| TL;DR 1. Healthcare insurers are compelled to lower their costs, enhance their efficiency, and live up to the customers’ expectations, while simultaneously handling the presence of old systems. 2. Through the use of data interoperability, insurers have the capability to harmonize their systems and elevate their workflows; therefore, they are able to make decisions quickly and provide personalized services. 3. Inaction can result in lost market opportunities, increased operational costs, and risk of becoming obsolete due to disconnected data and slow processes. 4. Some of the advantages of interoperability are that it allows AI-driven decision-making, improves risk management, speeds up claims processing, and facilitates the reduction of administrative costs. 5. VIZCare Connect provides a solution for data exchange in real-time, thus enabling collaboration, scalability, and the effortless integration of new technologies. |

The current health insurance landscape, which is largely characterized by escalating member demands, tighter regulations, and increased competition, data is no longer just an asset – it’s a competitive differentiator. But data alone isn’t enough. The real value lies in the seamless ability to connect, exchange, and act upon this information across all systems, processes, and stakeholders.

This is why data interoperability is essential, providing health insurers with a strategic edge. It transforms operations from merely reactive to efficiently predictive, eliminates fragmented service in favor of frictionless experiences, and evolves outdated systems into future-ready enterprises.

Today, implementing interoperability is more than a technical choice – it is a fundamental business mandate for insurers aiming to lead the market.

The blog will discuss solutions that change the operation of health insurance, such as VIZCare Connect, corresponding with the main benefits of data interoperability, showcasing its ability to streamline processes and future-proof business operations.

The Cost of Inaction: What Happens When Insurers Don’t Adapt

In a market where agility, intelligence, and real-time responsiveness define competitive advantage, refusing to modernize is no longer a neutral choice, it’s a strategic setback. The absence of data interoperability doesn’t just slow progress; it creates compounding inefficiencies, rising costs, and measurable revenue leakage across the value chain.

Here’s what’s at stake when insurers choose to “wait and watch” instead of transforming:

1. Lost Market Opportunities

- Slower Response to Market Demands: Disconnected data systems stall product innovation, making it difficult to launch personalized plans or respond to evolving member expectations.

- Inability to Scale or Introduce New Services: Without interoperable systems, insurers limit their own agility and slow down the launch of new offers, such as AI-based health assessments or telemedicine integration.

- Missed Growth Opportunities: Data fragmentation prevents insurers from exploring new avenues and trends, such as real-time risk assessment, or contemplating market share.

2. Increased Operational Spends

- Manual Workloads Soar: Fragmented systems require significant manual intervention, leading to higher administrative costs.

- Slower Claims Processing: Lack of synchronized claims, eligibility, and provider data increases cycle times and resource dependency.

- Data Reconciliation Costs: Teams spend more time fixing operational breakdowns, such as data fixes, repeated validations, and cross-team dependency loops, rather than delivering value that drives up overhead and reduces profitability. Healthcare data interoperability for operational efficiency addresses these issues at the source, driving measurable cost reduction.

3. Competitive Irrelevance & Market Erosion

- Service Experience Gap Widens: Modern consumers expect real-time visibility; legacy systems can’t deliver the digital-first experience members, providers, and brokers expect.

- New Entrants Outpace Traditional Players: Tech-forward insurers and digital-first startups seize ground faster with flexible, interoperable data ecosystems.

- Brand Perception Declines: Slow service, opaque processes, and delays create dissatisfaction that compounds into credibility loss.

4. Regulatory and Compliance Risks

- Non-compliance with Evolving Regulations: Real-time reporting mandates, HIPAA-aligned safeguards, and CMS interoperability rules demand connected systems.

- Data Privacy and Security Risks: Disjointed systems may lead to an increased number of data breaches or privacy law infringements, resulting in heavy penalties and reputational damage.

5. Customer Attrition Becomes Predictable

- Poor Experience Drives Switching: Members expect instant answers—not multi-day follow-ups and unresolved tickets.

- Provider Frustration Increases: Inaccurate data, eligibility delays, and authorization confusion strain network relationships.

- Retention Drops as Expectations Rise: Customers gravitate to insurers with transparent, omnichannel, digitally mature service models.

6. Falling Behind on AI & Tech Innovations

- Integration Roadblocks Stall Innovation: New technologies can’t plug into disconnected ecosystems.

- Inability to Compete in the AI-Driven Decade: The future of underwriting, claims, and experience management is intelligent, autonomous, and real-time; interoperability is the entry ticket.

According to HFS Research, the U.S. insurance industry is burdened with an estimated $200 billion in tech and process debt, with a significant portion, $66 billion, attributed to outdated claims processing systems.

Given the significant risks outlined, health insurers will have to adapt accordingly or risk falling behind.

Data interoperability solutions for health insurers are the gateway to transforming complex operational challenges into streamlined processes, smarter decision-making, and a competitive advantage in a data-driven market.

Why Data Interoperability is the Key to Future-Ready Operations

In today’s fast-moving healthcare ecosystem, operational excellence isn’t a “nice to have” – it’s mission-critical. With regulatory pressure intensifying, consumer expectations rising, and digital competition accelerating, health insurers can no longer rely on static systems and fragmented data workflows. The landscape demands real-time intelligence, seamless coordination, and a single source of truth.

This is where data interoperability graduates from an IT upgrade to a strategic differentiator. It aligns internal ecosystems, accelerates decision-making and unlocks proactive, experience-driven insurance operations.

It’s not just the edge for insurers- it’s the entry ticket to play in the next era of healthcare.

The Urgency: Data Fragmentation Is Costing More Than You Think

For many insurers, legacy infrastructure has created data disconnected across claims, eligibility, provider networks, and customer-facing channels. The outcome?

- Delayed claims and eligibility checks

- Incomplete member history across touchpoints

- Redundant manual processes and duplicated records

- Higher operational costs and call-center dependency

Fragmentation bleeds efficiency. Interoperability stops the leak.

By enabling systems to communicate in real-time whether internally, externally or with regulatory partners – insurers finally gain the holistic view required to support agile, growth-oriented operations.

Interoperability: Eliminating System Disconnects for a 360° Operational View

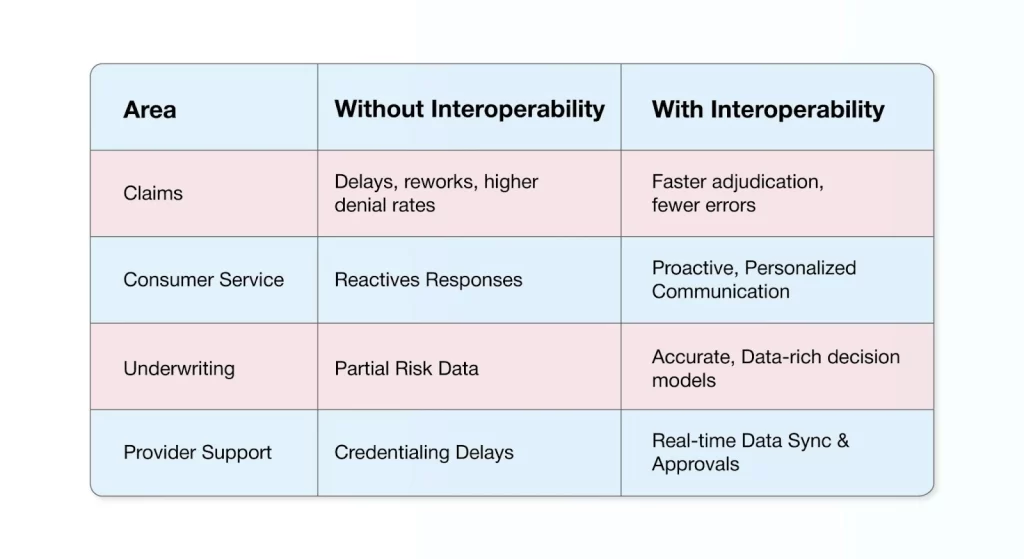

When data moves seamlessly across the system, every function upgrades

This lays a strong foundation for future-ready, AI-augmented decision support, eliminating manual interventions and enabling scalable service delivery.

The AI Advantage: From Static Processing To Predictive Decision-making

With interoperable data as the foundation, AI evolves from simply executing predefined rules to actively guiding decisions in real time. AI-powered data interoperability enables health insurance systems to continuously connect, contextualize, and analyze information across the enterprise, turning static processes into intelligent, adaptive workflows.

Once the data flows seamlessly, insurers can fully harness advanced analytics to :

- Personalize Member Experiences through timely, relevant and context-aware interactions

- Improve Risk Management and fraud detection by identifying anomalies and patterns as they emerge

- Enhance Operational Efficiency by automating decisions, reducing manual effort, and accelerating outcomes

Once the insurer moves away from conventional processing toward AI-powered decision-making, the data is no longer considered mere statistics. Instead, it becomes a strategic asset that can spur innovation in the customer experience while offering delight at every customer touchpoint.

Personalization, Risk Management and Member Experience

Interoperability unlocks hyper-personalization at scale. Insurers can tailor plan recommendations, coverage adjustments, and communication based on actual engagement signals, and not outdated static records.

Paired with predictive analytics, it strengthens risk visibility and empowers insurers to:

- Anticipate Claim Trends

- Prevent Fraudulent Patterns

- Optimize Loss Ratios Through Intelligent Intervention

- Deliver Tailored Guidance At Every Touchpoint

Scalability, Flexibility and Regulatory Readiness

As healthcare data volume multiplies, systems must flex, and not fracture.

Interoperability ensures insurers can:

- Scale transactions without compromising performance

- Easily integrate, onboard new partners, vendors or regulatory protocols

- Adopt new technology easily without ripping or replacing existing systems

The Operational Efficiency Dividend

By reducing redundancies, eliminating manual rework, and creating real-time transparency, interoperability fuels:

- Lower administrative overhead

- Faster time-to-resolution

- Cost-efficient processes

- Improved consumer satisfaction

How VIZCare Connect Enables Data Interoperability and AI Integration

To address these challenges and yet remain compliant, insurers need a next-generation interoperability platform that facilitates secure, scalable, and real-time data exchange. This is where VIZCare Connect, offered by AVIZVA, steps in.

VIZCare Connect is a purpose-built platform explicitly created for modern health insurance companies that need an end-to-end solution for seamless healthcare data integration and interoperability. A first-of-its-kind platform, designed to deliver unmatched visibility and transparency, VIZCare Connect provides comprehensive, real-time insights into data movements, dependencies, and potential bottlenecks. By offering a complete view across the entire data lifecycle, the platform empowers health insurers to make informed, timely decisions while ensuring that operations remain efficient, seamless, and fully accountable.

Here are some core features of VIZCare Connect:

1. Flexible Data Exchange

One of the significant barriers to interoperability is the incompatibility of different platforms with various data formats. VIZCare Connect removes this obstacle by supporting all considered integration protocols, from SFTP and HTTPS to JDBC, Kafka, and MQ, to interface with disparate systems.

The platform supports all data formats from CSV, Cobol Copybook, Flat Files, to XML, while at the same time embracing industry-specific standards for health, such as EDI, HL7, and NCPDP. Through this, the entire healthcare ecosystem gets interoperable, making the data exchange between different systems easy, strong, and efficient.

2. Automated Orchestration

VIZCare Connect provides a workflow-based, fully configurable data orchestration engine that completely automates data movement processes. By eliminating manual intervention, it ensures a timely and accurate data flow across all systems, while facilitating data transformation, enrichment, and validation before reaching target systems.

That way, human errors are reduced, speeding up data movement while ensuring complete compliance with strict regulatory frameworks.

3. Built-In Rules Engine

One of the key features of VIZCare Connect is its native rules engine. This allows insurers to dynamically transform data from one format to another based on business logic and integration requirements.

The rules engine dynamically changes as the needs change, so that data is always delivered in the right format to meet actual needs, whether it be in claims processing, risk assessment, or customer service.

4. Native AI Capabilities

AI-driven automation is the core of VIZCare Connect. The best way for insurers to leverage AI-powered automation on the platform is to self-configure new data sources and targets, thereby reducing the manual effort required to onboard external systems and partners.

This platform integrates the data by mapping and optimizing data formats instantaneously in both incoming and outgoing directions, reducing the cost and complexity of system onboarding.

5. Real-Time Operational Insights

One of the key benefits that VIZCare Connect offers is real-time operational & business insights correlating enterprise data across systems for comprehensive reporting, auditing, and monitoring. The platform has the capability of bringing all details relevant to the actual data transactions flowing across the system, hence allowing a clear view of how data is moving, the dependencies involved, and potential points of friction. This enhances decision-making and allows for proper tracking of compliance.

6. Supports Large Files and Multi-Channel Data Exchange

Healthcare data possesses a degree of complexity that is highly challenging to manage under multichannel conditions. VIZCare Connect is carefully designed to handle high volumes of data transactions between multiple channels simultaneously, thus ensuring efficient, scalable, and reliable data exchange.

This becomes essential when insurers need to process large and very complex datasets in a hurry and with utmost precision, while ensuring compliance and security.

Real-World Benefits of Data Interoperability in Health Insurance

Here’s how data interoperability directly transforms health insurance operations:

Streamlined Claims Processing

- Automated Document Review: AI also harnesses NLP and OCR to examine claims documents, thus resulting in faster claims adjudication and diminishing tedious manual intervention.

- Cost Reduction: By streamlining claims processing, an insurer can significantly reduce operating costs and be better positioned to deploy its resources.

Risk Management and Fraud Detection

- Proactive Risk Assessment: Real-time data allows insurers to spot high-risk claims at an early stage and curtail potential financial losses.

- Fraud Prevention: AI-powered systems can identify patterns and flag potential fraudulent claims early, helping insurers save costs and improve decision-making.

Improved Customer Experience

- Personalized Insurance Plans: With data interoperability, insurers will now be able to provide custom-made coverage suited very specifically to each member’s needs and preferences.

- Enhanced Engagement: With real-time, accurate data at their disposal, insurers can now actively engage customers for higher satisfaction and retention levels.

Cost Savings

- Reduced Operational Overhead: Automating everything, from data entry to complex data flows, significantly reduces administrative expenses.

- Increased ROI: Streamlined operations lead to better resource allocation, resulting in higher profitability and a competitive edge in the market.

Conclusion

As health insurers navigate the challenges of rising operational costs, data fragmentation, and customer demands, data interoperability is the key to transforming their workflow and improving member experiences.

Data interoperability in health insurance is the key to unlocking this transformation. However, there is a second layer of empowerment for data interoperability, aside from fine-tuning operations for better efficiency. It must also arm health insurers for a new dawn of insurance, where agility, swiftness, and customer-centricity are at its core.

With interoperability, insurers can harness advanced analytics, AI-driven insights, and real-time decision-making, all of which are critical to adapting to the rapidly evolving landscape of insurance and taking the lead against their competitors.

With the right solution, the insurer can solve present-day operational problems and ensure its survival in a fast-changing industry. By embracing VIZCare Connect, insurers can seamlessly integrate real-time data exchange and become future-ready.

FAQs

- What is data interoperability in health insurance, and why is it important?

Data interoperability in health insurance means a smooth flow and exchange of data in real-time between various systems, platforms, and organizations.

It is essential because it increases operational efficiency, assists in decision-making, and enhances the experience for members, ensuring that all data flows consistently and on time, both internally and externally, across different departments and external partners. This leads to reduction in operational efficiency and manual errors, ultimately improving service quality.

- How can data interoperability improve health insurance operations?

Data interoperability enables health insurers to break down data barriers and connect internal systems with those from external partners. Claims processing can be instantaneous, increasing accuracy while reducing administrative costs and ensuring regulatory compliance.

Interoperability automates workflows and grants real-time access to data, resulting in operational efficiency and smart decision-making that lead to member satisfaction and effective risk management.

- What are the benefits of integrating legacy systems with interoperable data solutions?

When legacy systems are connected through interoperability, insurers unlock immediate, measurable operational gains. Some of them include:

- Preserved technology investments without costly system overhauls.

- Seamless data flow between legacy and modern platforms.

- Faster claims and eligibility processing through connected workflows.

- Reduced operational costs by minimizing manual interventions.

- Improved operational efficiency with real-time data availability.

- Greater scalability to support future growth and new capabilities.

- How do AI and modern technology support data interoperability in health insurance?

AI and modern technology strengthen data interoperability by ensuring insurance data can be exchanged, understood, and used consistently across systems. They remove the friction that typically breaks data flow between platforms.

- AI standardizes data formats so information remains usable across systems.

- Real-time integration layers keep data continuously synchronized.

- Automated validation and mapping prevent data loss and mismatches.

For health insurers, this means interoperability that works reliably at scale—without repetitive fixes or delays.