Despite substantial advancements in healthcare insurance automation, the majority of enterprises have been slow to embrace these technologies. Today, only 14% of insurers use automation for claims processing, and just 25% have integrated it into underwriting. This lag has created a significant efficiency gap—one that forward-thinking enterprises are now racing to close.

In today’s highly competitive healthcare insurance landscape, outdated manual workflows are no longer sustainable. They cause delays, increase the risk of errors, and limit growth potential. With mounting regulatory pressures and rising customer expectations, insurers can no longer afford to depending only on legacy processes.

To stay competitive, enterprises must adopt modern healthcare automation software that streamlines operations across the entire value chain—from sales and onboarding to plan administration and renewals. By eliminating repetitive manual tasks, automation reduces operational costs, improves accuracy, and delivers a better, more consistent customer experience.

This blog will outline the primary workflow challenges healthcare insurers face and how healthcare automation software can help unlock greater operational efficiency.

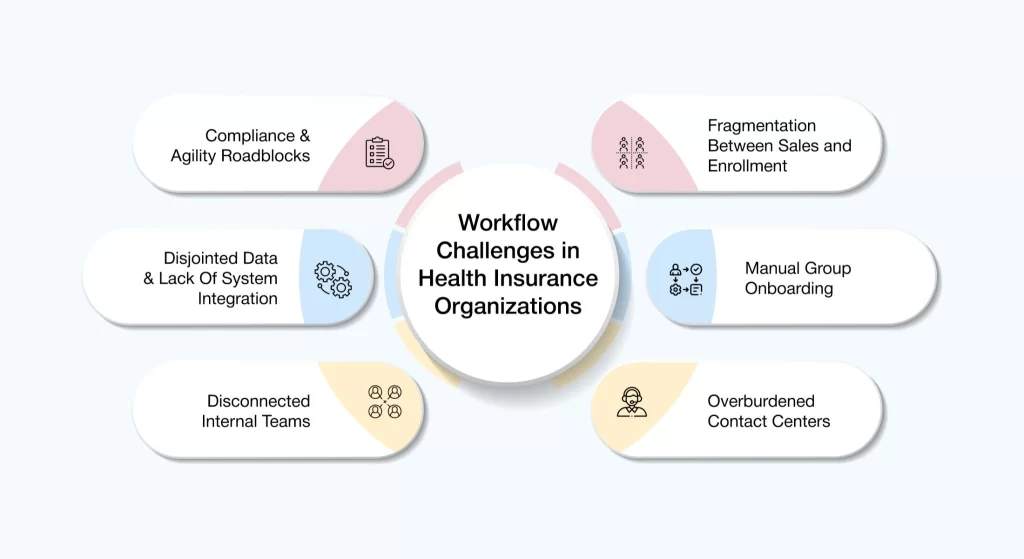

The Core Workflow Challenges Holding Back Healthcare Insurance Enterprises

- Fragmentation Between Sales and Enrollment Processes: Sales and enrollment processes that work in silos cause operational delays, inaccuracies, and missed opportunities. Without seamless healthcare data integration, insurers struggle to process sales and onboard clients efficiently, leading to frustration for both agents and customers. These bottlenecks reduce conversion rates and ultimately impact the company’s bottom line.

- Manual Group Onboarding: Group onboarding continues to rely heavily on manual processes and outdated systems, resulting in administrative backlogs and prolonged wait times. These inefficiencies strain internal teams, frustrate consumers, and put key relationships at risk—ultimately harming the enterprise’s reputation.

- Overburdened Contact Centers: Health insurance contact centers are overwhelmed by high volumes of repetitive queries. Without automation, agents must manage these tasks manually—resulting in longer wait times, inconsistent service, and mounting frustration for both customers and staff. These inefficiencies ultimately degrade customer satisfaction and weaken brand loyalty.

- Disconnected Internal Teams: When critical healthcare insurance teams like sales, onboarding, customer service, and claims operate in silos, it creates misalignment across the enterprise. Without integrated platforms and shared data visibility, insurers face fragmented workflows and inconsistent customer interactions—undermining agility and the ability to deliver a seamless, unified experience.

- Disjointed Data & Lack of System Integration: Data scattered across multiple systems results in inaccuracies, slows decision-making, and hinders effective risk management. Without a unified data platform, insurers face challenges in responding promptly to customer needs and maintaining trust. This fragmentation diminishes operational agility and negatively affects overall performance.

- Compliance & Agility Roadblocks: In today’s rapidly evolving regulatory landscape, healthcare insurers are under constant pressure to maintain compliance with precision and transparency. This requires robust, auditable workflows that can stand up to scrutiny—while also remaining flexible enough to accommodate frequent policy updates and shifting legal mandates.

However, most enterprises still operate on legacy infrastructure and disconnected systems, making it difficult to align compliance efforts with operational agility. These rigid frameworks slow down decision-making, complicate documentation, and hinder the swift rollout of new products or plan adjustments. The result? Delayed innovation, increased risk exposure, and a missed opportunity to meet rising member expectations in an increasingly competitive market.

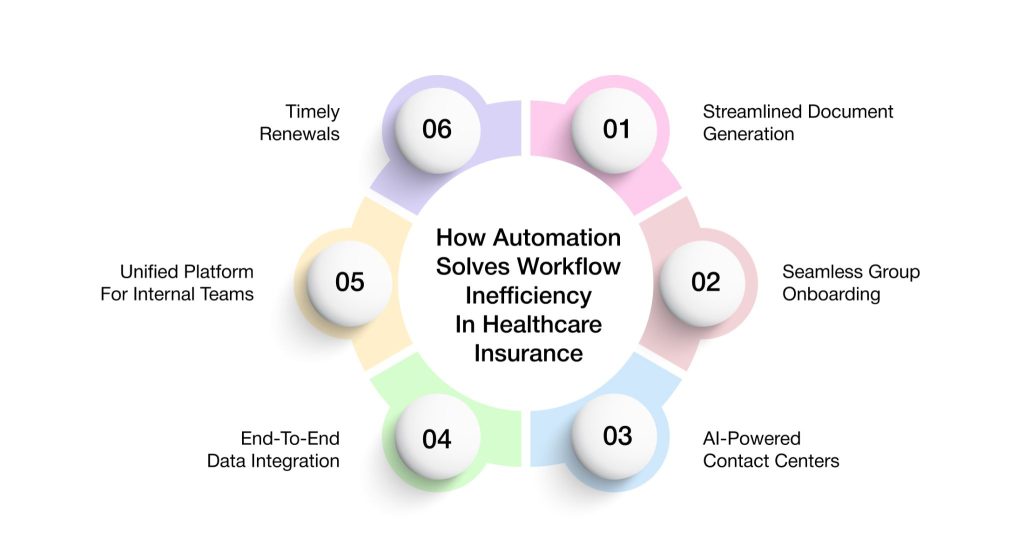

Automation: The Bridge Over Workflow Inefficiency In Healthcare Insurance

1. Streamlined Document Generation

Healthcare insurance enterprises often rely on manual workflows to produce quotes, proposals, and contracts, slowing down operations and increasing the risk of errors. These inefficiencies impact responsiveness, drain resources, and hinder scalability.

Healthcare workflow automation enables faster, more accurate, and consistent document generation :

- Quote Generation: Leverages customer data to create accurate quotes instantly, minimizing manual input and reducing risk.

- Proposal Development: Delivers customized proposals in real time, improving customer alignment and speeding up decisions.

- Contract Creation: Utilizes standardized templates to generate compliant contracts quickly and reliably.

By streamlining these critical processes, insurers can lower operational costs, accelerate sales cycles, and improve service delivery. This not only boosts internal productivity but also enhances customer satisfaction through faster, more dependable interactions.

2. Seamless Group Onboarding

Group onboarding remains one of the most challenging processes in healthcare insurance, often hindered by paperwork, manual data entry, and approval delays. Healthcare process automation transforms this traditionally complex process into a streamlined, error-resistant workflow.

Key areas where automation improves group onboarding include:

- Digital Data Capture: Secure digital forms collect group information accurately and efficiently, eliminating errors associated with manual input.

- Automated Document Verification: Automated checks ensure that submitted documentation meets compliance and eligibility requirements, significantly reducing review time.

- Real-Time Workflow Routing: Intelligent workflows route onboarding steps automatically, speeding up approvals and minimizing delays.

By automating group onboarding, insurers can significantly reduce administrative burden, eliminate process bottlenecks, and improve accuracy. With the support of AI-driven tools, onboarding becomes faster, more efficient, and more customer-centric—positioning insurers as leaders in service excellence.

3. AI-Powered Contact Centers

Healthcare insurance contact centers are under constant pressure to manage high volumes of queries from members, providers, and brokers. Traditional models struggle with speed, consistency, and scalability.

AI-powered contact centers are transforming agent performance and customer engagement in multiple ways:

- Real-Time Agent Guidance: Equips agents with instant access to knowledge, next-best-action recommendations, and contextual prompts to resolve queries more efficiently.

- Omnichannel Customer Support: Enables consistent assistance across voice, chat, SMS, and IVR channels, ensuring a seamless customer experience in healthcare regardless of how they connect.

- Instant Provider Eligibility Verification: Performs real-time eligibility verifications during provider conversations, increasing accuracy and reducing friction

- Intelligent Task Automation: Captures key interaction details, automates task assignment, and streamlines follow-ups—enhancing workflow transparency.

- Live Call Summarization: Generates real-time summaries and transcripts of calls, improving documentation and enabling faster knowledge sharing.

By integrating AI into contact center operations, insurers can significantly enhance responsiveness, service quality, and agent efficiency—while lowering operational costs. The result is a more agile, customer-focused enterprise with improved satisfaction and stronger loyalty.

4. End-To-End Data Integration

Fragmented data silos hinder insurers from gaining a complete view of their operations and customer needs. An integrated platform is essential to unify disparate data across systems—creating a single source of truth that enables smarter decisions and more efficient processes.

Key benefits of a connected data ecosystem include :

- Centralized Data Management: Consolidates member, provider, broker, and employer data in one place—reducing duplication and improving accuracy.

- AI-Driven Insights: Applies machine learning to surface service opportunities, anticipate customer needs, and automate key actions.

- Advanced Search & Retrieval: Empowers service teams to access critical information quickly, ensuring faster and more accurate responses.

By leveraging unified enterprise data, insurers can minimize errors, strengthen cross-functional collaboration, and gain a real-time, 360° view of their operations—transforming data into a strategic asset.

5. Unified Platform For Internal Teams

Disjointed systems often create silos between internal teams, such as sales, onboarding, customer service, and claims, leading to delays and miscommunication. A unified platform brings all teams together, enabling seamless collaboration and operational alignment.

Key capabilities of a unified platform include :

- 360-Degree Visibility: Provides a complete view of member, employer, provider, and broker interactions—including claims, profiles, and past conversations—so teams can make informed decisions quickly.

- Streamlined Workflows: Simplifies common tasks like sending ID cards, managing open enrollment, or handling claims appeals—reducing manual effort and improving turnaround times.

This level of integration breaks down organizational silos, accelerates service delivery, and enhances the overall consumer experience.

6. Timely Renewals

Timely plan renewals are essential for revenue stability in healthcare insurance. Yet many insurers still rely on manual tracking and outreach—risking missed opportunities and administrative headaches.

A healthcare automation software ensures renewal success through :

- Prompt Reminders: Automated notifications keep employers informed and engaged throughout the renewal process.

- Data-Driven Benefit Selection: Leverages the power of data to guide employers in selecting optimal benefit packages, ensuring both coverage alignment and satisfaction.

- AI-Powered Recommendations: Suggests tailored options based on historical usage and preferences—helping employers make informed, confident decisions.

- Seamless Workflows: Automates updates, approvals, and communications—removing manual errors and accelerating cycle times.

By streamlining the renewal process, insurers can improve retention, maximize revenue, and create a smoother experience for employers —laying the foundation for long-term loyalty and growth.

Real-World Impact: How Automation Transforms Healthcare Insurance Operations

1. Accelerated Sales Lifecycle With Fewer Errors, And Higher Conversion Rates

Automation streamlines the sales process by removing repetitive manual tasks and significantly reducing the chances of human error. AI-powered systems can instantly generate accurate quotes, issue plans, and create contracts—tasks that would typically take much longer when done manually. With this efficiency, prospective customers receive personalized offers faster, making it easier for them to make timely decisions.

The result is a shorter, more reliable sales cycle that not only improves internal productivity and leads to better conversion rates and a more seamless path from lead to loyal customer.

2. Elevated Member Satisfaction Through Reduced Wait Times and Better Support

Automation plays a very important part in improving service experiences for members. By minimizing delays and providing real-time assistance across multiple channels, insurers can offer a smoother, more satisfying service experience. AI-assisted contact centers help agents respond quickly and more accurately, while automated workflows handle claims processing and routine inquiries with minimal friction.

Members benefit from faster responses, fewer follow-ups, and a consistent experience whether they reach out via phone, chat, or email. This results in higher satisfaction, improved trust, and stronger long-term relationships.

3. Simplified Compliance and Greater Operational Transparency

Automation also supports regulatory compliance by maintaining clear, auditable records and providing real-time visibility into operational workflows. Key tasks such as document generation, renewals, and compliance checks are handled automatically, reducing the chance of oversight or error.

This improves transparency, streamlines audit preparation, and ensures consistent adherence to regulatory standards—creating a more accountable and resilient enterprise.

4. Scalable Growth Through Reduced Manual Overhead

By eliminating repetitive, manual tasks and workflow delays, healthcare automation software frees up valuable time and resources. Business teams can shift their focus from administrative work to high-value initiatives such as customer engagement, product innovation, and market expansion. This operational efficiency enables insurers to scale more effectively while maintaining service quality and cost control—positioning the enterprise for sustainable, technology-enabled growth.

VIZCare Empower: Transforming Healthcare Insurance Operations With Intelligent Automation

AVIZVA is a healthcare technology company that empowers payers, TPAs, and PBMs to enhance care delivery through a comprehensive suite of engineering products and services. With over 14 years of experience in leveraging technology to simplify, optimize, and accelerate care, AVIZVA has become a trusted technology partner to a wide range of healthcare enterprises.

AVIZVA’s healthcare offerings are grouped into two key categories: Engineering Services and its proprietary product suite, VIZCare. Each product within VIZCare is purpose-built to address specific business challenges in healthcare. A flagship product in this suite is VIZCare Empower—an AI-enabled, one-stop platform that automates and streamlines end-to-end healthcare business operations, enhancing efficiency, compliance, and scalability.

Some of its core capabilities include :

- End-To-End Sales Management: VIZCare Empower provides teams with real-time visibility into broker activities, progress, and support needs, enabling timely, personalized assistance, faster deal closures, and improved broker satisfaction. The platform streamlines the entire broker journey, from quoting and contract signing to enrollment, all within a single, unified interface.

- Business Process Automation and Workflow Management: VIZCare Empower offers an intuitive drag-and-drop interface, allowing healthcare teams to build and modify workflows without technical expertise. It integrates seamlessly with existing systems and scales effortlessly with the business. As needs evolve, teams can quickly update workflows to stay agile and efficient.

- Seamless Onboarding of Groups and Individuals: VIZCare Empower streamlines end-to-end onboarding for new clients and employer groups. With intuitive tools, automated configurations, and seamless workflows, it eliminates manual steps, shortens setup time, and helps teams onboard clients smoothly from the start.

- Single Pane to Service All Consumers: VIZCare Empower centralizes all the critical data, tools, and context that service teams need to manage and support every consumer, including members, providers, brokers, or employers. It eliminates silos and unites all service teams in one place, enabling them to deliver personalized, efficient, and proactive assistance with ease.

- AI-Enabled Contact Center Management: VIZCare Empower creates a better experience for both contact center agents and customers. It equips agents with real-time guidance and intelligent insights, helping them resolve customer inquiries faster and more accurately. Whether they’re handling complex claims for providers, supporting brokers, or managing member issues, the platform delivers knowledge base access, instant recommendations, and next-best-action prompts.

- Timely and Hassle-Free Renewal Management: VIZCare Empower simplifies and streamlines the renewal process. With automated reminders, real-time data access, and optimized workflows, it enables teams to manage renewals more efficiently—reducing manual errors and enhancing overall accuracy.

From tracking upcoming renewals to managing communications and processing plan updates, everything is seamlessly integrated in a single platform.

Conclusion

Automation has become a critical driver of transformation in healthcare insurance. By improving accuracy and efficiency across workflows, it not only enhances operational performance but also elevates the overall customer experience. Insurers that adopt automation achieve faster sales cycles, fewer errors, and deeper, more trusted customer relationships.

To get started, enterprises should assess their current processes and identify areas where healthcare automation software can eliminate bottlenecks and reduce manual effort. With a thoughtful, well-structured automation strategy, insurers can build a more agile, precise, and customer-centric business ecosystem—positioning themselves for long-term success in an increasingly competitive market.

If you’re a healthcare insurance enterprise looking to harness the full power of automation, partner with AVIZVA and discover how VIZCare Empower can transform your operations and redefine service excellence.

Frequently Asked Questions

1. What is automation in healthcare?

In healthcare insurance, automation means using technology to handle repetitive tasks, like claims processing, enrollment, and renewals, without needing constant manual effort. It helps insurers move faster, reduce errors, and deliver a smoother experience for members, brokers, and providers. From AI-powered contact centers to automated workflows, automation is transforming how insurers operate behind the scenes.

2. What are the most common reasons healthcare organizations experience workflow inefficiencies?

Workflow inefficiencies usually happen because of outdated systems, manual processes, and teams working in silos. In healthcare insurance, disconnected platforms and fragmented data slow down everything, from onboarding to claims resolution. Without automation, insurers face delays, backlogs, and a lot of unnecessary rework that impacts both service quality and speed.

3. How does automation help healthcare organizations streamline their administrative processes?

Automation takes over time-consuming tasks like data entry, document generation, and customer follow-ups, making daily operations much faster and more reliable. In healthcare insurance, it simplifies group onboarding, quote creation, and renewal tracking, which boosts efficiency and reduces manual errors. It also helps teams work better together by connecting systems and giving everyone access to the same real-time data.

4. What challenges do healthcare providers face when adopting automation for workflow efficiency?

Adopting healthcare workflow automation software can be tricky at first. Healthcare insurers often struggle with integrating new tools into their existing systems and ensuring their teams are trained to use them. There can also be concerns about data migration, compliance alignment, and the cost of change, but with the right platform and guidance, these challenges are manageable.

5. How can automation reduce human error and improve patient care in healthcare settings?

Using business process automation in healthcare insurance means fewer manual touchpoints, which leads to fewer mistakes in critical areas like eligibility checks, plan renewals, or claims approvals. Automated systems follow predefined rules and workflows, so the chances of missing a step or miscommunicating information go down significantly. This results in faster, more accurate service for members, ultimately supporting better outcomes and experiences.

6. What are the potential risks of relying too much on automation in healthcare workflows?

While automation brings a lot of benefits, relying on it entirely can sometimes lead to gaps in personalization or oversight. In healthcare insurance, it is important to strike a balance; some cases still need a human touch, especially when handling complex member issues or unique plan exceptions. The key is to combine automation with smart decision-making so service stays efficient but also empathetic.

7. How can small and mid-sized healthcare organizations implement automation effectively?

Smaller healthcare insurance enterprises can start by identifying the most time-consuming manual tasks, like document processing or onboarding, and automating those first. They do not need a massive overhaul; many modern platforms offer scalable, plug-and-play solutions that fit their size and budget. Choosing user-friendly software and focusing on easy wins helps teams build momentum and see quick results.

8. Which is the best healthcare automation software?

If you are in the healthcare insurance space, VIZCare Empower is one of the best platforms to consider. It is an AI-enabled, all-in-one solution built specifically for insurers, TPAs, and PBMs. From sales to support and renewals, it streamlines every touchpoint with smart workflows, real-time insights, and a unified view of every stakeholder, making your operations faster, leaner, and more member-friendly.