In 2026, insurance isn’t just about policies – it’s about precision, speed, and seamless experiences. As the healthcare insurance landscape grows more complex and consumer expectations soar, insurance automation is no longer a luxury – it’s a strategic imperative.

From slashing claims processing times by over 60% to dramatically reducing manual errors and compliance risks, insurance automation is redefining what operational excellence looks like. It’s transforming tedious workflows into intelligent, self-running engines – boosting productivity while enhancing both stakeholder trust and member satisfaction.

This blog delves into the future-forward world of insurance automation, unpacking the top 5 high-impact use cases and the transformative benefits they bring to healthcare insurers, brokers, and beyond.

What Does Insurance Automation Really Mean?

In an industry where precision and speed can directly impact lives, insurance automation is emerging as the heartbeat of modern operations. It refers to the application of advanced digital technologies, like AI, machine learning, and rule-based engines, to seamlessly execute processes that were once manual, repetitive, and time-consuming.

In today’s fast-evolving healthcare insurance ecosystem, automation in the insurance industry isn’t just a cost-saver; it’s a game-changer. It empowers organizations to streamline operations, scale faster, and deliver a consistently superior experience to members, providers, brokers, and employers alike.

Why Is Automation in the Insurance Industry Important?

Healthcare insurance organizations face a complex trio of challenges:

- Maintaining strict regulatory compliance

- Efficiently managing a growing volume of processes

- Meeting rising customer expectations in a digital-first world

Insurance automation rises to meet these demands with power and precision. It drives:

- Higher accuracy, minimizing human error in critical workflows

- Faster processing, reducing delays in claims, underwriting, and onboarding

- Lower operational risks, through built-in compliance and audit-ready trails

- Elevated customer service, offering speed, transparency, and reliability at every touchpoint

Insurance organizations face three primary challenges : maintaining regulatory compliance, handling processes efficiently, and delivering satisfactory customer service. Automation in insurance helps solve these problems. The automation of operations delivers enhanced accuracy alongside faster processing, reduces risk, and improves compliance rates, while supporting quick and dependable customer service requirements.

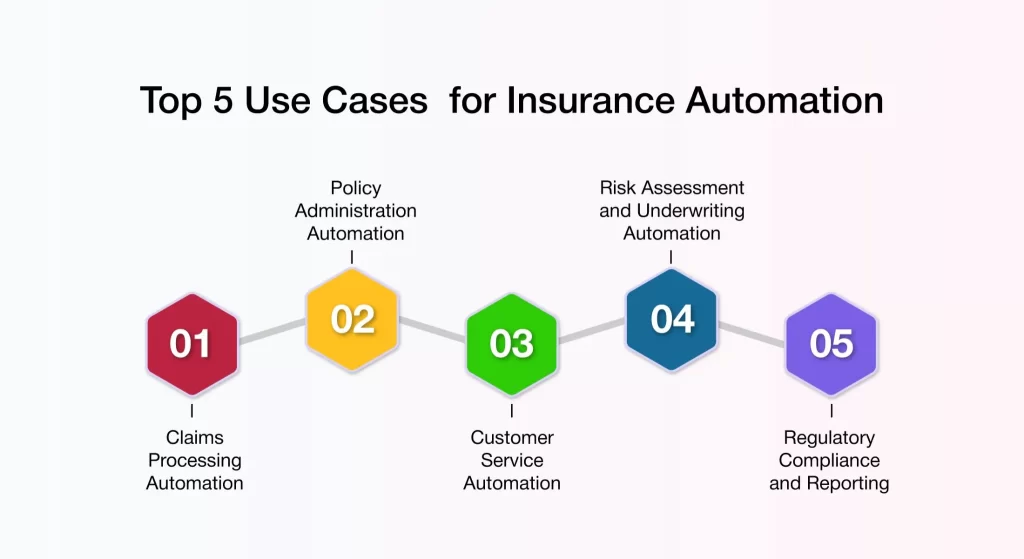

Top 5 Use Cases for Insurance Automation

Insurers should recognize automation in their operations as a fundamental requirement instead of an optional enhancement. Organizations leverage automated insurance solutions to deliver better customer service while also streamlining their claims process and reducing operational expenditures.

The following section outlines the key situations where automated solutions yield measurable outcomes for insurance organizations.

1. Claims Processing Automation

Processing claims is often regarded as the most challenging and time-consuming aspect of the insurance process. It involves document verification, fraud detection, approvals, and payout. Customers have found this to be slow and error-prone in the past.

Here is how automation in insurance claims works.

- Document Handling: After submitting claims, AI steps in to extract and verify data from claim forms and receipts. It also extracts data from images using Optical Character Recognition. This ensures accuracy and speeds up the process.

- Fraud Detection: As the claim progresses, machine learning models analyze historical data to flag suspicious claims. By detecting patterns and anomalies, these models help prevent fraudulent claims.

- Decision-Making: Robotic Process Automation bots handle straightforward claims automatically. More complex claims are routed to human adjusters, while customers receive instant updates on their claim status.

2. Policy Administration Automation

The policy administration section encompasses all tasks related to policy issuance, endorsements, renewals, cancellations, and customer data management. Multiple systems require traditional manual updates through back-office staff, but such processes often lead to delays and mistakes.

Insurance workflow automation transforms this in the following ways:

- Policy Issuance: Automated systems generate policy documents and calculate accurate premiums based on underwriting rules. They also dispatch onboarding emails to policyholders instantly, ensuring a smooth initiation process.

- Renewals and Reminders: The scheduled insurance automation system triggers timely renewal notices and applies applicable loyalty discounts. They also execute automatic policy renewals with minimal manual oversight, enhancing customer retention.

- Policy Changes: Requests for address updates, nominee modifications, or coverage adjustments can be processed automatically through self-service portals. This minimizes administrative delays and improves service efficiency.

3. Customer Service Automation

Today’s policyholders expect quick, round-the-clock support—whether it’s checking premium due dates, filing a claim, or updating personal information. Staffing for 24/7 support isn’t always feasible, especially at scale.

This workflow is transformed by automation in insurance in the following ways:

- AI Chatbots: These chatbots can answer policy questions. They can also guide users through form submissions and process simple requests without needing human intervention.

- Automated Ticketing: Robotic Process Automation tools classify support requests based on urgency and topic. They then route the requests to the right departments.

- Self-service Portals: Empower customers to independently manage routine tasks – from accessing documents and making payments to submitting requests – all at their convenience.

4. Risk Assessment and Underwriting Automation

Underwriting involves processes that assess the risk associated with insuring an individual or asset. Traditionally, the process depends on static underwriting rules and legacy system operations. It also relies on manual data verification. This often results in processing times that extend over several days.

Here’s how insurance workflow automation makes this process smarter:

- Data Aggregation: Pulls real-time data from multiple sources, including credit agencies, medical records, driving history, and IoT devices.

- Predictive Modeling: AI models evaluate hundreds of variables to assess risk and recommend premium pricing.

- Decision Support: Underwriters receive AI-assisted risk scores and suggested decisions for faster processing.

5. Regulatory Compliance and Reporting

Insurance operates within one of the most regulated industries. Maintaining compliance requires careful record-keeping, frequent audits, and prompt reporting. When handled manually, these processes consume a lot of time and are prone to risks.

This workflow is transformed by automation in the following ways:

- Audit Trails: Every transaction or workflow is logged with metadata for traceability.

- Auto-generated Reports: Scheduled bots can compile, format, and distribute compliance reports in required formats.

- Real-time Monitoring: Alerts are triggered when anomalies or breaches in regulatory parameters occur.

Can Automation Make Insurance More Efficient?

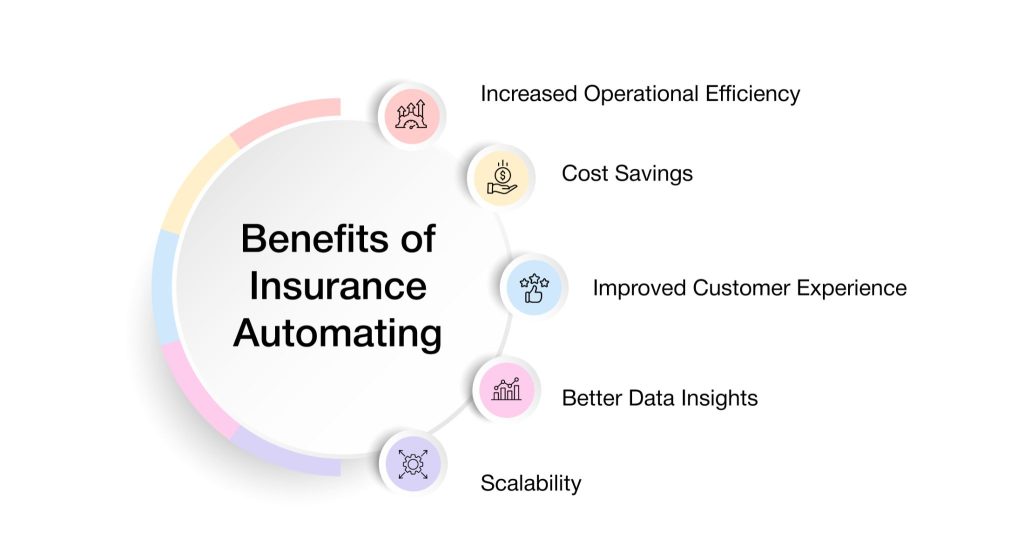

Automation is largely responsible for the rapid changes occurring in the insurance sector. Insurers are cutting expenses and improving system responsiveness by automating core functions.

Here are the key benefits of automation in the insurance industry:

1. Improved Customer Experience: Today’s customers expect instant answers, real-time updates, and simple digital interactions. Automation in insurance facilitates 24/7 self-service via chatbots and customer portals. It ensures faster claims resolution and policy changes. Customers spend less time waiting and more time engaging. Satisfaction scores rise, and customer retention improves because policyholders feel valued and well-served.

2. Better Data Insights: Insurance companies hold massive volumes of data – claims, risk profiles, customer behavior, and compliance logs—but much of it remains underutilized when trapped in manual systems. Insurance automation captures and organizes data from every interaction and process. It utilizes analytics tools to identify trends, risks, and opportunities. It supports dynamic dashboards for real-time performance monitoring.

3. Scalability: As insurers grow, handling more policies, claims, and customer interactions without compromising quality becomes a challenge. Automation makes it easier to scale without reengineering core systems or hiring excessively. Systems automatically adjust to handle peak periods (e.g., renewal season or disaster claims surges). New workflows or products can be launched with minimal setup time.

What Should Insurers Watch Out for in Automation?

While automation holds incredible promise for streamlining processes in healthcare insurance, insurers must tread carefully to achieve successful and ethical integration. Some of the key points insurers in healthcare need to ensure to maximize the advantages while minimizing the risks from the growing realm of insurance automation. Let’s go over what needs to be watched:

1. Data Privacy and Security Issues

Automated systems involve vast amounts of sensitive data, and insurers should therefore implement robust measures to ensure their security. Data breaches or mishandling could result in non-compliance and a loss of trust with clients.

2. Ensuring Regulatory Compliance

Insurance automation operates within an evolving framework of laws and regulations, including HIPAA, and applicable regional data protection laws. The price to pay when these are not met is both legal penalties and the insured’s reputation at stake.

3. Integration with Legacy Systems

Many insurers are still using legacy systems that were never designed to integrate easily with modern insurance automation systems. When new automation technology is poorly implemented, it creates bottlenecks and inefficiencies.

4. Maintaining Human Touch in Critical Interactions

While automation is great at handling routine activities, complex claims and customer queries require a personal touch. Striking the right balance between automation and human involvement is essential.

5. Continuous Monitoring and Optimization

Automation systems aren’t set-and-forget solutions. Hence, the insurer must continuously monitor performance and detect anomalies to fine-tune workflows, ensuring that the value of automation in insurance is maximized and unintended disruptions are minimized.

By keeping these considerations in mind, insurers can harness insurance automation effectively without sacrificing quality or customer trust.

AVIZVA: The Future of Insurance Automation

AVIZVA is a technology services and solutions provider that supports payers, TPAs, and PBMs in strengthening care delivery with a wide range of engineering products and services. With over 14 years of experience using technology to simplify, optimize, and accelerate healthcare operations, AVIZVA has become a leading healthcare IT company in 2026. Their strong track record includes enduring client partnerships and more than 150 custom product deliveries, built on four specialized practices.

As the industry increasingly embraces AI, AVIZVA recognizes the challenges insurers face, such as data security, compliance, and the limitations of traditional AI tools. This is where VIZCare AI, AVIZVA’s cutting-edge, enterprise-ready platform, comes in – designed specifically to address these obstacles and drive operational efficiency for insurers in 2026.

1. Deep Healthcare Insurance Intelligence: Pre-trained on real-world payer operations, VIZCare AI understands critical entities, including members, providers, claims, benefits, prior authorizations, and clinical codes. These deep contextual interpretations empower the AI with the ability to interpret data correctly, come up with actionable insights, and help in decision-making around all insurance operations.

2. Private, Secure & Compliant: Deployed in a HIPAA, SOC 2, and GDPR-compliant private environment, VIZCare AI provides insurers with complete control over data access, ensuring the full protection of sensitive information while adhering to legal constraints.

3. Agentic Architecture with Full Functional Coverage: Built on the proprietary Presentation Context Protocol (PCP), VIZCare AI orchestrates AI-driven workflows across all payer operations, delivering reliable and context-aware interactions. From claims processing and benefits management to provider coordination, the platform ensures full functional coverage for enterprise workflows.

4. Granular Data Accuracy and Access Control: VIZCare AI ensures precise delivery of data to the right user or system at the right time. Through RBAC and ABAC built within the platform, insurers can impose fine-grained restrictions that protect truly sensitive data, ensuring that only those authorized are able to view or take action on such critical records.

Key Considerations Before Adopting Insurance Automation

Before implementing automation, insurance companies need a clear plan. Automation is not just about adding new technology. It is about ensuring the entire organization is prepared to support and benefit from it.

Evaluating Your Organization’s Readiness

The first step is to assess if the current environment can support insurance automation. Key areas to consider include:

- Infrastructure: Do you have the necessary digital systems? Legacy systems might need upgrades or connectors to work with automation tools.

- Current Processes: Are workflows standardized and documented? Automation works best when applied to well-defined, repeatable processes.

- Integration Needs: Can the new automated insurance solution connect easily with your CRM, policy management systems, claims platforms, and data sources?

Choosing the Right Automation Tool

To find the right automation tool, find answers to these questions.

- Is it scalable? Can the platform grow with the business needs?

- Can it handle insurance workflows? Look for features like claims intake, underwriting support, and regulatory reporting.

- How customizable is it? Ensure that insurance workflow automation suits internal processes.

- Does it integrate well with your existing tech stack? Avoid platforms that require a complete system overhaul.

- What support and training are offered? Successful insurance automation depends on how easily teams can adopt and adapt.

Conclusion

Non-automated insurance functions result in reduced operational efficiency along with non-compliance standards. The system delivers simpler operations for managing policy claims in addition to running policies and providing customer assistance. While automated insurance solutions help both tasks to operate at increased speed alongside higher accuracy levels.

Through insurance automation, operations become more scalable, resulting in substantial cost savings. The insurance company can offer superior service experiences to its clients through its operations.

AVIZVA, with its expertise in healthcare and insurance automation, offers a comprehensive solution with its VIZCare AI platform. Organizations seeking modernized operations can streamline claims, enhance compliance, and deliver superior member experiences by integrating AI-driven workflows for seamless, efficient, and scalable operations.

Get in touch now to understand how AVIZVA can assist your business with insurance automation!

FAQs

- How does insurance automation enhance regulatory compliance in healthcare insurance?

Insurance automation enhances regulatory compliance in healthcare insurance by streamlining reporting, ensuring accurate data capture, and minimizing human errors. Automated systems maintain audit trails, ensuring the system complies with regulations such as HIPAA, and inform insurers of any potential areas of non-compliance in real-time. Avoiding penalties enables insurers to gain the trust of their members by showing a mature approach to transparency and industry standards.

- What role does AI play in personalizing insurance offerings for members?

AI personalizes offerings by analyzing lots of member data, including demographics, behavior, and claims history. AI utilizes various machine-learning models to identify individual needs and preferences, enabling the customization of insurance plans, pricing, and recommendations for greater relevance. Such personalization enhances member satisfaction by offering plans that are more closely aligned with their health and financial conditions, thereby helping to retain and engage members.

- Can automation in insurance improve cross-departmental collaboration?

Yes, the automation processes in insurance encourage cross-departmental collaboration by providing centralized data support for seamless communication between teams. Automated workflows enable local teams, such as underwriting, claims, and customer service, to access shared information concurrently, thereby reducing silos and aligning their teams. This, in turn, shortens working hours for major decisions, improves worker efficiency, and advances service cohesion toward members.