In today’s fast-paced healthcare ecosystem, data is no longer just an operational necessity; it is the key to making smarter, evidence-based decisions. This invaluable resource powers transformative technologies, such as AI and data analytics in healthcare, which are crucial for delivering the precision, personalization, and performance necessary to thrive in the highly competitive health insurance landscape.

With 60% of health insurance executives already leveraging analytics to boost operational efficiency and improve member outcomes, the industry is well on its way to embrace a shift from reactive to proactive data-driven strategies. The impact is clear: 42% have seen a significant increase in member satisfaction, while 39% have sharply reduced operational costs. This clearly demonstrates that when data and intelligence come together, transformation is inevitable.

The benefits of data analytics extend far beyond operational improvements. Healthcare enterprises are leveraging it to anticipate risks, detect fraud, optimize care management, deliver personalized experiences at scale, and intelligently orchestrate the entire member journey. This highlights the application of data analytics in healthcare for predictive insights and operational excellence.

As the healthcare industry transitions from a policy-driven to an insight-driven approach, this blog delves into nine transformative ways AI and data analytics in healthcare are reshaping the way enterprises operate, revolutionizing everything from underwriting and claims management to customer engagement and predictive care.

What is Healthcare Data Analytics?

Healthcare Data Analytics is the science and art of collecting, processing, and interpreting health-related data to extract actionable insights. These insights can be leveraged by enterprises to improve health outcomes, reduce care delivery costs, and optimize operational efficiency.

In the health insurance landscape, this means transforming vast amounts of raw data—claims, member behavior, provider performance, risk profiles—into meaningful patterns and predictive insights. By leveraging AI-driven analytics, organizations can make smarter, proactive decisions that enhance both operational performance and member experiences.

What Are the Benefits of Data Analytics in Healthcare?

Data analytics empowers healthcare enterprises in the following ways :

- Identification of trends in population health

- Prediction of high-risk cases before they escalate

- Optimization of care plans and provider networks

- Personalization of member experiences

- Prevention of fraud before it causes significant damage

Integrating AI, machine learning, and big data, healthcare data analytics transforms raw data into a dynamic, proactive tool – driving smarter, data-driven decisions at every every level of the healthcare ecosystem.

In essence, healthcare data analytics isn’t just about understanding past events -it’s about what a healthcare organization using AI in data analytics can do to anticipate future needs and drive continuous improvements to deliver better health outcomes.

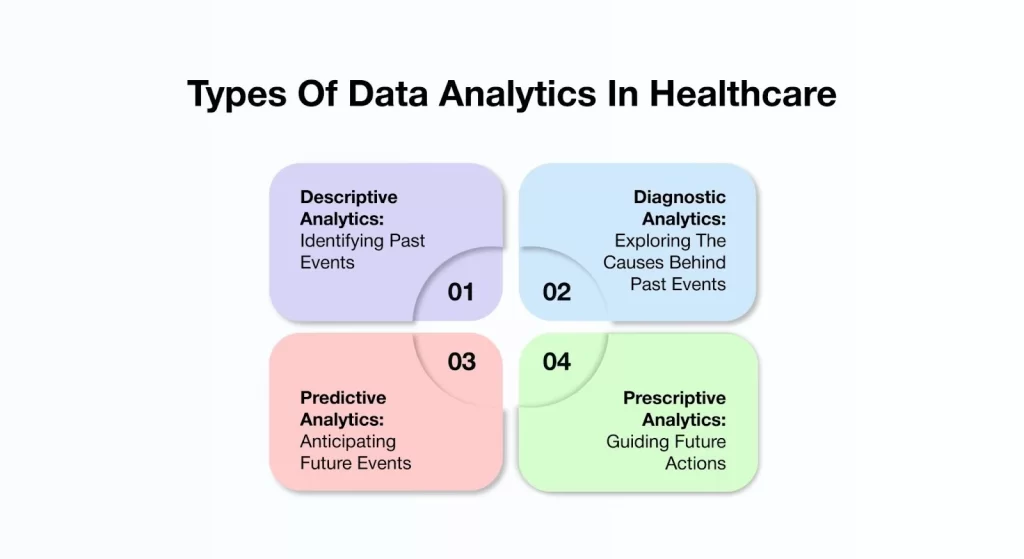

What Are the Key Types of Healthcare Data Analytics?

Following are the four main types of data analytics in healthcare :

1. Descriptive Analytics – Identifying Past Events

Definition : Descriptive Analytics serves as the foundation of data analysis. It involves reviewing historical data to identify trends, measure performance, and set benchmarks. This helps stakeholders gain insights into past events and draw meaningful conclusions from them.

Example: An insurer analyzes claims data from the past year and discovers that 30% of members aged 45 and older filed high-cost claims due to chronic conditions like diabetes and hypertension.

Insights Drawn : There is a high utilization of healthcare services among members with chronic conditions in a specific age group.

2. Diagnostic Analytics – Exploring The Causes Behind Past Events

Definition : Once the “what” is understood through Descriptive Analytics, the next step is to uncover the “why.” Diagnostic Analytics goes much deeper into the data to explore the underlying causes and hidden patterns behind past events, helping healthcare teams understand the factors that led to particular outcomes.

Example: After identifying that 30% of members aged 45 and older filed high-cost claims due to chronic conditions, the insurer uses diagnostic analytics to explore the underlying causes. The analysis reveals that many of these members missed preventive screenings or failed to follow up on their care plans due to factors such as lack of awareness or limited access to healthcare resources.

Insights Drawn: Inadequate care management and low member engagement significantly contributed to the high-cost claims.

3. Predictive Analytics – Anticipating Future Events

Definition: AI predictive analytics in healthcare goes beyond looking at past and present trends. It uses historical data, statistical models, and AI to predict future events, helping healthcare enterprises spot emerging risks, foresee health issues, and take preemptive action.

Example: The insurer develops a predictive model that analyzes members’ current lifestyle choices, medication adherence, and past health history to identify individuals at high risk of developing chronic conditions within the next 12 months.

Insights Drawn: Early identification of at-risk members allows for timely interventions, preventing conditions from escalating into more severe health issues.

4. Prescriptive Analytics – Guiding Future Actions

Definition: Prescriptive analytics is the most advanced type of analytics. It not only forecasts future events but also guides decision-making by evaluating various scenarios and recommending the optimal course of action.

Example: Based on predictive models, the insurer automatically enrolls high-risk members into personalized wellness programs, assigns health coaches, and sends reminders for screenings.

Insight: Proactive care interventions help reduce long-term healthcare costs and improve health outcomes.

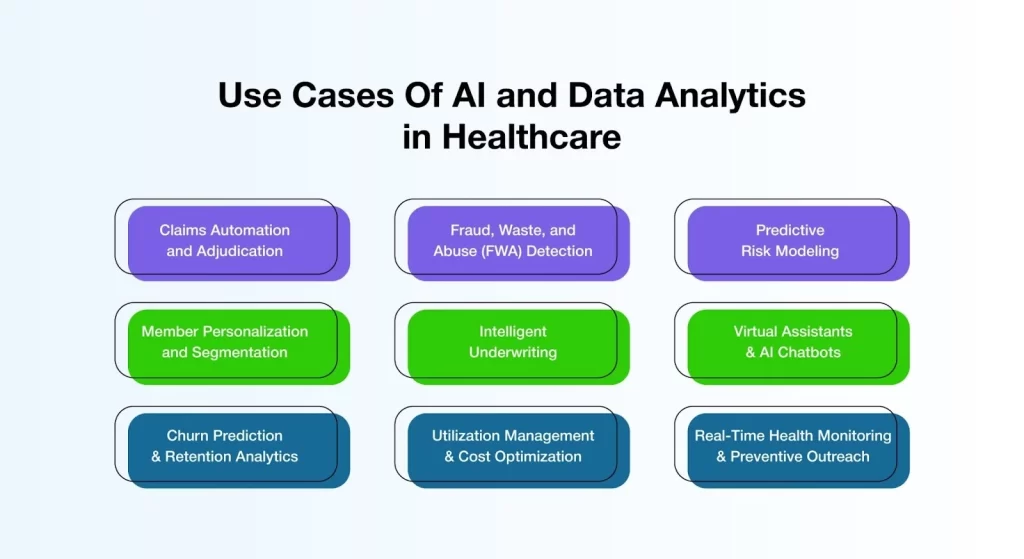

Top 9 Use Cases of AI And Data Analytics in Healthcare

The following are the top 9 AI applications in healthcare.

1. Streamlining Claims Automation and Adjudication

AI-driven claims automation and adjudication replace manual processing, reducing errors and minimizing administrative costs. Insurers now use AI to streamline document intake, enable real-time eligibility checks, and accelerate payment cycles.

AI in insurance also flags coding inconsistencies and errors. Therefore, it improves claims accuracy to 99.9% by eliminating human error and standardizing workflows, as reported by Enter Health.

Why it matters:

- Reduce costs by minimizing manual efforts and costly errors.

- Enhance turnaround times by automating each step of the claims lifecycle.

- Improve accuracy by ensuring data consistency and error-free submissions.

2. Fraud, Waste, and Abuse (FWA) Detection

Fraud, waste, and abuse (FWA) represent significant financial drains in healthcare, demanding advanced detection methods. A Deloitte survey found that 35% of insurance executives prioritize fraud detection as a key area for adopting generative AI within the next year.

AI and ML in healthcare continuously analyze historical and real-time data to identify irregular billing patterns, such as duplicate charges and upcoding. Predictive algorithms enable proactive fraud detection by flagging suspicious activities before payments are made.

Why it matters:

- A prevention-first approach minimizes financial losses by identifying fraud early in the claims process.

- Reduced losses improve financial sustainability, freeing resources for member care improvements.

- Enhanced regulatory confidence results from accurate, data-driven compliance monitoring.

3. Optimizing Health Outcomes Through Predictive Risk Modeling

By analyzing clinical records, social determinants of health, and utilization patterns, healthcare organizations using AI in data analytics can identify high-risk members who are likely to require chronic care or emergency interventions. This actionable insight supports preventive outreach and efficient resource allocation, minimizing costs and improving outcomes.

Why it matters:

- Better health outcomes are achieved by addressing risks before they escalate.

- Targeted care plans are developed based on accurate, data-driven predictions.

- Fewer ER visits result from proactive care that keeps members healthier.

4. Transforming Health Insurance with Member Personalization and Segmentation

By segmenting members into targeted personas based on demographics, lifestyle, digital behavior, and health profiles, AI enables insurers to move beyond one-size-fits-all strategies. This approach facilitates tailored health tips and customized plan options, driving a 15% increase in customer retention and a 10% improvement in premium growth.

Why it matters:

- Increased loyalty results from delivering personalized journeys that strengthen trust and satisfaction.ue growth.

- Improved engagement is achieved through content that resonates with each member’s unique health profile.

- Relevant communications ensure that outreach aligns with individual needs and preferences.

5. Elevating Underwriting with AI-Enabled Precision and Speed

Traditional underwriting can take weeks. By evaluating structured and unstructured data, such as lab results, medical history, and lifestyle patterns, AI accelerates the process. It has reduced decision times from three to five days to just 12.4 minutes for standard policies. AI also lowers processing times by 31%. It adapts to new data, ensuring policies remain accurate and fair.

Why it matters:

- Faster decisions help insurers meet market demands with timely responses.

- Smarter pricing uses real-time data to reflect accurate risk assessments.

- Scalable evaluations support consistent growth and operational efficiency.

6. Virtual Assistants & AI Chatbots

AI-powered bots now handle a wide range of queries, such as plan benefits, claim status, and provider networks, across apps, websites, and voice interfaces. Trained on healthcare-specific language models, these assistants ensure accurate and consistent responses while providing 24/7 support.

Why it matters:

- Always available, these assistants reduce wait times by delivering instant answers around the clock.

- Consistent messaging improves trust by delivering clear, uniform information.

- Higher member satisfaction results from fast and reliable support that minimizes frustration.

7. Churn Prediction & Retention Analytics

Not all unhappy members voice their concerns. This is why AI algorithms monitor usage patterns, call sentiment, and benefit engagement to predict member churn before it occurs. This empowers insurers to act promptly with outreach or plan changes to retain valuable members. Healthcare leaders must embrace churn prediction to build resilience and boost retention in a competitive market.

Why it matters:

- Reduced attrition is achieved by proactively identifying at-risk members and addressing their concerns early.

- Personalized retention tactics emerge from data-driven insights that shape targeted engagement efforts.

- Higher lifetime value results from improved loyalty and long-term satisfaction with tailored solutions.

8. Utilization Management & Cost Optimization

Data analytics can pinpoint overuse, underuse, and misuse of healthcare services. It enables insurers to refine utilization management and cost optimization strategies. By evaluating patterns, insurers can collaborate with providers on smarter care protocols. They can offer better benefit designs and identify cost outliers to negotiate contracts more effectively.

Why it matters:

- Controlled spending is achieved by minimizing wasteful utilization and steering resources toward high-value care.

- Evidence-driven policy design is supported by actionable insights that align care delivery with member needs.

- Value-based provider networks emerge through analytics that promote partnerships focused on cost-efficient, high-quality care.

9. Real-Time Health Monitoring & Preventive Outreach

With data from wearable devices, electronic health records, and mobile apps, insurers gain a comprehensive, real-time view of members’ health status. This enables AI-driven healthcare data analytics and reporting, helping identify risks, promote preventive care, and nudge members toward healthier behaviors.

It delivers reminders for check-ups, medication adherence, and fitness milestones. This proactive approach promotes healthier lives and reduces costly claims.

Why it matters:

- Real-time visibility enables insurers to adapt strategies and respond swiftly to evolving health trends.

- Healthier populations are achieved by encouraging preventive care and active wellness engagement.

- Reduced downstream costs result from early intervention and fewer avoidable treatments.

Tips For Strategic Adoption Of Data Analytics in Healthcare

1. Link Analytics to Core Business Objectives

Connect analytics to core business objectives by starting with the most pressing challenges. Analytics should aim for measurable improvements, such as reducing member churn, spotting fraud, improving claims accuracy, or strengthening care coordination.

Predictive modeling, for example, can identify high-risk members early so timely interventions can be made to improve outcomes and lower long-term costs. Linking analytics to business goals ensures everyone supports these efforts and sees real returns on investment.

2. Eliminate Data Silos for a 360° Member View

Break down data silos to create a complete picture of members. Integrating data from claims, pre-authorization records, provider performance, call center logs, and wearable devices lays the groundwork for smart automation and precise insights. A unified data environment leads to better risk profiling, more complete member engagement, and personalized communication strategies.

3. Foster a Data-Driven Culture Across the Organization

Promote a culture that values data across the entire organization. Analytics tools work best when everyone can use them confidently. Underwriters, claims adjusters, care managers, and marketing teams all need to make decisions based on real-time insights.

This includes regular training on dashboards and tools. It also involves creating cross-functional analytics teams and making sure KPIs and insights are part of everyday work. When teams understand and trust the data, better decisions follow.

4. Ensure Compliance, Security, and Ethical Use

Ensure secure, compliance, and ethical use of data. In healthcare insurance, data privacy is more than just a legal requirement; it is a fundamental principle. It shapes brand trust. All analytic models, dashboards, and workflows must meet the standards of HIPAA, SOC 2, and internal governance.

Role-based access control, anonymizing member data in testing, and following ethical guidelines for AI deployment are essential. As personalization increases, these guardrails must be even stronger.

5. Move from Insights to Intelligent Automation

Insights are just the beginning; the real value comes from turning analytics into intelligent action. Automating fraud detection enables suspicious claims to be flagged in real-time while complex claims are dynamically routed to expert reviewers for faster, more accurate processing.

Communication is personalized based on member behavior. When analytics are seamlessly integrated into core systems like CRM, claims, and portals, insurers transition from reactive to proactive approaches. This shift also moves them from manual tasks to scalable, efficient processes.

Healthcare Innovation Made Simple: Why AVIZVA is the Right Choice

Staying current with healthcare technology is no longer enough—it’s about staying ahead of the curve. That’s where AVIZVA steps in. They see technology as an enabler, not a constraint. As healthcare continues to evolve, the need for efficient, secure, and scalable AI solutions has never been greater.

VIZCare AI, offered by AVIZVA, is designed to meet these challenges head-on. Serving as a robust AI foundation, VIZCare AI empowers insurers and healthcare enterprises to automate workflows, enhance data security, and streamline operations across all facets of healthcare. Built specifically for healthcare insurance, VIZCare AI enables insurers to stay ahead of industry demands while driving operational efficiency and reducing costs.

Here’s how VIZCare AI helps:

- Deep Understanding of Healthcare Insurance

VIZCare AI is pre-trained on real-world healthcare payer operations, giving it a deep, embedded intelligence in areas like members, providers, claims, benefits, prior authorization, and clinical codes. This domain-specific knowledge ensures unmatched accuracy and relevance across critical insurance processes. It’s purpose-built for healthcare insurance, reducing implementation effort and accelerating digital transformation for insurers. - Private, Secure & Compliant

Data security and regulatory compliance are top priorities for healthcare insurers. VIZCare AI ensures enterprise-grade security by deploying AI models within a dedicated, private environment, with full compliance to HIPAA, SOC 2, and GDPR standards. Enterprises maintain complete control over data residency and access, ensuring sensitive healthcare data is always protected and never exposed to unauthorized environments. This approach eliminates compliance risks and ensures peace of mind for all stakeholders. - Agentic Architecture with Full Functional Coverage

VIZCare AI leverages an MCP-compliant agentic architecture powered by the proprietary Presentation Context Protocol (PCP), providing end-to-end functional coverage across all payer-facing workflows. The platform ensures context-aware orchestration, driving operational reliability and scale. This design supports everything from claims processing to provider management, making the platform adaptable to dynamic healthcare environments while enhancing efficiency and data integrity. - Data Accuracy with Granular Access Control

With fine-grained, role- and attribute-based access controls, VIZCare AI ensures that every user receives the right data at the right time. Enterprises can define precision-level permissions for each record and attribute, guaranteeing compliance, auditability, and operational integrity. By securing data interactions and workflows, the platform provides full control over sensitive healthcare information while supporting reliable and actionable decision-making across the organization.

Conclusion

Today, AI and data analytics in healthcare are foundational to growth and success. From telemedicine and preventive care insights to fraud prevention and resource optimization, these technologies are reshaping how healthcare insurers, payers, and PBMs operate.

The ability to fully harness these benefits depends on choosing the right technology partner. That’s where AVIZVA and its VIZCare AI platform come in. By delivering AI-driven automation, context-aware orchestration, secure and compliant data management, and pre-built, healthcare-specific workflows, VIZCare AI empowers enterprises to accelerate growth, optimize operations, and enhance member engagement.

Are you a healthcare enterprise looking to transform your business operations with future-ready technology solutions? Get in touch with AVIZVA now!

FAQs

- How to choose an AI-driven automation tool for real-time system health monitoring?

When selecting an AI-driven automation tool for real-time system health monitoring, insurers should consider specific key attributes. The seamless installation process with existing systems, the presence of predictive analytic tools, and customizable dashboard settings are three such attributes. The tool should have the ability to enforce industry laws and regulations (such as HIPAA) and allow for real-time data processing to help promptly solve arising issues and optimize the system.

- How do AI-powered provider network analytics drive better claim results?

AI-powered provider network analytics enable insurers to optimize network efficiency by analyzing provider performance, treatment patterns, and member outcomes. By pinpointing high-performing providers and eliminating inefficiencies, insurers can reduce costs associated with claims while ensuring better quality care and more expeditious claim processes, thereby improving claim results and increasing member satisfaction.