In an era where digital convenience is the baseline, not the bonus, healthcare insurance providers face a pivotal moment: adapt or become irrelevant. What was once a differentiator—AI-driven assistance, self-service apps, and omnichannel engagement—has now become the new standard. Consumers no longer just hope for better digital experiences; they expect them.

From seamless claims tracking to personalized plan recommendations, technology isn’t just enhancing customer experience in insurance—it’s redefining it. And at the heart of this shift lies a deeper demand: clarity, speed, and empathy in every interaction.

In this blog, we unpack the accelerating role of digital in healthcare insurance, revealing how it’s evolved from a supporting actor to the main character in shaping loyalty, trust, and long-term value. If your enterprise isn’t innovating, it’s falling behind—and the clock is ticking.

How Technology Is Transforming Insurance CX – 8 Key Trends

1. Streamlined Enrollment

Enrolling in healthcare insurance has traditionally been a complex, time-consuming process for consumers—requiring them to navigate lengthy forms, confusing jargon, and piles of paperwork.

However, with the advent of digital transformation, this cumbersome process has been simplified into a guided, intuitive insurance customer experience. Today, advanced online platforms and mobile apps empower consumers to effortlessly compare plans, understand benefits, and secure the right coverage—all in just a few clicks. This shift has minimized paperwork, enhanced clarity, and redefined the enrollment journey.

2. Enhanced Transparency

Consumers have long faced challenges in understanding the full scope of their health insurance coverage. The fine print and hidden fees in plan documents only intensify this confusion.

Digital insurance customer engagement tools are turning this complexity into clarity. With intuitive interfaces and user-friendly dashboards, members can now effortlessly access real-time information about their plan coverage, dependents, costs, and benefits. This allows them to minimize surprises, make smarter decisions, and have greater control over their healthcare journey.

3. Personalized Recommendations

Consumers often struggle to find the right healthcare insurance plan that reflects their unique needs and preferences. Traditional methods of plan selection can overwhelm consumers with too many options, leaving them uncertain about which plan best aligns with their unique healthcare requirements.

By leveraging AI-driven analytics, insurers can provide personalized plan recommendations tailored to a consumer’s health history, preferences, and financial situation. This leads to better coverage, enhanced consumer satisfaction, and more meaningful engagement.

How are insurance companies using AI to improve customer experience? Many now rely on intelligent automation, predictive analytics, and recommendation engines that analyze historical data to anticipate consumer needs.

These AI tools improve customer experience in insurance support by ensuring timely responses, proactive communication, and relevant insurance options.

The proof is in the numbers: 81% of consumers are more likely to stay with insurers that offer personalized support. Moreover, personalized experiences can elevate consumer engagement in healthcare by up to 89%. Thus, personalization doesn’t just meet expectations; it strengthens trust and fosters long-term consumer loyalty.

4. Improved Communication

Clear and consistent communication is essential in healthcare insurance. When consumers are well-informed about plan updates and know exactly what to expect, it leads to enhanced satisfaction and minimized confusion.

Technology serves as a critical driver of this clarity. Automated updates via SMS, email, or mobile apps allow insurers to keep consumers informed in real time—whether it’s regarding coverage changes, renewal reminders, or necessary actions. This ensures fewer surprises, greater transparency, and a stronger, more trusted relationship with every consumer.

5. Access to Support and Resources

Today, healthcare consumers expect more than just comprehensive coverage—they want greater control over their insurance plans.

Since the pandemic, the demand for self-service has surged by 36%, as more consumers seek fast, effortless, and round-the-clock support. A recent survey of over 2,700 U.S. adults revealed that nearly 1 in 5 switched insurance providers due to a lack of self-service options. These statistics indicate a critical demand for healthcare enterprises to adapt to these evolving consumer expectations.

By integrating virtual assistants and user-friendly customer service portals, insurers can respond to these demands effectively. These digital insurance customer engagement tools empower consumers to resolve issues independently, reducing call volumes while enhancing overall satisfaction.

6. Virtual Care and Digital Health Partnerships

As consumers increasingly demand faster, more convenient access to healthcare, insurers are responding by incorporating virtual care into their plans. This not only boosts convenience but also adds substantial value to the overall plan offering.

Telehealth enables consumers to consult with providers from anywhere, eliminating long wait times and the need for travel. This smarter, more streamlined healthcare consumer experience significantly boosts consumer satisfaction.

Consider IMG (International Medical Group), a global insurance and assistance leader. By strengthening its partnership with Teladoc Health, IMG is expanding access to virtual care for more of its members—delivering 24/7 healthcare access right at their fingertips.

7. Health and Wellness Programs

Health and wellness programs have evolved from optional add-ons to essential pillars of modern health insurance offerings. Today, insurers are increasingly leveraging technology to deliver wellness solutions—such as fitness trackers, health risk assessments, and personalized wellness goals—that encourage healthier lifestyles and proactive care.

These programs do more than just track steps or monitor heart rates—they’re actively driving positive behavior change and fostering long-term loyalty. Many insurers now incentivize healthy actions with meaningful rewards, such as premium discounts or redeemable points for achieving fitness milestones.

A standout example is Ambetter Health’s My Health Pays® Rewards Program. Members can activate the program through their Ambetter account and earn rewards for completing health-focused activities. These points aren’t just symbolic—they carry real financial value and can be used toward doctor copays, monthly premiums, and more.

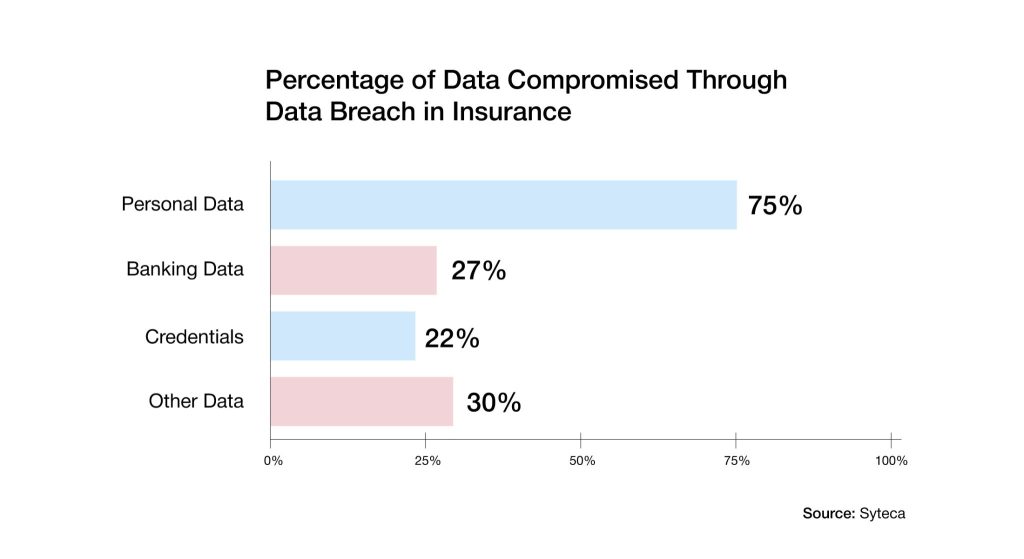

8. Data Security and Privacy

With the rise in digital vulnerabilities, protecting personal health data has shifted from a regulatory obligation to a strategic imperative for healthcare enterprises aiming to build and maintain trust. As both consumers and insurers continue to elevate their expectations around data security, the need for robust, proactive data protection has never been more urgent.

To address this growing challenge, insurers are integrating advanced data security technologies such as encryption, secure cloud solutions, and multi-factor authentication into their digital ecosystems. These tools not only defend against cyber threats and unauthorized access but also ensure that sensitive data remains secure and confidential at all times.

In addition to safeguarding data, strong security measures help insurers stay compliant with vital regulations such as HIPAA, while also reassuring consumers that their privacy is a top priority.

Why Getting the Basics Right Is The Key to Improving Customer Experience in Insurance

In an age of digital disruption and rising consumer expectations, technology alone can’t drive superior consumer experience. While innovation is crucial, it’s mastering the fundamentals—like communication and consistency— that truly makes the difference.

The following are the key elements to improving customer experience in the insurance landscape:

1. Clear Communication

Consumers should be able to navigate through their health insurance plans with ease. However, a recent KFF survey revealed that 51% of adults faced challenges with at least one aspect of their coverage. Surprisingly, 58% of college graduates also admitted to struggling with understanding their plans.

This challenge stems from the complex jargon and dense documentation often associated with insurance plans. Insurers can overcome this by communicating clearly and consistently with their consumers. By simplifying complex details—such as what’s covered, what’s not, and what’s changing—insurers can build consumer confidence. This, in turn, helps strengthen trust, enable better decisions, and build long-term loyalty.

2. Ease of Access

Today’s health insurance consumers expect a fast and effortless way to manage their plans. They want instant access to plan details, real-time claim tracking, and immediate support—all without navigating complicated processes

With the rise of web portals and mobile apps, insurance is now at their fingertips. When users can easily find what they need, they’re more likely to take charge and resolve issues independently, eliminating wait times and minimizing confusion.

3. Efficient Claims Processing

Claim processing has traditionally been a frustrating experience for consumers—marked by long delays, extensive paperwork, and uncertainty.

Today, insurers are leveraging automation and AI to transform this experience. By streamlining workflows, reducing manual errors, and speeding up approvals, they are delivering faster, more efficient, and more satisfying outcomes for consumers.

4. Responsive Customer Service

Today’s healthcare consumers expect prompt, effective, and empathetic support across every channel—whether it’s via phone, agents, or live chat.

Modern service interactions, powered by intelligent agents and digital portals, go beyond resolving queries—they reflect genuine care, build trust, and drive long-term loyalty.

5. Accurate Billing and Documentation

For healthcare consumers, trust begins with transparency. Billing errors, unexplained charges, and confusing invoices quickly erode confidence.

When insurers provide clear, accurate, and easy-to-understand documentation, consumers feel respected and secure. Knowing exactly what they’re paying for offers reassurance—and that is often as important as the care itself.

6. Personalized Assistance

Healthcare consumers expect personalized support at every stage of the insurance customer journey. From choosing the right plan to managing ongoing service needs, they value recommendations & guidance tailored to their unique health needs and preferences.

Meeting these expectations fosters an emotional connection, driving higher satisfaction and long-term consumer loyalty.

7. Reliability and Consistency

Consumers count on their insurers to meet their needs at all times. This requires maintaining dependable systems and delivering consistent, high-quality service.

Whether it’s a claims update or a routine inquiry, being there when it matters most builds consumer confidence—and that trust becomes the quiet force behind a strong, enduring brand.

8. Proactive Engagement

Consumers shouldn’t have to chase their healthcare insurers for answers. Proactive communication—through timely updates, alerts, and wellness tips—reflects an enterprise that genuinely values its consumers.

When consumers are kept informed, they feel empowered, respected, and more connected to their insurer.

Reimagining Insurance Consumer Experience with AVIZVA

As technology reshapes the insurance client digital experience, it’s crucial for enterprises to lead the transformation—and that’s where AVIZVA comes in.

AVIZVA is a healthcare technology company that enables Payers, TPAs & PBMs to simplify, accelerate, and optimize care delivery. Backed by over 14 years of deep healthcare expertise, AVIZVA offers a rich portfolio of healthcare offerings categorized into Engineering Services and Proprietary Products.

At the forefront of this innovation is VIZCare Xperience—an AI-powered, multi-portal suite built to transform customer experience across the entire insurance value chain. Designed for healthcare enterprises seeking to strengthen engagement, VIZCare Xperience delivers frictionless, personalized, and connected experiences for every stakeholder—Members, Brokers, Employers, and Providers.

Each sub-product within the suite is purpose-built to meet the unique needs of its users:

- MemberX – It is a one-stop shop for members to manage their coverage, search for benefits, find care, understand claims, and track prior authorizations. While it primarily focuses on enabling ease of self-service, thereby reducing operational workload for enterprises, it also simplifies and enhances interactions with member engagement teams. The platform delivers tailored campaigns to members based on their unique health needs and preferences, helping them make more informed and confident healthcare decisions.

- BrokerX – It is a platform that is designed to simplify client acquisition, management & retention for agencies & agents. It brings capabilities to manage the entire lifecycle of clients, covering pre-sales, sales, and post-sales, all at your fingertips. Some of the most used and high-impact features include quoting and proposals, managing their book of business, accessing commission statements, and gaining ready access to insightful analytics.

- EmployerX – With employers’ needs in mind, the platform is designed to facilitate effortless management and oversight of employee benefits and usage. Employers can easily manage their group membership, including open enrollment, life change events, member profile information, understanding plan benefits, invoices, and plan performance. The platform also supports employee health and wellness engagement initiatives. By offering access to rich analytics and real-time reporting, EmployerX enables employers to make informed, data-driven decisions that enhance both health outcomes and operational efficiency.

- ProviderX – The platform is designed to support both in-network and out-of-network providers by streamlining processes across the entire care journey. It simplifies pre-service interactions with real-time eligibility and benefits verification, accurate service cost estimates, and digital prior authorization tools. In the post-service stage, providers benefit from real-time claims submission, status tracking, and efficient referral management. Post-adjudication is enhanced through automated notifications and digital tools for fast, transparent dispute resolution—minimizing delays and administrative burden.

Together, these four portals create an interconnected ecosystem that not only links operational silos but also guarantees consistent communication at every point. In addition, VIZCare’s engineering services enable enterprises to effortlessly incorporate, customize, and scale these solutions according to their business landscape—thus boosting agility, innovation, and measurable outcomes.

In a tech-driven future, VIZCare Xperience is a game-changer for insurers as it grants them the power to provide customers with more relevant, data-driven, and humanized experiences, thus marking a new threshold for customer engagement in healthcare.

Conclusion

Technology is revolutionizing the customer experience in the insurance industry. From simplified enrollment and improved communication to enhanced data security, digital tools are making it easier, faster, and more convenient for consumers to manage their health insurance.

To unlock the full value of emerging technologies, healthcare enterprises need a partner with deep domain expertise and a proven track record—and that’s where AVIZVA stands apart. Backed by 14 years of healthcare expertise, AVIZVA brings VIZCare Experience—a comprehensive suite of cross-channel self-service products designed to enhance consumer experience and improve health outcomes.

If you’re a healthcare enterprise ready to elevate your consumer experience through cutting-edge digital tools, get in touch now!

FAQs

- How are insurance companies using AI to improve customer experience?

Insurance companies are using AI to elevate consumer experience by making every interaction faster, more intuitive, and deeply personalized. AI-driven virtual assistants and service portals offer instant support, while automated workflows shorten quote, onboarding, and claims cycles. With AI unifying insights across touchpoints, insurers can create seamless, proactive, and consistently high-quality experiences throughout the consumer journey. - What AI tools improve customer experience in insurance support?

AI tools such as conversational agents improve insurance support by handling routine inquiries, reducing wait times, and delivering real-time responses. Platforms like VIZCare AI add value by using contextual intelligence to enable more relevant guidance, route requests intelligently, and assist agents with real-time insights—reducing wait times and improving first-contact resolution. - What are the best AI tools for customer acquisition in insurance?

AI is an excellent aid for insurance companies in customer acquisition, as it offers tools such as AI-driven lead scoring, automated personalized outreach, and predictive analytics for identifying potential clients who are most likely to respond. This is all about delivering the right message at the right time, which is why these tools contribute to generating prospects and converting them through a friendly delivery approach. - How does technology shape customer experience in insurance?

The customer experience in insurance is predominantly defined by technology that not only provides but also guarantees faster and more efficient services, such as digital enrollment, real-time claims tracking, and AI-powered personalized recommendations. These innovations ensure that interactions are seamless, transparent, and convenient, enabling insurers not only to meet but also to exceed consumer expectations, ultimately building long-lasting relationships.