Rising consumer expectations are transforming every industry – and healthcare insurance is no exception. Today’s members seek more than just coverage; they want experiences that are seamless, intuitive, and personalized. Insurers that continue to rely on outdated engagement methods risk falling behind in an increasingly competitive market.

The stakes have never been higher. Studies reveal that disengaged members are far more likely to switch plans, while highly engaged members are up to three times more likely to remain loyal. This means that without modern, member-centric health insurance member engagement strategies, insurers risk losing not only revenue but also long-term trust and credibility.

To truly meet these expectations, insurers must proactively guide members through their care journeys, provide timely updates, and empower them with self-service capabilities. When supported by the right digital tools, these strategies can drive measurable improvements in health insurance customer satisfaction, health outcomes, and operational efficiency.

In this blog, we explore how digital transformation is redefining member experience in health insurance. From AI-powered chatbots that provide real-time support to intuitive self-service portals that put control in the hands of members, we’ll examine how insurers can build connected, consistent, and compliant experiences that meet the needs of today’s digital-first members.

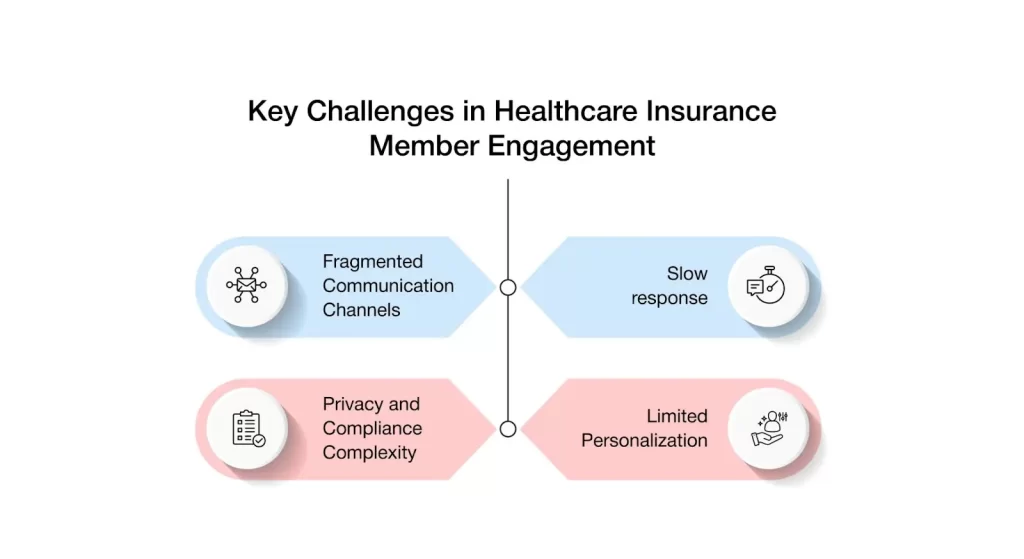

What Are The Key Barriers To Effective Member Engagement In Healthcare Insurance?

Healthcare insurers have long recognized that healthcare member engagement is essential to improving health outcomes, enhancing health insurance customer experience, and driving business performance. Yet, achieving consistent, meaningful engagement remains a complex and ongoing challenge across the industry.

Here’s a deeper look at the key challenges:

1. Fragmented Communication Channels

One of the most pressing challenges healthcare insurers face is maintaining consistency across multiple communication platforms. Mobile apps, member portals, emails, and other touchpoints often operate in silos, leading to disjointed messaging and inconsistent health insurance member engagement.

When communication is fragmented, members may receive conflicting or unclear information, leading to confusion, disengagement, and diminished trust. This not only reduces overall member satisfaction but also increases the volume of queries to support teams.

Without integrated and cohesive communication channels, it becomes significantly more difficult to keep members informed, engaged, and aligned with their healthcare journeys.

A major hurdle for insurers is maintaining consistency across various communication platforms such as mobile apps, portals, emails, and call centers. When these systems operate in silos, members often receive disjointed or conflicting information, creating confusion and frustration. This not only reduces member trust but also results in increased queries to support teams.

Without integrated communication, members find it harder to stay informed, engaged, and confident in managing their healthcare journeys.

2. Delayed Response Times

Timely communication is critical to delivering a positive health insurance member experience. However, many healthcare insurers continue to struggle with delays in responding to member queries, particularly regarding claim status, benefits clarification, and care management support.

When responses are slow or incomplete, members often become frustrated, which can erode trust and diminish their willingness to engage proactively.

In today’s competitive healthcare insurance landscape —where real-time service is increasingly expected—delays can severely impact health insurance customer engagement, satisfaction, retention, and overall brand perception.

3. Privacy And Compliance Complexities

Privacy regulations such as HIPAA impose strict restrictions on the collection, storage, and sharing of sensitive health information. While these safeguards are essential for protecting member data, they also present significant challenges for insurers seeking to deliver personalized and proactive health insurance member engagement.

Compliance obligations often limit how member data can be leveraged, restricting the implementation of advanced digital tools and reducing the flexibility of engagement strategies.

Striking a balance between personalization and regulatory adherence remains a critical—but complex—task for health insurers aiming to enhance member experience in health insurance.

4. Limited Personalization Capabilities

Despite having access to vast amounts of member data, many health insurers struggle to translate that information into timely, personalized communications. Limitations in data integration, analytics, and delivery mechanisms hinder the ability to provide the right message to the right member at the right moment.

Without personalization, insurers miss critical opportunities to deepen engagement, drive meaningful plan utilization, and foster long-term loyalty – outcomes that are central to effective member engagement strategies for insurers.

Hence, in a market where consumers expect tailored experiences, this gap can significantly impact health insurance customer satisfaction and overall health insurance member engagement outcomes.

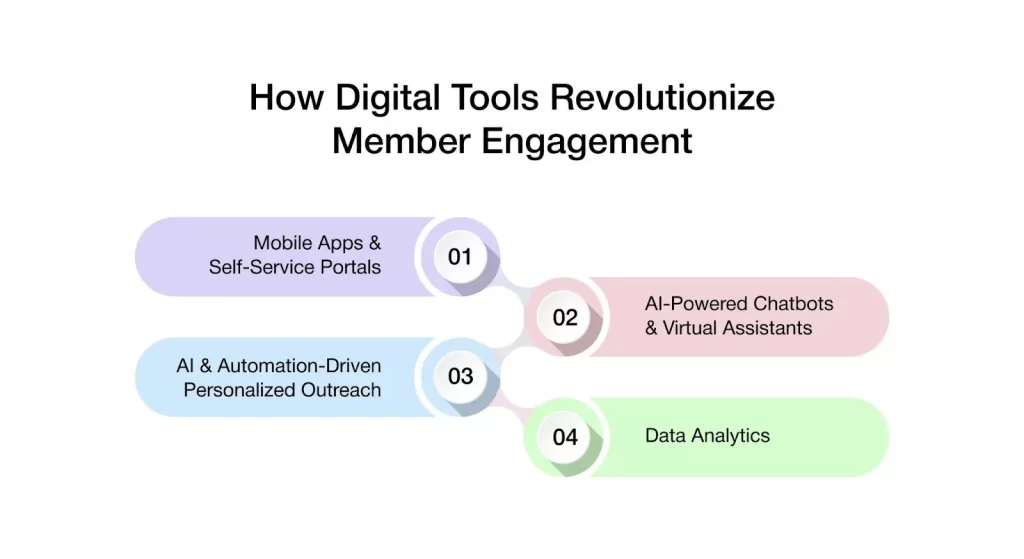

How Digital Tools Are Revolutionizing Member Engagement

Digital tools are transforming member engagement in healthcare insurance—making interactions more efficient, personalized, and seamless. These advancements help insurers overcome key challenges and elevate the member experience across every touchpoint.

Let’s discuss these key transformations in detail.

1. Mobile Apps And Self-Service Portals

Mobile apps and self-service portals are now foundational to a modern member engagement platform for insurers, empowering members with seamless, on-demand access to health information. Together, they enable anytime, anywhere interactions, from coverage management and claim tracking to document access – driving higher engagement, satisfaction, and operational efficiency.

By offering 24/7 access to benefits and plan details, insurers not only meet growing consumer expectations but also reduce the burden on customer support teams.

This shift enhances both operational efficiency and health insurance member experience. More importantly, these tools put members in control of their healthcare journey, enabling them to make informed decisions with confidence and independence.

2. AI-Enabled Chatbots And Virtual Assistants

AI-powered chatbots and virtual assistants are becoming vital tools in enhancing digital member support. These intelligent systems provide instant, accurate responses to common queries related to benefits, claims, and coverage, making them highly effective for engaging insurance members in real-time.

Moreover, these significantly reduce wait times and ensure consistent communication across digital channels.

By automating routine interactions, insurers can deliver faster, more reliable service while freeing up customer service teams to handle more complex member needs. This not only boosts operational efficiency but also contributes to a more satisfying, responsive member experience.

3. AI and Automation-Powered Personalized Outreach

AI and automation are transforming how insurers communicate with members by enabling personalized outreach at scale. Leveraging member data—such as health history, preferences, and behavior—insurers can deliver targeted messages that are timely and relevant.

Whether it’s reminders for preventive screenings, updates on plan changes, or invitations to wellness programs, this proactive approach keeps members informed and engaged. It not only enhances the overall experience but also encourages members to take a more active role in managing their health.

4. Data-Driven Predictive Insights

Data analytics in healthcare is becoming a powerful tool in enhancing member engagement by helping insurers better understand and anticipate member needs. By analyzing patterns in member behavior, claims, and health data, insurers can identify when individuals may require additional support or targeted services.

From chronic condition management to wellness program participation, data-driven insights enable timely, personalized interactions that deliver meaningful value. This proactive, informed approach not only improves engagement and retention but also elevates the overall health insurance member experience.

How Do Digital Tools Overcome Barriers in Privacy, Adoption, and Integration?

Member engagement must align with strict privacy regulations to protect sensitive health information and maintain trust between insurers and their members. With the rise of digital tools, managing these challenges has become more seamless—enabling secure, compliant, and effective communication. Let’s explore how digital solutions are making this possible.

1. Enabling Secure, Compliant Communication With Members

Digital tools such as secure portals and encrypted communication channels are essential for maintaining HIPAA compliance across all member interactions. These platforms support real-time claims tracking, status updates, and care-related communication while ensuring the protection of sensitive healthcare data.

By embedding privacy into accessible, user-friendly experiences, insurers can build greater trust with members and uphold regulatory standards—without compromising the speed or quality of engagement and service delivery.

2. Enhancing Accessibility And Digital Literacy For All Members

To overcome barriers related to digital literacy and accessibility, insurers are leveraging intuitive, user-friendly apps and self-service portals designed to accommodate varying levels of digital proficiency.

These platforms often feature simplified navigation, voice assistance, and multilingual support ensuring that all members, regardless of their technical comfort, can confidently access and engage with their health insurance tools.

By prioritizing inclusivity in digital design, insurers can broaden engagement, improve member satisfaction, and deliver a more equitable healthcare experience.

3. Streamlining Member Experience Through System Integration

Integrating engagement tools with core systems—such as claims management, enrollment platforms, and benefits administration—enables insurers to deliver a more cohesive and efficient member experience.

This seamless integration ensures real-time updates, accurate data exchange, and personalized interactions, allowing members to easily navigate their benefits and manage their healthcare plans.

By breaking down data silos and connecting key systems, insurers can enhance operational efficiency while delivering a more intuitive, responsive experience for members.

Deepen Member Engagement with AVIZVA’s VIZCare Xperience

For healthcare insurers, member engagement has evolved beyond simply responding to queries—it’s now about delivering seamless, proactive, and personalized experiences that foster lasting trust. With over 14 years of healthcare expertise and more than 150 tailored solutions, AVIZVA is at the forefront of driving this transformation.

AVIZVA is a healthcare technology company that empowers payers, TPAs, and PBMs to enhance care delivery through a comprehensive suite of engineering products and services. With more than a decade long experience in leveraging technology to simplify, optimize, and accelerate care, AVIZVA has become a trusted technology partner to a wide range of healthcare enterprises.

AVIZVA’s healthcare offerings are grouped into two key categories: Engineering Services and its proprietary product suite, VIZCare. Each product within VIZCare is purpose-built to address specific business challenges in healthcare.

One of its leading products is VIZCare Xperience, a suite of AI-powered web and mobile portals built to improve the consumer experience. Designed for payers, TPAs, and PBMs, VIZCare Xperience brings all actions and information to the fingertips of the consumers.

VIZCare Xperience includes four distinguished products designed for four distinct user groups:

- MemberX: The portal is a one-stop shop for members to manage their coverage, search for benefits, find care, understand claims, and track prior authorizations. While it primarily focuses on enabling ease of self-service, thereby reducing operational workload for enterprises, it also simplifies and enhances interactions with member engagement teams.

- BrokerX: The portal is designed to simplify client acquisition, management & retention for agencies & agents. It brings capabilities to manage the entire lifecycle of clients, covering pre-sales, sales, and post-sales at your fingertips. Some of the most used and high-impact features include quoting and proposals, managing their book of business, accessing commission statements, and gaining ready access to insightful analytics.

- EmployerX: With employers’ needs in mind, the portal is designed to enable effortless management and oversight of employee benefits and usage. Employers can easily manage their group membership, including open enrollment, life change events, member profile information, understanding plan benefits, invoices, and plan performance.

- ProviderX: The portal is designed to cater to both in-network and out-of-network providers, enabling them to understand patients’ benefits, track claims status, payments, and appeals, as well as manage referrals and prior authorizations. It also integrates with the provider empanelment process, offering a comprehensive and unified digital experience for providers.

Conclusion

When thoughtfully integrated with the human element, technology has the power to strengthen member relationships and enhance the overall healthcare experience. In today’s dynamic landscape, digital tools have become essential for healthcare insurers striving to stay competitive and member-focused.

VIZCare Xperience is a comprehensive suite of platforms designed to drive this transformation. At the heart of this suite is MemberX—a powerful, intuitive solution that enables insurers to enhance member engagement and improve health outcomes.

By placing essential information and actions at members’ fingertips, MemberX ensures seamless access, greater convenience, and a more connected healthcare journey.

Contact us to discover how VIZCare MemberX can help you elevate member engagement and deliver meaningful experiences.

FAQs

1. How can digital tools enhance the member engagement experience in healthcare?

Digital tools make it easier for members to access information, track claims, and receive timely updates. Features like self-service portals, AI chatbots, and personalized outreach improve convenience, reduce support wait times, and keep members actively involved.

2. What are the challenges healthcare organizations face when implementing digital tools for member engagement?

Common challenges include fragmented communication channels, slow response times, privacy compliance issues, and difficulty in delivering personalized experiences. These obstacles can limit the effectiveness of engagement strategies if not addressed properly.

3. How do digital tools improve communication and transparency between healthcare providers and members?

Digital tools enable real-time updates, secure messaging, and easy access to benefits and claims. This helps members stay informed, reduces confusion, and builds trust through consistent and transparent communication.

4. What role does personalization play in improving member engagement through digital tools?

Personalization ensures that members receive timely and relevant updates based on their health history and preferences. This targeted communication helps improve satisfaction, increases plan usage, and encourages long-term engagement.

5. How can healthcare organizations use digital tools to drive better health outcomes for members?

By using data analytics and automation, healthcare organizations can send preventive care reminders, manage chronic conditions, and guide members through their care journey. This proactive support leads to better health decisions and improved outcomes.

6. What impact do digital tools have on member satisfaction and retention in healthcare organizations?

Digital tools improve member satisfaction by offering easier access to care, personalized communication, and faster support. This convenience and engagement lead to stronger trust and better retention for healthcare organizations.

7. What are the best member engagement strategies for insurers?

The most effective member engagement strategies focus on simplicity, relevance, and proactive support across the member lifecycle. Insurers that perform best prioritize:

- Unified digital experiences across portals, mobile, and support channels.

- Proactive communication driven by data and lifecycle events.

- Self-service tools that reduce friction and improve confidence.

The goal is to move from reactive service to guided, always-on engagement.

8. What features should a member engagement platform for insurers include?

To be considered a contemporary member engagement platform, it needs to gather all the information in one place and allow personalized and secure communication at the same time. The main functionalities are:

- Unified member portal for benefits, claims, authorizations, and documents.

- AI-powered self-service for instant answers and guided support.

- Tailored notifications and prompts according to member context and actions.

- Self-service actions with real-time status tracking and updates.

- Smooth channel transition among web, mobile, and assisted support.

- Secure, compliance-ready access to sensitive information.

- Engagement metrics to analyze usage and fine-tune outreach.

These capabilities help insurers deliver consistency at scale.

9. How does healthcare insurance member management software help insurers?

Healthcare insurance member management software enables insurers to orchestrate interactions across the entire member journey from one connected system. It helps by:

- Reducing service costs through self-service and automation

- Improving satisfaction with faster, clearer interactions

- Enabling data-driven engagement instead of disconnected outreach

Ultimately, it transforms member management from an operational task into a strategic growth lever.

10. How can insurers ensure communications are accessible to members with varying digital literacy?

Insurers have the opportunity to enhance their customers’ experience by making their practices easy, user-friendly, and versatile. Some of the things that can be done are:

- Use of simple and clear terms together with guided, step-by-step interactions.

- Similar quality of experiences across all apps, portals, and assisted support.

- Using digital channels for support, and human support when it is not enough for the customer.

This ensures engagement remains inclusive without increasing service friction.