In the modern healthcare insurance market, customers expect more than just coverage—they demand personalized, seamless experiences that are fast, intuitive, and responsive to their evolving needs.

They value effortless interactions with their insurers, powered by solutions that anticipate their questions and deliver proactive, real-time support. Enterprises are increasingly leveraging AI to turn this vision of customer engagement in insurance into reality.

However, over 30% of customers remain dissatisfied with their digital experiences. In a landscape where convenience and transparency are critical, failing to deliver seamless engagement risks customer frustration, lost trust, and higher churn.

In this blog, we’ll explore five proven strategies to elevate insurance customer engagement in the healthcare industry. From AI-powered personalization to streamlining renewals, these approaches can help enterprises stand out from the competition, drive growth, and build deeper, more lasting relationships with their customers.

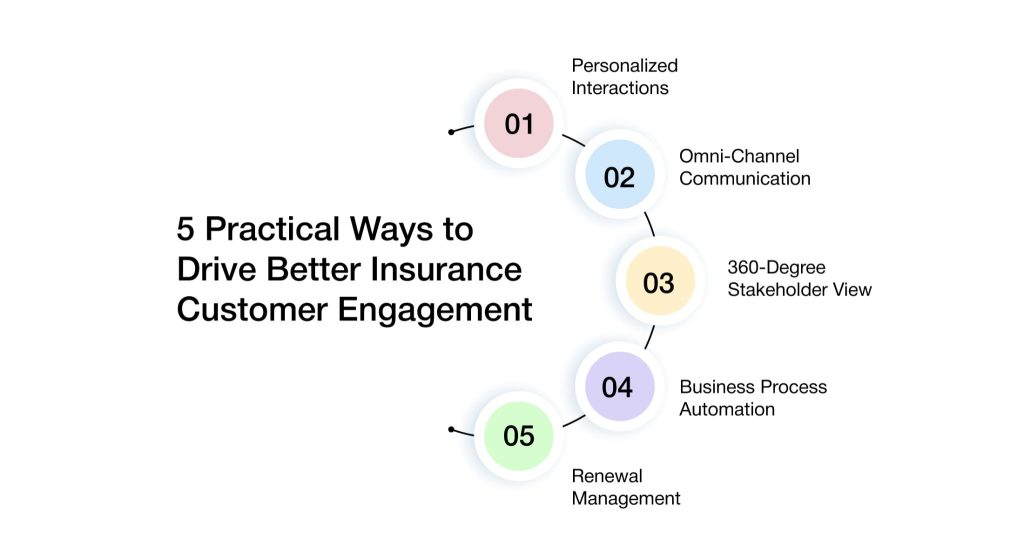

5 Practical Ways To Enable Better Customer Engagement In Healthcare Insurance

The following are five practical customer engagement solutions for healthcare insurance that can help enterprises differentiate themselves in today’s competitive market.

1. Leveraging AI To Drive Personalized Interactions

In today’s healthcare insurance landscape, personalized consumer engagement is no longer optional—it’s a vital differentiator and a key driver of competitive advantage. Yet, many insurers face growing challenges in delivering tailored experiences across a broad network of stakeholders, including members, providers, brokers, employers, and internal teams.

To address these challenges, leading enterprises are turning to AI-driven personalization—achieving measurable improvements in customer satisfaction, retention, and overall business performance.

AI-powered insurance customer engagement tools and intelligent assistants are transforming how insurers communicate with every stakeholder. By anticipating consumer needs and delivering timely, relevant messaging, AI in insurance enables a more human, context-aware experience. This personalized approach extends beyond members to include providers, brokers, and employers—ensuring every interaction is meaningful, consistent, and impactful.

- Dynamic Personalization at Scale: Tailor communications based on individual health data, preferences, and behavior to create highly relevant, personalized interactions across all stakeholder groups.

- Intelligent Automation for Routine Engagement: Automate routine communications—such as appointment reminders, coverage updates, and onboarding messages—to reduce manual workloads and improve consistency.

- Predictive Engagement Using Data Insights: Use AI-driven analytics to identify emerging needs and behavior patterns, enabling proactive outreach through targeted, data-backed campaigns that enhance satisfaction and loyalty.

- Unified Stakeholder Communication: Facilitate seamless, real-time communication across internal teams, brokers, and providers by delivering timely, actionable insights that drive collaboration and informed decision-making.

2. Implementing Omni-Channel Communication For Seamless Engagement

As digital channels continue to expand, healthcare insurance consumers increasingly demand consistent, high-quality service across all touchpoints—SMS, WhatsApp, email, mobile apps, IVR systems, and more. When communication is fragmented or lacks continuity, consumers often feel frustrated and disconnected—especially when required to repeat information across channels.

Omni-channel communication platforms solve this by delivering a unified experience. By preserving context and history across interactions, these platforms allow insurers to engage intelligently and consistently—no matter where the conversation starts or continues.

- Consistent Communication: Deliver timely, relevant updates across voice, text, email, and app-based channels—ensuring a coherent consumer experience.

- Context-Aware Engagement: Maintain full conversation context across all channels, eliminating the need for consumers to repeat themselves.

- Increased Member Responsiveness: Reach customers through their preferred channels, boosting engagement and satisfaction.

- Reduced Friction and Operational Complexity: Integrate communication methods into a single platform to streamline internal processes and improve service delivery.

3. Providing A 360-Degree Stakeholder View For Informed Service

Fragmented data across disparate systems often prevents insurers from delivering timely, personalized service to stakeholders such as members, providers, brokers, and employers. Without a unified view, service teams lack the context needed to respond effectively—resulting in delays, errors, and diminished trust.

By consolidating this information into a single, 360-degree view of each stakeholder, insurers gain a comprehensive understanding of everyone they serve. This holistic perspective empowers teams to respond faster and more accurately, tailoring interactions based on real-time context and historical insights. The result is greater operational efficiency, improved customer experiences, and stronger stakeholder relationships.

- Unified Data Access: Consolidate data from members, providers, brokers, and employers into a centralized platform, enabling quicker, informed decision-making.

- Faster, Personalized Responses: Equip service teams with comprehensive, up-to-date information to improve response times and personalize interactions.

- Improved Decision Making: Utilize contextual insights to conduct more effective conversations and achieve better outcomes across all stakeholder interactions.

- Enhanced Trust: Deliver accurate, tailored responses that build trust and increase stakeholder satisfaction.

4. Automating Business Processes To Accelerate And Improve Service

Healthcare insurers face increasing pressure to streamline operations and minimize manual tasks that are time-consuming and prone to errors. Key processes such as claims approvals, plan renewals, and member notifications often involve repetitive steps that can slow down service delivery and introduce inaccuracies.

By choosing digital customer engagement platforms for insurance, companies can significantly lessen manual workloads, minimize errors, and speed up processing times. Beyond boosting operational efficiency, automation enhances the member experience in healthcare by enabling faster, more reliable service.

- Reduced Manual Effort: Automate repetitive processes to improve accuracy and reduce administrative burden.

- Faster Service Delivery: Accelerate response times for consumer requests, boosting satisfaction and trust.

- Improved Operational Efficiency: Allow teams to focus on complex, high-impact cases by removing routine workload.

- Timely Follow-Ups: Automatically trigger reminders and next steps to ensure consistent, proactive engagement.

5. Streamlining Renewal Management To Boost Retention

Renewal management is a critical component of member retention—but when processes are manual, disjointed, or unclear, they often lead to delays, errors, and poor experiences. Inefficient renewal workflows not only frustrate members but also increase the risk of attrition, as they may seek more seamless alternatives elsewhere.

By automating and streamlining the renewal process with integrated workflows and timely notifications, insurers can improve accuracy, reduce friction, and keep members informed throughout the journey. A simplified, proactive renewal experience increases satisfaction and improves retention rates.

- Automated Renewal Reminders: Send timely notifications that prompt action and prevent lapses in coverage.

- Integrated Workflows: Simplify the renewal journey with automated data handling and approvals that improve speed and reduce errors.

- Enhanced Member Confidence: A seamless, reliable process builds trust and satisfaction—key drivers of long-term loyalty.

- Increased Revenue Retention: Streamlined renewal management helps reduce churn and supports consistent growth.

Real-World Success: How Top U.S. Health Insurers Drive Customer Engagement

1. Aetna’s Member Engagement Program: Empowering Members Through Digital Tools

Aetna offers a comprehensive suite of digital tools and resources designed to help members actively manage their health insurance needs. Through its Member Engagement Program, Aetna provides easy access to essential information, personalized health insights, and dedicated support—empowering members to make informed decisions about their care.

- Personalized Health Insights: Members can complete health assessments to gain a clearer understanding of their overall health status and potential risks.

- Health Record Access: Secure access to personal health records—including claims, test results, and visit summaries—gives members a comprehensive view of their health journey.

- Health Goal Support: Interactive tools, challenges, and activities encourage members to set and achieve wellness goals, fostering a proactive approach to health management.

- Health Decision Support: Educational videos and resources guide members through their care options, helping them make informed and confident healthcare decisions.

- App and Device Integration: Members can seamlessly connect their favorite health apps and wearable devices to track fitness, monitor health metrics, and stay actively engaged in their wellness routines.

By delivering personalized insights and easy access to essential health data, Aetna’s digital tools drive deeper member engagement and smarter health choices. Aetna’s success reflects a broader shift in the U.S. healthcare industry, where the adoption of AI-driven engagement solutions is enabling insurers to not only meet, but exceed the rising expectations of today’s health-conscious consumers.

2. EmblemHealth’s Member Portal: Centralized Access To Health Resources

EmblemHealth’s Member Portal leverages AI-powered tools to provide members with seamless access to essential health services. From tracking health records and scheduling virtual visits to receiving personalized health recommendations, the portal is designed to improve member experience in healthcare and enhance satisfaction. With 24/7 availability, it ensures that members can manage their care anytime, anywhere—whether at home or on the go.

- Dedicated Care Team: Each member is paired with a Primary Care Provider and a team of specialists who work together to deliver coordinated, personalized care—including virtual visit options that bring quality healthcare directly to members’ homes.

- Digital Access to Health Records: Through the myACPNY patient portal, healthcare providers can securely access members’ medical records. This real-time access helps eliminate unnecessary delays and supports smooth, coordinated care across the entire care team.

- Convenient Virtual Visits: Members can easily schedule virtual appointments with trusted healthcare professionals—making it simple to access care when it’s needed most, without the hassle of travel or waiting rooms.

As U.S. insurers continue to adopt digital health tools to meet the rising demand for convenience and accessibility, EmblemHealth’s portal stands out as a robust solution that supports the industry’s shift toward more patient-centered care.oward more patient-centered care.

AVIZVA: The AI-Powered Engine Transforming Health Insurance Customer Engagement

In today’s fast-paced insurance market, standing out requires more than just competitive pricing—it demands exceptional customer engagement at every step. VIZCare Xperience is an advanced, AI-driven platform that empowers insurers to elevate every interaction across the value chain. Whether it’s with brokers, members, employers, or providers, BrokerX, MemberX, EmployerX, and ProviderX work together seamlessly to deliver highly personalized, frictionless experiences that build trust and drive long-term loyalty.

Let’s see how it delivers:

- BrokerX: Empowering Brokers to Deliver Personalized Service

BrokerX streamlines the way brokers interact with customers by offering real-time insights, personalized communication, and simplified processes. It enables brokers to respond to customer queries quickly, provide tailored recommendations, and manage policies with ease, ensuring that your clients receive the best possible service every time.

- MemberX: Enhancing Member Experiences Across Channels

MemberX offers a unified platform that ensures members have access to their benefits, claims status, and support at any time, from any device. The solution leverages AI to deliver personalized notifications, manage healthcare benefits, and simplify claims, improving member satisfaction while reducing administrative overhead for insurers.

- EmployerX: Simplifying Employer-Employee Interactions

With EmployerX, insurance providers can offer employers a streamlined way to manage employee benefits, track claims, and provide support. The platform’s self-service capabilities empower employers to quickly make updates, track plan details, and access real-time reporting, improving efficiency and engagement across the employer-employee relationship.

- ProviderX: Enhancing Provider Collaboration for Better Outcomes

ProviderX enables seamless communication between insurers and healthcare providers. It simplifies the exchange of claims information, medical records, and payments, ensuring providers can quickly deliver services to members while minimizing delays. This results in better collaboration, faster approvals, and improved member care.

Additionally, with VIZCare’s engineering services, insurers can leverage cutting-edge technology to seamlessly integrate the entire suite into their existing systems, ensuring a tailored solution that meets their unique business needs.e journey.

Conclusion

Customer engagement in insurance goes far beyond sending routine updates and reminders. It’s about delivering seamless, personalized, and consistent experiences across every touchpoint.

AI-driven personalization, omnichannel communication, comprehensive data visibility, workflow automation, and proactive renewal management form the foundation of a modern, effective customer engagement strategy.

Healthcare technology solutions, such as VIZCare Xperience, bring these capabilities together, providing the intelligence and automation needed to serve members more effectively while driving operational efficiency. Now is the time to reevaluate insurance customer engagement tools and explore how intelligent automation can improve member experience in healthcare, streamline operations, and position your business for the future.

FAQs

1. What common mistakes do health insurance companies make when trying to improve customer experience?

Many insurers focus too much on one channel, like just calls or emails, while ignoring the need for seamless, connected experiences. Others rely heavily on outdated systems that slow down service and frustrate customers. Without a strong digital customer engagement platform for insurance, it’s easy to miss the mark on what customers actually want: fast, personalized, and hassle-free support.

2. How can health insurers balance customer experience improvements with cost efficiency?

By automating routine processes and using smart tech, insurers can deliver better service without increasing costs. AI tools help personalize interactions while freeing up teams to focus on complex issues. With the right insurance customer engagement strategy, it’s totally possible to improve service and reduce overhead at the same time.

3. What role does technology play in transforming the customer experience in health insurance?

Technology is the real game-changer. From self-service portals to AI-powered support, modern tools help insurers stay responsive, proactive, and efficient. A customer engagement platform for insurance brings everything together, data, channels, workflows, so customers feel heard, supported, and in control.

4. What are the challenges in maintaining high levels of customer satisfaction in health insurance?

Customers expect instant, personalized service, but delivering that across multiple teams and systems isn’t easy. Siloed data, slow processes, and inconsistent communication often get in the way. That’s why more insurers are turning to customer engagement solutions for insurance that unify service and simplify how teams connect with members.

5. How do customer experience improvements impact customer retention in the health insurance industry?

A smoother, smarter experience makes people feel more confident and cared for, which is key to keeping them around. When members can easily find help, understand their coverage, and get timely updates, they’re more likely to stay loyal. With digital insurance customer engagement tools, insurers can build trust and boost long-term retention without adding friction.

6. How can insurers improve customer engagement?

Through the use of personalized communication, accessibility of benefits and claims information, and support of AI-powered tools, insurers will be able to boost customer engagement. Streamlining processes and offering multi-channel communication ensures that customers feel heard and valued.

7. What features should a customer engagement platform have?

A future-focused customer engagement platform should deliver a high-impact, end-to-end ecosystem that meets customers where they are, anticipates their needs, and accelerates meaningful interactions across every touchpoint. It should offer unified customer intelligence, real-time personalization, and seamless omnichannel journeys that adapt dynamically to context.

Advanced automation, self-service enablement, and proactive outreach are essential to reduce friction and keep members engaged. Additionally, deep integrations with policy, claims, and service systems ensure that every interaction is informed, efficient, and consistently aligned with the customer’s lifecycle.