In today’s healthcare insurance landscape, delivering a seamless and personalized customer experience is no longer a differentiator – it’s the baseline. As expectations continue to rise, insurers that fail to evolve risk being overtaken by more agile, customer-focused competitors.

The urgency is underscored by data: nearly 29% of healthcare consumers are considering switching insurers within the next year, with customer experience emerging as a critical driver of member loyalty. To thrive in this increasingly member-driven market, insurers must ensure that every touchpoint—from plan selection to claims resolution—is fast, intuitive, and digitally enabled.

Traditionally, health insurers functioned largely as transaction processors—focused on plans, claims, and payouts. But that model is no longer sustainable. With digital technologies now mainstream, the industry is shifting toward experience-driven engagement. In fact, 84% of health insurers report leveraging artificial intelligence (AI) and machine learning (ML) across various healthcare product lines. While speed remains important, the new imperative is delivering personalized, connected experiences at every touchpoint.

CX: The Competitive Frontier of 2025

With more options at their fingertips than ever before, healthcare consumers are no longer focused solely on premiums or benefits. They expect a frictionless, personalized experience across the entire insurance journey, from enrollment to care navigation to claims support.

This is where the industry is seeing real transformation.

Customer experience (CX) is rapidly becoming the next competitive frontier in healthcare insurance. Since 2020, 85% of health insurers have launched digital transformation in insurance, with 80% of those leveraging technology specifically to enhance customer service, streamline operations, and accelerate business growth. This shift highlights the critical importance of insurance and digital transformation for modern competitive advantage.

However, basic digital tools like mobile apps or online forms are no longer enough. The industry demands a deeper, integrated approach. A comprehensive technology overhaul that is driven by unified platforms that connect plan administration, claims management, underwriting, customer service, and data insights is now essential. These systems do more than simplify operations; they unlock the ability to deliver truly personalized, proactive, and connected member experiences at scale.

Wondering how integrated platforms can elevate your customer experience strategy? Let’s take a closer look.

State of Customer Experience in Healthcare Insurance Today

Inefficient Claims Processing: Legacy systems and outdated workflows continue to cause significant delays in claims processing. These inefficiencies not only frustrate members but also erode trust in the insurer. In healthcare, where timely access to care can be critical such delays are more than just an inconvenience; they can directly impact health outcomes and member satisfaction.

Lack of Personalization: The disparate systems across claims, underwriting, and support make it nearly impossible to build a complete view of the customer. Without this visibility, personalization suffers and members receive generic, one-size-fits-all service in a market that now demands tailored experiences.

Slow Response Times: Today’s healthcare consumers expect fast, seamless interactions especially when dealing with claims or support requests. However, legacy systems are often too rigid and outdated to keep pace with these expectations. Delayed responses frustrate members, reduce satisfaction, and increase the risk of churn in an increasingly digital-first market.

Inaccurate Risk Assessments: Outdated underwriting tools and fragmented data systems hinder accurate risk evaluation, leading to mispriced plans and mismatched coverage. These issues can erode member trust and satisfaction, as customers expect transparency, fairness, and plans that truly meet their needs. Without modern, data-driven underwriting, insurers risk undermining the very loyalty they seek to build.

Compliance Challenges: Healthcare insurance operates within one of the most heavily regulated environments, yet many legacy systems lack the advanced analytics needed to keep pace with evolving regulations. This gap increases the risk of compliance failures, leading to operational inefficiencies and potential financial penalties ultimately impacting the overall member experience and trust.

What is Technological Transformation in Healthcare Insurance?

When teams rely on disconnected technological tools to handle a single claim or customer request, the result is fragmented data, communication gaps, and an inconsistent member experience. True technological transformation requires more than digital upgrades, it calls for integrated, end-to-end platforms that eliminate silos and streamline operations.

In healthcare insurance, digital transformation in insurance isn’t just about bringing processes online. It’s about reengineering the business to be faster, smarter, and more responsive. By adopting AI-powered platforms that unify core functions like claims, underwriting, member support, and billing, insurers can evolve from transactional service providers to truly member-focused enterprises.

Real transformation means building a connected ecosystem where member data, plans, and claims flow seamlessly across departments. Ultimately, technological transformation is not only about improving operational efficiency; it’s about delivering the speed, personalization, and convenience today’s members expect, providing a glimpse into the future trends in digital transformation for the insurance industry.

What Are Integrated Platforms in Healthcare Insurance?

Imagine managing your healthcare insurance business through a single, integrated platform where every team has access to the same real-time information, systems communicate effortlessly, and processes flow without delays.

That’s the power of integrated, cloud-based digital transformation solutions for healthcare insurance companies.

These platforms bring together all core business functions including claims processing, underwriting, customer service, plan management, and more, into one unified ecosystem.

The result? No more siloed systems. No more manual handoffs. Just a seamless, end-to-end operation that improves efficiency, enhances collaboration, and delivers a consistent, high-quality member experience.

How It Works In Healthcare Insurance

1. Unifying Processes

In many healthcare insurance enterprises, critical back-end functions like underwriting and claims still operate in isolation from member-facing applications. Integrated platforms eliminate these silos by consolidating all business operations into a single, unified ecosystem. This ensures seamless data flow across departments, improves internal alignment, and enhances the overall member experience.

2. Real-Time Access To Data

Integrated platforms provide instant access to up-to-date member information including claims status, plan details, and service history across all functions. This eliminates the need for manual data entry or delayed reporting, allowing teams to deliver faster, more accurate, and more informed service at every touchpoint. Real-time visibility ensures a consistent experience and empowers insurers to respond proactively to member needs.

3. Enhanced Operational Efficiency

Integrated platforms streamline day-to-day operations by automating routine tasks and eliminating manual processes. This reduces administrative burden, minimizes delays, and frees up teams to focus on higher-value activities like resolving member issues quickly and delivering better service. The result is faster turnaround times, improved accuracy, and a more responsive organization.

Impact Of Integrated Platforms On Customer Experience In Healthcare Insurance

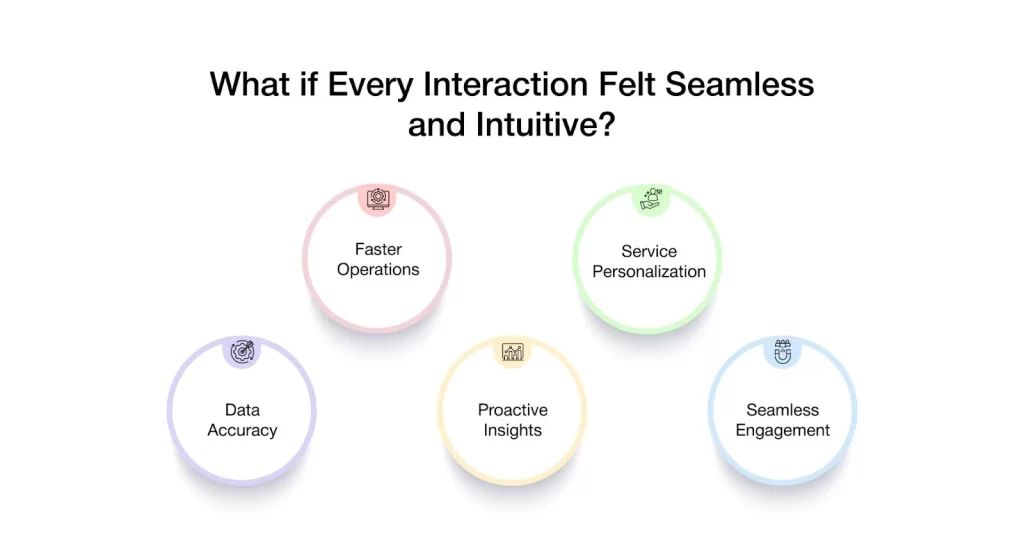

In today’s competitive landscape, customer loyalty is earned—not guaranteed. Integrated platforms are redefining how insurers engage with members by seamlessly connecting people, systems, and data. The result is a more responsive, intelligent, and personalized experience at every touchpoint. Here’s how integrated platforms are transforming customer experience in healthcare insurance:

Streamlined Operations And Faster Response Times

Integrated platforms unify core functions such as claims, underwriting, and customer service within a single system. This eliminates delays caused by manual processes and inter-functional handoffs, creating a smoother, more efficient experience for both teams and members.

Impact: Reduced manual work, faster claims processing, and quicker resolution of member queries all leading to improved satisfaction and operational efficiency.

Example: A member submits a claim online. Instantly, the claims team is alerted, underwriting has access to all relevant details, and customer support is equipped with real-time updates eliminating the lag between departments and ensuring timely communication with the member.

Enhanced Personalization Of Services

Integrated platforms centralize member data across claims, support, plan, and engagement systems enabling insurers to deliver tailored experiences based on individual needs, preferences, and behaviors. This allows for smarter, data-driven recommendations and more relevant interactions throughout the member journey, which is central to digital transformation in the insurance industry.

Impact: More personalized plans, communication, and services that reflect each member’s unique needs driving stronger engagement and loyalty.

Example: A member logs into their portal and receives a personalized plan recommendation. The system detected a recent address change and, based on updated regional coverage and past interactions, proactively suggested a better-suited option without any manual input from support teams.

Improved Data Accuracy And Decision-Making

Integrated platforms eliminate the need for manual data entry by enabling real-time data flow across all systems. With a single source of truth, teams have access to up-to-date, accurate member information leading to more confident, timely, and informed decisions, particularly in areas like risk assessment and policy pricing.

Impact: Fewer errors, improved underwriting accuracy, and smarter pricing strategies all contributing to greater trust and operational efficiency.

Example: An underwriter reviews a member’s profile and instantly accesses the most recent claim data, coverage history, and relevant notes—all in one place, allowing them to generate a precise quote without switching systems or chasing down missing details.

Real-Time Customer Insights And Proactive Service

Integrated platforms do more than store data, they continuously analyze member behavior across channels to surface actionable insights. This allows insurers to anticipate needs, resolve potential issues early, and offer support before the member even reaches out.

Impact: Faster issue resolution, more proactive service, and a member experience that feels personalized and attentive.

Example: A member begins filling out a claim form in the mobile app but abandons it midway. The system detects the drop-off and automatically triggers a follow-up from support—offering help before the member submits a request.

Seamless Multi-Channel Engagement

Integrated platforms enable a consistent, connected experience across all channels like mobile apps, web portals, and contact centers. No matter how or where a member engages, their information and activity history remain synchronized, ensuring continuity and eliminating the need to repeat information. This capability is a core benefit of digitalization in the insurance industry.

Impact: A smooth, frustration-free experience across every touchpoint—building trust, satisfaction, and long-term loyalty.

Example: A member starts a plan update in the mobile app, continues it on the website, and follows up with a phone call. Because all channels are connected through a single platform, the support team has full visibility into the interaction history and can assist immediately, without asking the member to start over.

How VIZCare Empower Exemplifies the Integrated Platform Model

Imagine all your healthcare insurance teams working on a unified platform, sharing real-time data, and collaborating without silos or delays.

That’s the value AVIZVA’s VIZCare Empower delivers.

VIZCare Empower isn’t just another healthcare digital tool – it is an AI-enabled, one-stop platform that automates and streamlines end-to-end healthcare business operations, enhancing efficiency, compliance, and scalability. Some of its core capabilities include :

1. End-To-End Sales Management: VIZCare Empower gives teams real-time visibility into broker activities, progress, and support needs, enabling timely, personalized assistance, faster deal closures, and improved broker satisfaction. The platform streamlines the entire broker journey, from quoting and contract signing to enrollment, all within a single, unified interface.

2. Business Process Automation and Workflow Management: VIZCare Empower offers an intuitive drag-and-drop interface, allowing healthcare teams to build and modify workflows without technical expertise. It integrates seamlessly with existing systems and scales effortlessly with the business. As needs evolve, teams can quickly update workflows to stay agile and efficient.

3. Seamless Onboarding of Groups and Individuals: VIZCare Empower streamlines end-to-end onboarding for new clients and employer groups. With intuitive tools, automated configurations, and seamless workflows, it eliminates manual steps, shortens setup time, and helps teams onboard clients smoothly from the start.

4. Single Pane to Service All Consumers: VIZCare Empower centralizes all the critical data, tools, and context that service teams need to manage and support every consumer—whether they’re members, providers, brokers, or employers. It eliminates silos and unites all service teams in one place, enabling them to deliver personalized, efficient, and proactive assistance with ease.

5. AI-Enabled Contact Center Management: VIZCare Empower creates a better experience for both contact center agents and customers. It equips agents with real-time guidance and intelligent insights, helping them resolve customer inquiries faster and more accurately. Whether they’re handling complex claims for providers, supporting brokers, or managing member issues, the platform delivers instant recommendations, knowledge base access, and next-best-action prompts. This showcases AI-driven customer service in insurance through digital transformation.

6. Timely and Hassle-Free Renewal Management: VIZCare Empower simplifies and streamlines the renewal process. With automated reminders, real-time data access, and optimized workflows, it enables teams to manage renewals more efficiently—reducing manual errors and enhancing overall accuracy. From tracking upcoming renewals to managing communications and processing plan updates, everything is seamlessly integrated in a single platform.

Conclusion

Today’s members expect faster service, seamless experiences, and solutions tailored to their needs. Legacy systems, fragmented teams, and outdated workflows can no longer keep pace with these evolving expectations.

That’s why technological transformation in healthcare insurance is no longer a competitive advantage, it’s a business imperative. The successful embrace of digital transformation in the insurance industry is what separates leaders from laggards.

VIZCare Empower by AVIZVA is an AI-powered, unified platform that drives this transformation by connecting disparate systems, empowering cross-functional teams, and elevating consumer experiences.

Ready to future-proof your business operations? Let’s start the conversation.

FAQs

1. What is digital transformation in insurance?

Digital transformation in insurance simply means using modern technology to streamline processes and connect everything from systems to data to teams.

2. How does digital transformation improve insurance services?

It helps insurers process tasks faster, such as handling claims or updating policies. This cuts down manual work and makes the service faster and smoother.

3. How is digital transformation improving customer experience in insurance?

With technological transformation in place, customers get easy access, fast answers, and support that feels personal. No matter how they reach out, whether through the app, website, or call, everything works smoothly together.

4. What are the challenges of digital transformation in insurance companies?

Many insurers still use traditional systems that don’t integrate well. It’s also hard to align teams and connect all the technology in one place.

5. What role does automation play in insurance digital transformation?

Automation handles routine tasks like claims and updates, so teams can work faster with fewer mistakes and spend more time helping customers.