The U.S. healthcare insurance landscape is evolving at an unprecedented pace. Yet many insurers find themselves unequipped to keep up. Without the right tools and technology, they are caught in a persistent cycle of fragmentation and inefficiency.

Core business functions like claims processing, plan administration, fraud detection, and consumer service—continue to operate in isolated systems. This siloed infrastructure delays access to critical data, obstructs comprehensive visibility, and makes real-time decision-making nearly impossible. As a result, fraud often goes undetected until after the damage is done, operational costs rise unnecessarily, and enterprises struggle to maintain regulatory compliance.

The root of this challenge lies in the inability to integrate systems and analyze data in real time. In today’s high-stakes environment, that gap is more than a technical inconvenience—it’s a strategic risk.

This is where modern predictive analytics in healthcare changes the game. By consolidating and analyzing enterprise data in real time, predictive tools:

- Flag fraud as it happens.

- Deliver early warning signals for emerging risks.

- Enable seamless, automated claims processing.

- Bring accuracy and foresight into every decision.

With an integrated, real-time view of all enterprise data, insurers can shift from reactive problem-solving to proactive foresight – lowering costs, increasing efficiency, improving compliance, and enhancing consumer experiences.

This blog explores the top challenges predictive analytics solves for healthcare insurers and how data forecasting is reshaping risk and cost management.

What Makes Predictive Analytics in Healthcare a Game-Changer?

Predictive analytics empowers healthcare insurers to anticipate challenges before they arise. Acting as an intelligent assistant, it leverages historical claims data and current trends to identify early warning signs—whether it’s rising costs, potential fraud, or emerging risks—and enables timely intervention to prevent escalation.

Beyond risk detection, predictive analytics accelerates claims processing, enhances fraud prevention, and helps maintain cost control. By shifting from reactive decision-making to proactive forecasting, insurers can stay ahead in a rapidly evolving industry—delivering better outcomes and operational efficiency.

Data : The Foundation Of Effective Predictive Models

Behind every accurate prediction lies comprehensive, high-quality data. The effectiveness of any predictive analytics initiative depends on the depth, diversity, and reliability of the data used.

For healthcare insurers, this means integrating information from multiple sources to form a complete, actionable picture:

- Claims Data: Reveals treatment patterns, utilization trends, and billing anomalies.

- Member Demographics And Medical History: Supports accurate risk assessment and personalized care strategies.

- Provider Performance And Network Data: Evaluates service quality and operational efficiency across the network.

- External Factors: Includes regulatory changes, economic conditions, and market dynamics that influence healthcare delivery and costs.

When these data sources are unified and analyzed, they unlock meaningful insights that support smarter decisions and drive measurable impact.

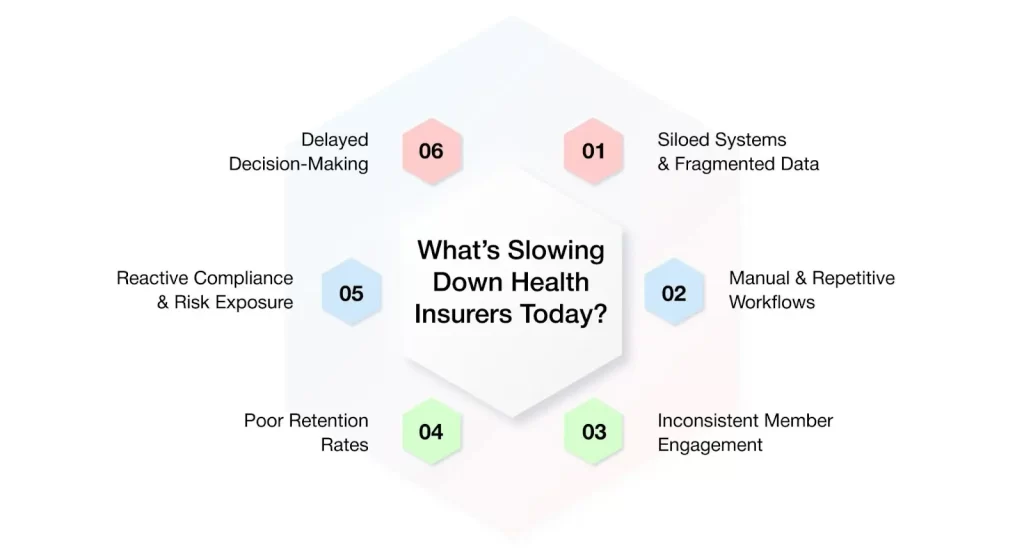

What Hidden Bottlenecks Are Hurting Health Insurers Today?

Healthcare insurers today face mounting challenges—rising operational costs, increasing business complexity, and growing member expectations. It’s not a lack of effort from teams that’s holding enterprises back; it’s outdated systems and manual processes that limit efficiency and responsiveness.

The good news is that predictive analytics is reshaping the healthcare insurance landscape. By leveraging data-driven insights, insurers can streamline operations, reduce inefficiencies, and shift their focus on what truly matters—delivering better care, enhancing service quality, and staying competitive in a rapidly evolving market.

- Siloed Systems And Fragmented Data

One of the most persistent challenges faced by healthcare insurers is the reliance on disconnected systems across the enterprise. Functions such as claims, underwriting, customer service, and compliance often operate in isolation, with limited integration or data sharing. As a result, critical information becomes trapped in silos.

For example, a claims team may not have access to a member’s complete health history or relevant provider information, leading to time-consuming manual searches, greater potential for errors, and delayed decision-making.

Predictive analytics in healthcare helps overcome this challenge by integrating data across systems and touch-points. By providing a unified view of the member, provider, and claim data, it enables teams to access actionable insights more quickly—driving faster resolutions, more accurate decisions, and reduced administrative burden.

- Manual And Repetitive Workflows

Many insurers still rely heavily on manual workflows, particularly in high-volume processes like claims handling. These repetitive tasks drain time and resources—and significantly increase the risk of human error.

Consider a claims processor handling hundreds of submissions a day. Without intelligent automation, it’s easy to overlook red flags like duplicate charges, unusual billing patterns, or policy misapplications.

Predictive analytics in healthcare using AI addresses this challenge by continuously analyzing historical and real-time data to surface irregularities and potential problems early. This enables faster, more accurate decisions, reduces errors, and allows teams to redirect their efforts toward tasks that add greater strategic value.

- Inconsistent Member Engagement And Poor Retention Rates

Today’s members expect more than just plan coverage—they want personalized, timely, and relevant interactions that reflect their unique health needs. When communication feels generic or disconnected, members are less likely to engage with their plans or take advantage of the support available to them.

Consider a member managing a chronic health condition. Without proactive, personalized outreach, they may miss critical information or resources that could improve their outcomes.

Predictive analytics healthcare companies help solve this challenge by enabling insurers to better understand individual member behaviors, preferences, and health needs. By uncovering key insights and anticipating future needs, it allows insurers to deliver the right message at the right moment—whether it’s promoting preventive care, offering tailored health guidance, or providing ongoing support for complex conditions. This level of personalization builds trust, increases engagement, and strengthens long-term member loyalty.

- Reactive Compliance and Risk Exposure

Regulatory compliance is a non-negotiable part of healthcare insurance—but for many insurers, staying compliant remains a reactive, labor-intensive process. Teams often rely on spreadsheets, manual checklists, and siloed documentation to manage everything from privacy requirements to claims accuracy. This fragmented approach not only drains time and resources but also increases the risk of non-compliance, penalties, and reputational damage.

Predictive analytics transforms compliance from a reactive task into a proactive strategy. By providing real-time visibility into data and processes, it enables insurers to detect anomalies, monitor regulatory risks, and flag potential issues before they escalate. This improves audit readiness, strengthens internal controls, and ensures compliance efforts are embedded into daily operations—not managed in a last-minute rush.

- Delayed Decision-Making

Many healthcare insurers still rely on retrospective reports to guide decision-making. However, by the time trends—like rising claims costs or shifting market conditions—become evident, the opportunity for impactful action may have already passed.

Predictive analytics in healthcare changes that. By identifying emerging patterns and potential risks early, it empowers insurers to make proactive, data-driven decisions. From adjusting plan designs and pricing to anticipating care needs or launching targeted wellness initiatives, predictive insights support more agile strategies—driving better financial performance and stronger member satisfaction.

Reshaping Healthcare With Predictive Analytics and AI

AI-powered predictive analytics in healthcare is evolving rapidly—delivering greater speed, accuracy, and intelligence than ever before. It’s no longer limited to analyzing historical trends. Today, it enables insurers to gain real-time insights and anticipate what’s coming next.

By leveraging machine learning and live data streams, insurers can accelerate decision-making, automate routine processes, and deliver more personalized experiences to their members.

But what does that actually look like in day-to-day operations? AI-powered predictive analytics is helping healthcare insurers break through big challenges and work smarter in several ways: bridging data silos to deliver a unified member view, automating routine workflows, driving member retention & personalized engagement, optimizing renewals with data-driven recommendations, enabling risk stratification & member profiling, and ensuring regulatory & compliance readiness. Let’s explore each of these in greater depth.

- Smarter Underwriting & Product Pricing

Underwriting is no longer a game of guesswork. With predictive analytics, insurers can tap into real-world data—such as claims history, lifestyle patterns, and care utilization—to gain a more accurate and clear understanding of individual health risks.

Here’s how predictive analytics transforms underwriting and pricing :

- More accurate risk scoring based on actual behaviors and benefit usage

- Personalized pricing that reflects individual risk, not just generalized averages

- Improved forecasting of reserves and potential losses, strengthening financial planning

This results in smarter, more equitable pricing models that are grounded in real behavior—leading to healthier margins, fairer premiums, and more sustainable healthcare insurance products.

- Proactive Claims Management

Claims management doesn’t have to be slow or reactive. Predictive analytics empowers insurers to get ahead of issues before they escalate—streamlining processes, reducing friction, and improving outcomes for both the insurer and the member.

Here’s how predictive analytics revamps claims management:

- Early identification of claims likely to be denied or appealed, enabling preemptive resolution

- Fraud detection by spotting suspicious patterns and red flags before they become serious issues

- Process optimization by identifying bottlenecks and inefficiencies to speed up claims handling

The result is faster approvals, fewer errors, and a smoother, more transparent experience for all healthcare insurance stakeholders.

- Personalized Member Engagement

Today’s members expect more than just coverage—they want proactive, personalized support. Predictive analytics enables insurers to meet this expectation by using data-driven insights to guide meaningful interactions and improve health outcomes.

Here’s how predictive analytics elevates member engagement :

- Proactive nudges that encourage continued participation in wellness and preventive care programs

- Timely reminders for screenings, checkups, or prescription refills—delivered through preferred communication channels

- Targeted interventions by identifying high-risk members and connecting them to care teams before issues escalate

The result is outreach that feels personal, not generic—leading to stronger member relationships, higher satisfaction, and improved retention.

- Intelligent Risk Stratification

Not all health risks are obvious at first glance. Predictive analytics gives insurers a comprehensive view of member health by analyzing data from care visits, prescriptions, and past claims—helping identify those at risk before costly events occur.

Here’s how predictive analytics enhances risk stratification :

- Real-time risk scoring based on integrated clinical, behavioral, and utilization data

- Proactive intervention by care teams to manage conditions before they escalate

- Avoidance of high-cost events like emergency room visits and hospital admissions

This shift from reactive care to proactive prevention leads to better health outcomes for members—and significantly reduced costs for insurers. It’s not just about treating illness—it’s about anticipating risks and staying one step ahead to improve long-term health outcomes.

- Optimized Utilization & Network Performance

Inefficient use of provider services can drive up costs and reduce the quality of care. Predictive analytics empowers insurers to assess how their networks are performing and make informed decisions to optimize utilization across the board.

Here’s how predictive analytics improves utilization and network management :

- Identify under- or over-utilized providers to balance care delivery and reduce waste

- Spot inefficiencies in service usage to streamline operations and improve member access

- Detect coverage gaps across geographic regions or specialties to enhance network adequacy

The result is a more efficient, better-aligned provider network—ensuring members receive the right care, in the right place, at the right time, while keeping costs under control.

- Streamlined Compliance Management

Healthcare regulations are complex, constantly evolving, and non-negotiable. Staying compliant without slowing down operations is a major challenge—but predictive analytics can help insurers stay ahead of the curve.

Here’s how predictive analytics strengthens regulatory and compliance readiness :

- Automated rule enforcement to ensure adherence to CMS, HIPAA, and other regulatory standards

- Real-time error detection that flags missing or incorrect data before claims are submitted

- Comprehensive audit trails that support internal reviews and external audits with ease

The result is a more resilient and responsive compliance process reducing risk, minimizing manual effort, and ensuring smoother day-to-day operations.

AVIZVA: The AI Engine Behind Smarter Health Insurance

AVIZVA is a healthcare technology company that empowers payers, TPAs, and PBMs to enhance care delivery through a comprehensive suite of engineering products and services. With over 14 years of experience in leveraging technology to simplify, optimize, and accelerate care, AVIZVA has become a trusted technology partner to a wide range of healthcare enterprises.

AVIZVA’s healthcare offerings are grouped into two key categories : Engineering Services and its Proprietary Product Suite, VIZCare. Each product within VIZCare is purpose-built to solve high-impact challenges across the healthcare landscape—from operational efficiency and member engagement to compliance and data-driven decision-making.

A flagship product in this suite is VIZCare AI – a private, enterprise-ready AI platform built to meet the unique needs of healthcare enterprises. By offering a robust suite of prebuilt conversational AI applications, VIZCare AI empowers every consumer and stakeholder within the health plan ecosystem—including members, providers, employers, brokers, and even admin and operations teams—to engage effortlessly and efficiently.

Designed to deliver personalized, context-aware interactions, these AI-driven solutions streamline inquiries, automate routine workflows, and provide real-time support—reducing operational burden while boosting satisfaction and productivity.

Here’s how VIZCare AI turns predictive analytics into real-world impact:

- Real-Time Assistance For Customer Service Agents

VIZCare AI equips customer service agents with real-time, AI-driven guidance during live calls and chats. Instead of navigating multiple systems or relying on guesswork, agents receive intelligent prompts and context-aware suggestions right when they need them. This results in faster response times, more accurate resolutions, and a significantly improved experience for members—driving both satisfaction and operational efficiency.

- Predictive Member Engagement

VIZCare AI’s predictive analytics anticipate member needs before they arise—enabling timely, personalized engagement that builds trust and loyalty. By analyzing behavioral patterns, preferences, and historical data, VIZCare AI identifies the optimal moments to deliver relevant reminders, support, or updates.

The result is communication that feels personal rather than generic—strengthening member relationships, improving retention, and driving better health outcomes.

- Streamlined Renewal Processes

VIZCare AI transforms the renewal process by automating key workflows and delivering intelligent, personalized recommendations. By analyzing member profiles, preferences, and usage patterns, the platform identifies the most relevant plans for each individual—eliminating guesswork and reducing administrative burden. This approach minimizes delays and errors, accelerates decision-making, and makes renewals smoother and more member-centric—ultimately boosting retention and overall satisfaction.

- Integrated Enterprise Data

VIZCare AI eliminates data silos by unifying information across the enterprise into a single, cohesive platform. From claims and onboarding to customer support and compliance, every function is seamlessly connected. With integrated systems and intelligent automation, teams can work more efficiently, reduce manual effort, and make faster, data-driven decisions. The result is more streamlined operations that saves time, enhances productivity, and drives better business outcomes.

- Embedded Regulatory Compliance

VIZCare AI integrates compliance safeguards directly into everyday workflows, enabling enterprises to stay ahead of evolving regulatory requirements. The platform delivers real-time alerts, automated audits, and intelligent checks that help identify and resolve potential issues early. This built-in approach ensures continuous compliance, minimizes risk, and keeps enterprises secure and audit-ready at all times.

Conclusion

Disjointed data systems continue to be a major challenge for healthcare insurers. When information related to claims, member history, fraud alerts, and compliance resides in isolated platforms, it’s nearly impossible to gain a clear, real-time view of enterprise operations. As a result, decisions are delayed, risks go undetected, and resources are strained.

Predictive analytics in healthcare changes that paradigm. By centralizing and analyzing data through AI, insurers can uncover insights faster, act on risks earlier, and engage members more effectively. The result is not just improved performance—but a more agile, future-ready enterprise.

That’s exactly what AVIZVA’s VIZCare AI delivers.

This intelligent platform unifies your data, automates routine tasks, and gives your teams real-time insights they can act on—immediately. From accelerating claims and streamlining renewals to supporting compliance and enhancing member engagement, VIZCare AI helps you reduce costs while improving outcomes. Wondering how it fits into your workflows?

FAQs

1. How can predictive analytics improve decision-making and operational efficiency in healthcare?

Predictive analytics empowers healthcare organizations to move from reactive to proactive decision-making. By analyzing historical and real-time data, it helps:

- Identify risks early – Flagging patients likely to develop chronic conditions or face readmissions.

- Optimize resources – Forecasting demand for staff, beds, and equipment to reduce bottlenecks.

- Prevent fraud and errors – Detecting unusual patterns in claims for faster resolution.

- Support clinical decisions – Offering data-driven treatment recommendations for better outcomes.

- Boost engagement – Predicting member behavior to improve adherence and satisfaction.

The result is smarter decisions, reduced costs, and streamlined operations, ultimately enabling healthcare enterprises to deliver more efficient, effective, and patient-centric care.

2. What challenges do healthcare organizations face when implementing predictive analytics into their operations?

While predictive analytics holds immense promise, healthcare organizations often face hurdles such as:

- Data silos & integration issues – Fragmented systems make it difficult to unify and analyze data.

- Data quality concerns – Inaccurate, incomplete, or inconsistent data can skew predictions.

- Privacy & compliance – Strict regulations like HIPAA require careful governance of sensitive data.

- Cultural resistance – Clinicians and staff may hesitate to trust AI-driven insights over traditional methods.

- Cost & scalability – Advanced infrastructure, skilled talent, and ongoing model maintenance demand significant investment.

Overcoming these challenges requires a thoughtful approach—combining strong data governance, interoperable systems, and a culture that embraces AI-driven decision-making.

3. How does predictive analytics help healthcare organizations identify trends and forecast patient needs?

Predictive analytics helps healthcare organizations spot patterns in historical and real-time data, enabling them to forecast patient needs, anticipate demand, personalize care, and allocate resources more efficiently.

4. How can predictive analytics reduce healthcare costs while improving patient outcomes?

Predictive analytics reduces costs by preventing avoidable hospitalizations, optimizing resource utilization, and minimizing inefficiencies, while simultaneously improving outcomes through early risk detection, personalized treatment plans, and proactive care management.

5. What are the limitations of predictive analytics in healthcare, and how can they be mitigated?

Predictive analytics is powerful but not foolproof. Challenges such as data quality issues, privacy concerns, algorithm bias, and integration complexities with existing systems often arise. These can be addressed through strong data governance, use of diverse and representative datasets, strict compliance with regulations like HIPAA, transparent AI practices, and phased integration supported by clinician training and feedback.