you to handle integrations and vendor or platform relationships.

- Buy: Buying from an established vendor with a robust ecosystem is ideal when you need access to an existing network of integrations and partnerships.

- Partner: A third-party provider partnership can be of considerable help when entering a new market or domain.

AVIZVA: The Hybrid Approach Insurance Companies Need to Win

Once the factors—cost, time-to-market, customization, scalability, and risk have been weighed by the potential buyer, the final decision mostly hinges on who they partner with. Choosing a good partner is crucial because it allows you to have both speed and control, giving you the best of both worlds: the speed of buying and the control of building.

AVIZVA: Your Partner for Building and Buying Smarter

Insurance companies no longer have to choose between building from scratch or buying off-the-shelf. With AVIZVA, you can do both—strategically.

- Buy what works right away: Our VIZCare product suite comes with pre-built, battle-tested solutions for claims automation, compliance tracking, customer engagement, and more.

- Build what makes you different: Use our high-end engineering services to develop custom features, integrations, and innovations that give you a competitive edge.

- Mix and match effortlessly: Deploy products for immediate needs while building tailored solutions alongside them.

- Accelerate time-to-market: Skip the long development around standard capabilities, and focus your build time where it is most valuable.

- Reduce risk and cost: Minimize costly missteps by relying on our proven technology and experienced engineering teams.

- Scale with confidence: Our hybrid approach ensures that your systems will scale with changing regulations, market needs, and customer expectations.

- Leverage deep insurance expertise: Our team understands the complexities of insurance operations, ensuring solutions that fit your real-world challenges.

With AVIZVA, you get more than technology—you get a strategic partner who helps you deliver quick wins today while building future-ready capabilities for tomorrow.

Conclusion

When choosing between build, buy, or partner, healthcare insurance companies need to evaluate their strategic goals, budget, timelines, and regulatory needs. The choice is hardly ever universal; very often, it is up to the company to decide whether to use one, none, or a mix of these approaches, depending on the technology at hand and the business objectives to be met.

By factoring in each consideration, including cost, time to market, degree of customization required by the customer, data security, and scalability, among others, a healthcare technology director will ensure that the strategy presented will actually address both immediate and long-term needs. Whether your consideration is to build a customized approach, buy one ready-made, or partner with an outside party, ensure that the choice will feed into the vision of digital transformation and operational excellence set for your company.

Don’t let the guesswork confuse your technology decisions. Schedule a free demo and take the first step toward transformation.

FAQs

1. When to build, buy, or partner for technology development?

Building and owning represents a choice when you need full control over the tech, and it is core to your competitive edge. Buying involves acquiring an off-the-shelf, ready-made solution that meets your needs within a sufficient timeframe and is cost-effective.

2. How can buying tech solutions reduce CapEx in businesses?

Buying tech solutions, especially those that are subscription-based tech services, moves expenses away from high upfront costs (CapEx) to predictable, ongoing operational expenses (OpEx). Major capital investments are less financially intimidating when subscription payments are small and spread over time, which in turn helps entities in managing cash flow.

3. How to choose the right tech vendor for buying solutions?

When selecting a tech vendor, inspect their capability to offer scalable solutions and proper customer support toward the industry standards. Cross-check their solution with your strategic business goals, budget, and long-term strategy. Through customer reviews and case studies, we can gauge the vendor’s reputation.