In the modern healthcare ecosystem, data serves as a strategic driver, enabling operational excellence across the entire spectrum of business functions, from sales and onboarding to claims processing, while ensuring adherence to critical compliance obligations.

Yet, for many healthcare insurance enterprises, data remains fragmented, inconsistent, and confined within siloed systems. This not only hampers operational efficiency but also presents significant challenges in maintaining compliance and meeting evolving regulatory requirements.

Recent industry insights reveal that 76% of insurers who invest in robust data management practices report a measurable improvement in operational performance, reinforcing the vital role of intelligent data management in achieving business agility and regulatory readiness.

By embracing an automation-first approach, healthcare insurers can unlock the full value of their data and turn it into a sustainable competitive advantage. Powered by modern healthcare automation software, organizations can unify and streamline data workflows while embedding compliance into every process – delivering higher accuracy, stronger accountability, and enterprise-grade operational agility at scale.

This blog explores how next-generation healthcare automation solutions are transforming data management, driving operational efficiency, and ensuring regulatory compliance.

Key Highlights

- Challenges of managing complex and fragmented data in healthcare insurance.

- Role of healthcare automation in streamlining data management, elevating operational efficiency, and strengthening regulatory compliance.

- Key factors for choosing the right automation solution.

- Best practices to consider while implementing automation in the healthcare sector.

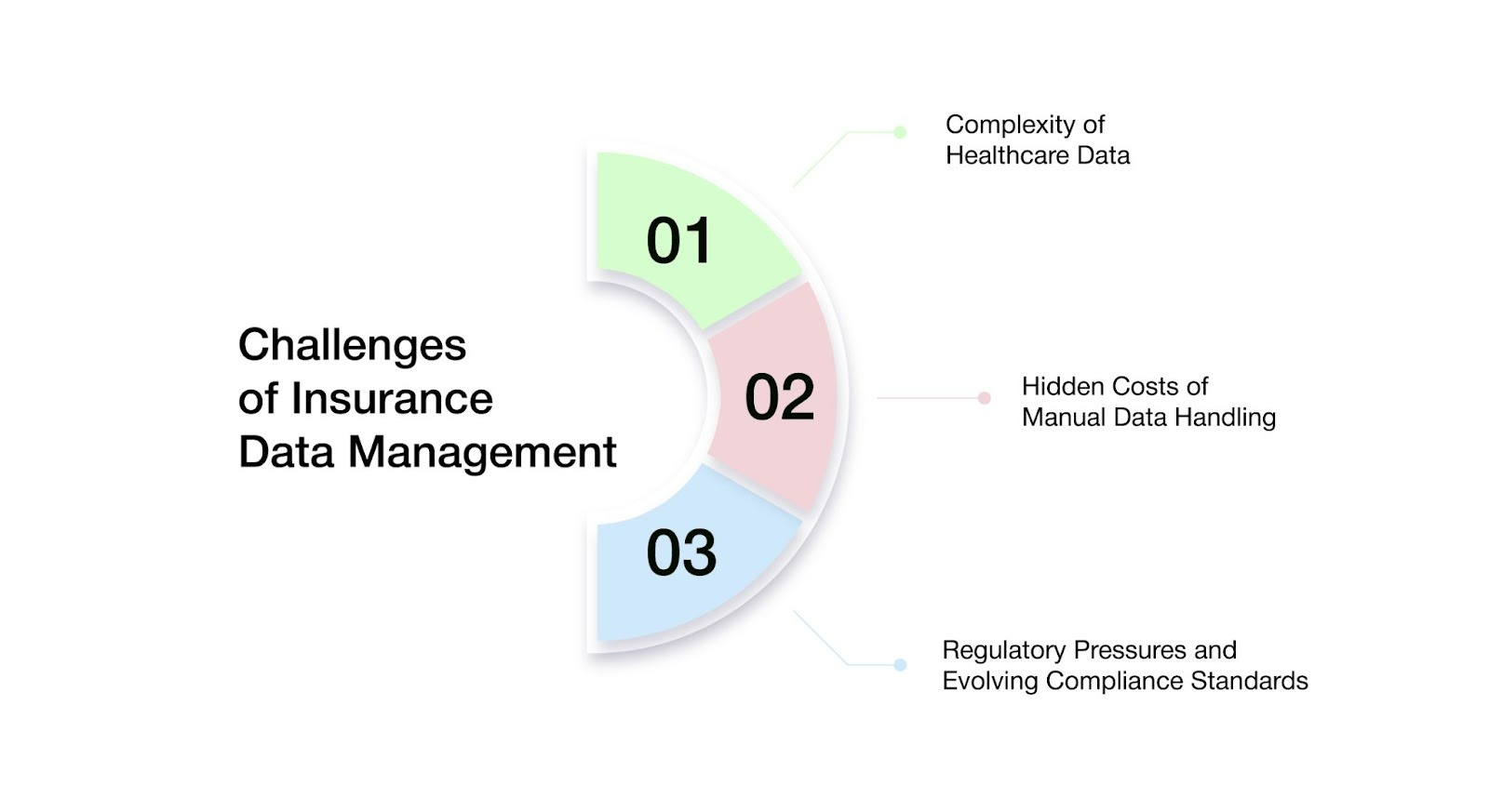

Challenges of Data Management in Healthcare Insurance

In an industry where accuracy, speed, and compliance are paramount, healthcare insurance enterprises navigate the complex challenge of managing an ever-growing volume of healthcare data flowing through a vast network of systems and stakeholders.

While this data has the potential to drive smarter operations and informed decision-making, outdated tools and manual processes often turn it into an obstacle rather than an asset.

Below are some of the key data management challenges faced by enterprises, and how automation in health insurance can help overcome them.

- Complexity of Healthcare Data

Healthcare insurance enterprises are responsible for managing a diverse range of data types, including claims, member eligibility records, provider contracts, billing information, authorizations, explanations of benefits (EOBs), and pharmacy benefit details.

These data sets originate from a wide array of sources such as hospitals, provider networks, laboratories, pharmacy benefit managers (PBMs), government agencies, and even the members themselves. However, each of these sources speaks a different ‘data language,’ adhering to its own formats, structures, and update cycles.

As a result, the enterprise is left with a fragmented data environment that is difficult to integrate into a single, accurate, and trusted source of truth.

Such fragmentation introduces a host of operational challenges—from delayed or inaccurately adjudicated claims, to provider payment backlogs, to members receiving outdated or inconsistent benefit information.

Moreover, it degrades the overall member experience and exposes insurers to increased risks of compliance breaches and costly financial penalties.

- The Hidden Costs of Manual Data Handling

Although the healthcare insurance industry has made significant strides in digital transformation, many insurers continue to rely on outdated workflows – utilizing spreadsheets, manual data entry, and siloed legacy systems to manage essential data.

Modernizing these legacy systems is often resource-intensive, and integrating new technologies can involve steep costs and complex challenges. Consequently, teams are forced to manually bridge the gap, transferring data between platforms, validating entries by hand, and patching broken workflows to keep operations running.

Manual data handling is not only inefficient but also introduces considerable risk. Human errors can result in incorrect claims, billing inconsistencies, and inaccurate member records. Such errors lead to processing delays that further hinder timely provider payments and customer service.

Moreover, compliance breaches due to incomplete or outdated information expose insurers to costly audits and penalties. Collectively, these operational challenges create ripple effects across the enterprise—escalating costs, undermining member trust, and impeding business growth.

- Evolving Regulatory Pressures & Compliance Standards

In the highly regulated healthcare insurance landscape, compliance is not optional—it is a fundamental imperative. Payers must adhere to stringent regulatory frameworks, including HIPAA, SOC 2, HITRUST, and various state-specific requirements. These regulations govern every aspect of member data management, from secure storage and controlled sharing to comprehensive reporting and thorough auditing.

Moreover, these regulations are constantly evolving, with new privacy laws, reporting standards, and audit protocols emerging regularly. Without real-time visibility and centralized control over enterprise data, maintaining compliance across fragmented, siloed systems becomes increasingly difficult—and potentially costly.

Non-compliance carries significant consequences, including legal disputes, prolonged audits, erosion of trust among members and partners, delays in achieving key accreditations, and damage to brand reputation and competitive standing.

The Role of Automated Healthcare Solutions in Data Management Platforms

Managing healthcare insurance data is increasingly complex, driven by fragmented systems, high transaction volumes, and stringent regulatory mandates. To navigate this landscape, insurers are accelerating adoption of advanced automated healthcare solutions that bring structure, accuracy, and intelligence to enterprise data operations.

Modern insurance automation platforms act as a unified data fabric, consolidating information across disparate systems and ensuring continuous validation, cleansing, and real-time synchronization. Built-in compliance frameworks proactively monitor data flows, flags exceptions, and maintain audit readiness minimizing manual intervention while strengthening governance. These platforms also deliver end-to-end traceability and regulatory-aligned reporting to keep pace with evolving compliance standards.

By operationalizing automation-driven data management, payers can significantly reduce administrative overhead, elevate data integrity, and respond faster to business and regulatory changes while sustaining compliance at scale in an increasingly dynamic healthcare ecosystem.

- Streamlining Data Collection, Validation And Integration

Effective healthcare insurance data management goes far beyond basic storage. It demands real-time data ingestion, intelligent validation, and seamless synchronization across a highly distributed ecosystem of systems and partners. This is where automation in health insurance becomes a transformative layer. Let’s take a quick look at how this works at each stage:

- Real-Time Data Collection from Disparate Systems

Healthcare insurance enterprises manage vast volumes of data originating from a wide range of internal and external systems – including provider portals, hospital systems, government databases, pharmacy networks, EDI feeds, mobile applications, and wearable devices.

With each system using different formats, update frequencies, and data standards, collecting and standardizing this fragmented data into a consistent and usable form poses a significant operational challenge. Insurance automation helps enterprises overcome this complexity by seamlessly integrating with diverse data sources, standardizing formats in real time, and channeling information into a unified, accessible data pipeline.

As a result, insurers can consistently operate with clean, current, and consistent data – accelerating workflows, reducing integration overhead, and enabling more informed, confident decision-making across the enterprise.

- Intelligent Data Validation for Compliance and Accuracy

As healthcare insurance enterprises consolidate increasing volumes of data from disparate sources, they must overcome the critical challenge of ensuring data accuracy and regulatory compliance.

Automation addresses this challenge by systematically validating incoming data against established business rules, regulatory requirements, and contractual obligations.

This intelligent validation significantly reduces errors—such as duplicate claims, incomplete member information, or inaccurate coding—that can otherwise cause processing delays and elevate compliance risks.

By embedding these validations directly into automated workflows, enterprises can accelerate claim processing with greater accuracy, while simultaneously minimizing operational risks and safeguarding member trust.

- Seamless Data Integration for Strategic Insights

Effective decision-making in healthcare insurance relies on a unified, comprehensive view of data dispersed across multiple systems—including claims processing, customer relationship management, billing, and analytics.

Automation enables seamless data integration by consolidating validated information from different sources into a centralized repository. This integrated data environment eliminates inconsistencies and fragmentation, providing insurers with real-time, accurate insights that enable more informed and timely decisions.

Ultimately, such a cohesive data infrastructure enhances operational efficiency, strengthens compliance, and drives innovation in healthcare insurance service delivery.

- Elevating Operational Efficiency

For healthcare insurers, managing high volumes of complex, regulated data across fragmented systems often results in operational bottlenecks and avoidable delays. Automation eliminates these friction points by standardizing how data is validated, updated, and propagated across systems, significantly reducing dependency on repetitive follow-ups and corrective actions.

This clearly underscores the benefits of automation in healthcare, faster processing cycles, improved data consistency, and more stable, predictable operations that scale with business growth rather than headcount.

Here are key ways these platforms enhance operational efficiency across healthcare insurance enterprises :

- Accelerated Claims Processing

Claims processing is often slowed by manual data entry, inconsistent information, and repetitive verification, leading to delays and increased costs. Automation tackles these issues by standardizing and validating data at the point of entry, minimizing manual intervention, and eliminating redundant checks. This streamlines workflows, speeds up claim adjudication, and improves cash flow.

- Real-Time Eligibility Verification

Verifying member eligibility through manual processes can be slow and prone to errors, causing service delays and administrative bottlenecks. Automated platforms instantly cross-reference data across multiple sources, providing accurate and up-to-date eligibility information in real time.

This accelerates verification workflows, reduces errors, and ensures members receive timely access to benefits, enhancing operational efficiency and customer satisfaction.

- Improved Provider Network Management

Managing provider contracts, credentials, and performance data across different systems can cause delays and errors. Automation brings all provider information into one place, making it easier to update records, renew contracts, and track performance quickly.

This helps ensure a reliable provider network, reduces paperwork, and strengthens relationships with providers.

- Enhanced Member Engagement

Clear and timely communication is crucial to keeping members satisfied. Automation brings together member data from different sources to send accurate, personalized messages about claims, benefits, and plan updates quickly. This improves the member experience and lowers the number of support queries.

- Strengthening Regulatory Compliance

In the face of evolving regulatory demands, healthcare insurers must maintain rigorous compliance while keeping operations efficient. Automation delivers a smart, scalable approach to compliance management—simplifying complex manual processes into streamlined, accurate workflows.

Here’s how automation reinforces compliance in healthcare insurance:

- Embedded Regulatory Enforcement

Automation allows insurers to embed compliance rules—such as HIPAA, SOC 2, and HITRUST—directly into day-to-day operational workflows. From claims intake to reporting, every step is automatically validated against regulatory standards.

This reduces manual checks, minimizes errors, and gives compliance teams confidence that all processes meet industry requirements.

- Real-Time Monitoring And Notification

Automated platforms continuously monitor critical data flows and operations, sending real-time alerts to compliance and IT teams when anomalies, policy violations, or suspicious activities occur. This proactive approach lowers risk, speeds up issue resolution, and ensures the enterprise stays prepared for regulatory changes.

- Simplified Audit Trails and Documentation

Automation creates a secure, centralized log of all user actions, data changes, and workflow activities. These audit trails support regulatory compliance, enhance transparency, and make it easy to demonstrate accountability during audits—eliminating the need for time-consuming manual tracking.

- Predictive Risk Management

AI-driven automation continuously monitors historical and real-time data to identify early signs of compliance risk, like repeated claim denials, inconsistent entries, or unusual system access. This proactive approach allows insurers to address issues before they escalate, reducing risk and improving operational integrity.

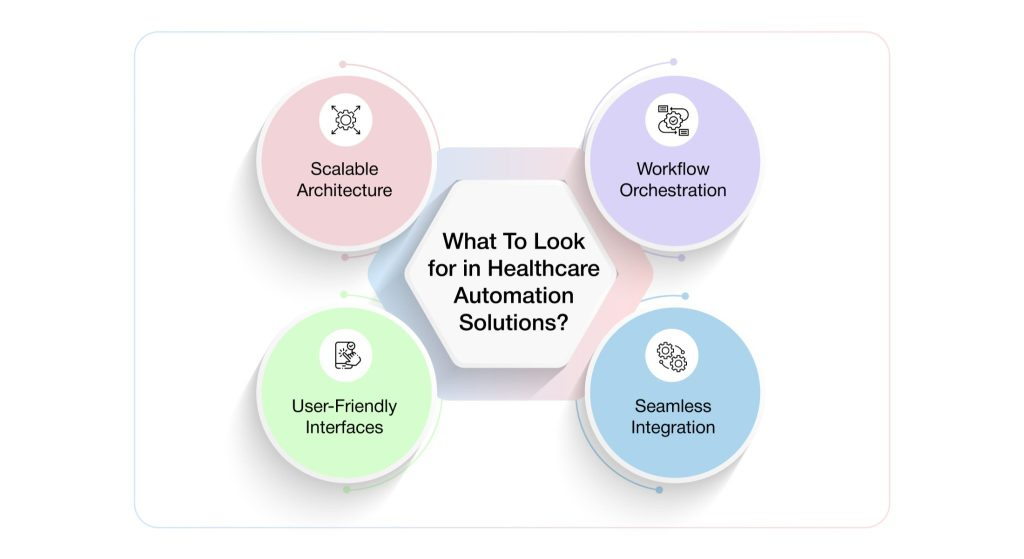

What To Look for in Healthcare Automation Solutions?

Choosing the right healthcare automation software goes beyond simply digitizing manual tasks. It’s about enabling smarter operations, improving regulatory responsiveness, and fostering seamless collaboration across teams.

For healthcare insurers, the ideal solution must be designed to handle the industry’s complexity, scale, and strict compliance demands.

Here are four key capabilities to look for :

- Workflow Orchestration Across Core Insurance Functions

Modern automation goes beyond basic task execution—it intelligently orchestrates workflows across key business functions such as claims, member services, provider relations, and compliance. By routing tasks based on predefined rules, urgency, or exceptions, it eliminates manual handoffs, reduces delays, and ensures accuracy at every step.

This leads to fewer errors, greater efficiency, and smoother operations across the enterprise.

- Seamless Integration with Legacy and Modern IT Systems

Most insurers operate within complex ecosystems that include legacy systems such as claim adjudication engines, member databases, and third-party portals—many of which can’t be easily replaced. An effective healthcare automation solution must integrate seamlessly with both modern and legacy platforms, without disrupting core operations.

This ensures continuous data flow, maintains data quality, and enables transformation without the need for costly system overhauls.

- User-Friendly Interfaces with Robust Training Support

Not every team in a healthcare insurance enterprise has technical expertise—which is why leading automation platforms prioritize simplicity and ease of use. With intuitive interfaces, user-friendly dashboards, and streamlined workflows, these platforms enable quick adoption across all business operations teams.

By offering seamless onboarding and robust training support, they help reduce adoption barriers, accelerate implementation, and empower users to work confidently—without ongoing reliance on IT support.

- Scalable Architecture That Evolves with Regulatory Demands

Healthcare insurance regulations are constantly evolving, and automation platforms must be flexible enough to keep up. They should be built on modular, scalable architectures that can easily adapt to future compliance requirements—such as CMS updates, HIPAA changes, and state-level mandates—without costly reconfigurations.

Scalable systems not only protect an enterprise’s investment but also reduce time-to-compliance and lower long-term operational costs.

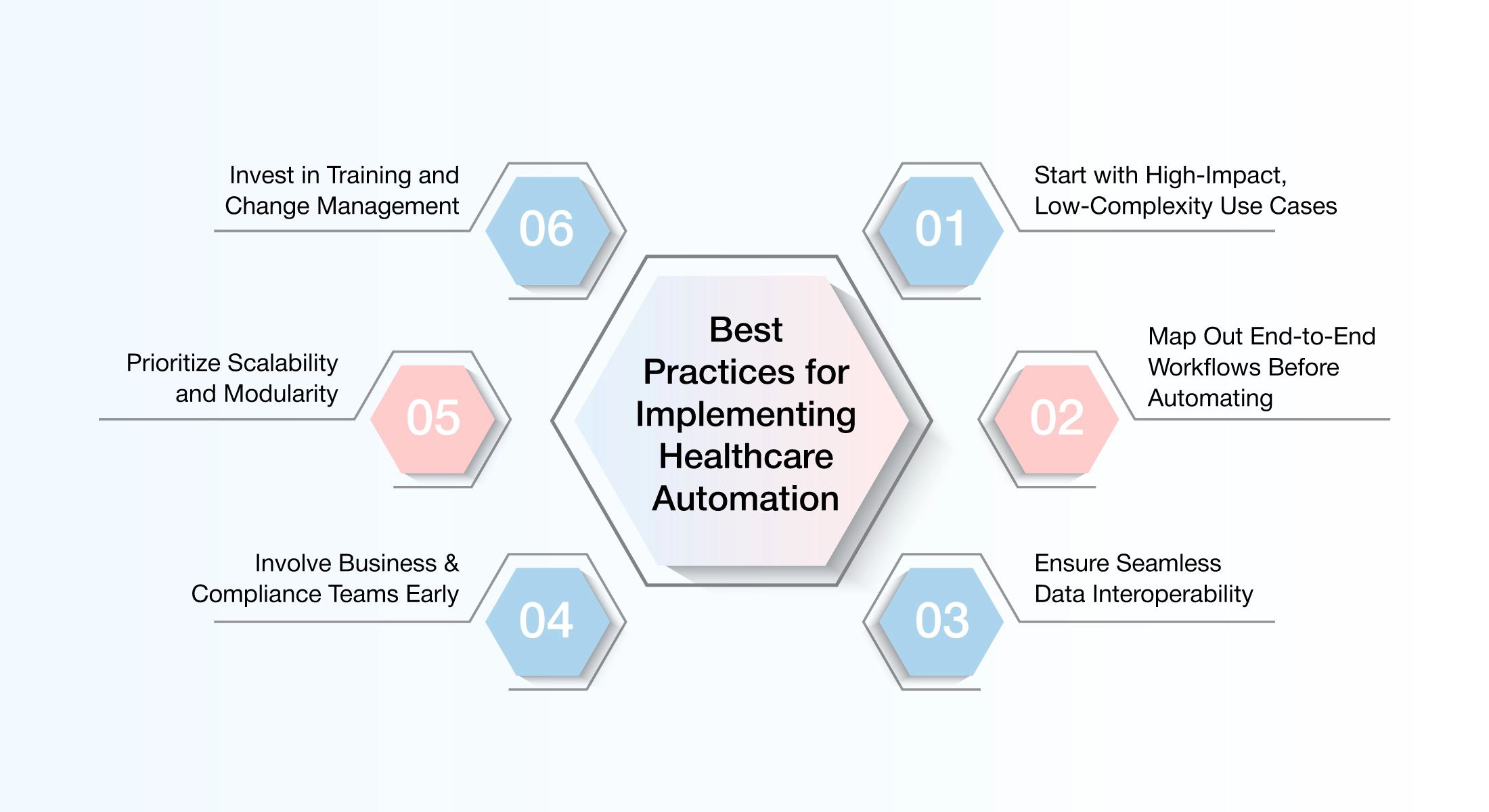

What Are The Best Practices for Implementing Healthcare Automation?

Implementing healthcare automation is not just about selecting the right technology—it’s about enabling lasting transformation across people, processes, and systems. To unlock the full benefits of automation in healthcare insurance, enterprises must adopt a thoughtful and strategic approach. Below are the best practices that ensure successful implementation:

Start with High-Impact, Low-Complexity Use Cases

Begin by automating repetitive, rule-based tasks that are simple to implement but deliver clear, measurable impact—such as eligibility verification, claims sorting, or member onboarding. These early quick wins help demonstrate value, build momentum, and establish a strong foundation for scaling automation across the enterprise.

Map Out End-to-End Workflows Before Automating

Avoid the mistake of automating inefficient processes. Before implementation, ensure to conduct a thorough review of current workflows and redesign them where needed. Gain a clear understanding of the complete process—including handoffs, data inputs, and exception handling—so automation is built to streamline operations, not simply replicate existing ones.

Ensure Seamless Data Interoperability

Ensuring seamless data interoperability is foundational to modern health insurance operations. By enabling systems across claims, enrollment, care management, and customer engagement to communicate in real time, insurers can eliminate data silos and operate from a single, reliable source of truth.

Seamless interoperability ensures that information flows accurately and securely across internal platforms and external partners, empowering teams to make faster decisions, reduce manual intervention, and deliver consistent experiences at every touchpoint. In an environment where speed, accuracy, and compliance are critical, seamless data interoperability transforms disconnected systems into a unified, intelligent ecosystem.

Involve Business & Compliance Teams Early

Successful automation requires cross-functional alignment right from the start. Engaging business users, compliance teams, and frontline staff early in the process ensures shared understanding of goals, workflows, and regulatory requirements such as HIPAA and HITRUST.

Their input helps shape effective, compliant solutions—reducing risk, avoiding rework, and supporting smoother implementation.

Prioritize Scalability and Modularity

Select solutions for automation that can scale with your evolving needs—whether it’s managing higher claim volumes, adapting to new regulatory requirements, or expanding across functions. A modular architecture enables incremental, strategic deployment, ensuring flexibility and long-term value.

Invest in Training and Change Management

Even highly advanced technology can fall short without user adoption. Equip teams with the right training, engage cross-functional champions, and foster a culture where automation is embraced as a tool for empowerment—not disruption. Ensuring users understand and trust the automation solution is key to long-term success.

By implementing the right automation strategy, insurance companies can significantly enhance operational efficiency while elevating the digital experience for their clients, without compromising on compliance. Automation enables insurers to embed regulatory controls directly into workflows, ensuring accuracy, consistency, and adherence across every stage of operations.

VIZCare Connect: Powering Compliance-Ready Data Automation in Healthcare

When automation fails, compliance is often the first casualty.

Despite accelerating automation initiatives, many healthcare organizations continue to struggle with fragmented data, inconsistent integrations, and the manual upkeep of critical reference information.

The consequences are significant. Automation efforts lose momentum, compliance risks escalate, and operational teams are forced to spend valuable time fixing data instead of extracting value from it.

True healthcare automation doesn’t begin with workflows, it begins with clean, standardized, and continuously governed data. Without a strong data foundation, even the most advanced automation strategies fall short.

This is where VIZCare Connect, built by AVIZVA, plays a foundational role. By enabling seamless data interoperability and compliance-ready automation at scale, VIZCare Connect empowers healthcare organizations to move beyond reactive fixes and toward resilient, intelligent operations.

VIZCare Connect: Automating Data Management with Compliance Built In

VIZCare Connect is an enterprise-grade healthcare data connectivity platform designed to eliminate manual data handling, standardize integrations, and keep systems continuously compliance-ready. At its core, it enables automation by solving two of the hardest problems in healthcare data management:

- Preloaded Healthcare Industry Data That Keeps Systems Compliance-Ready

Even the best automation fails if the underlying data is outdated or incomplete. VIZCare Connect eliminates this risk with preloaded and continuously updated healthcare industry datasets, removing the need for manual data maintenance.

What this means in practice:

- The up-to-date industry code sets (ICD-10, CPT, HCPCS, NDC, DRG, GPI) are centrally maintained, eliminating version mismatches across automated workflows.

- Provider and network reference data (NPIs, taxonomy, licensing, participation) are kept in sync so that no processing or reporting errors can sneak downstream.

- Built-in data governance that ensures every automated transaction runs against standardized, validated reference information.

Because this data is maintained and refreshed automatically, organizations gain:

- Higher data accuracy across all automated workflows

- Reduced operational risk from outdated reference information

- Stronger alignment with regulatory and reporting requirements

This turns compliance from a reactive activity into an always-on outcome of automation.

- A Robust Suite of Healthcare APIs That Standardize Automation

Automation breaks down when every system requires a custom integration. VIZCare Connect addresses this with a comprehensive suite of 300+ purpose-built healthcare APIs, designed specifically for real-world payer and enterprise use cases.

What this enables:

- Standardized access to member, provider, benefits, claims, enrollment, network, and financial data

- Built-in business logic and validation rules that reduce downstream errors

- Secure read, write, update, and search operations across systems

- Support for HL7 FHIR APIs to align with interoperability and regulatory requirements

By replacing one-off integrations with reusable APIs, it not only saves itself the hassle of manually sending data back and forth between different systems but also ensures that the data exchanged is consistent in terms of the rules, formats, and governance standards applied.

More Than APIs and Data: A Complete Automation Foundation

Some other features of the platform include:

- Beyond APIs and preloaded datasets, VIZCare Connect also delivers:

- End-to-end data orchestration across internal and external systems

- Real-time visibility into data movement, errors, and dependencies

- Detailed audit trails and transaction-level traceability

- Discrepancy detection and automated correction across systems

- Scalable architecture built to support millions of healthcare transactions

Together, these capabilities ensure that automation remains transparent, controlled, and trustworthy even as complexity grows.

Healthcare automation shouldn’t require trade-offs between speed, accuracy, and compliance. Built by AVIZVA’s experienced healthcare engineering teams and domain experts, VIZCare Connect reflects years of hands-on work solving real-world payer data challenges—from interoperability and regulatory alignment to large-scale transaction processing.

Explore VIZCare Connect to see how healthcare automation—backed by deep engineering expertise—can deliver cleaner data, stronger compliance, and operational confidence at scale.

Conclusion

In today’s rapidly evolving healthcare insurance landscape, enterprises face significant challenges from manual workflows, fragmented data systems, and ever-changing regulations—all of which hinder their ability to deliver efficient service and meet rising consumer expectations. To stay ahead, insurers must embrace automation in insurance as a strategic enabler of growth and compliance.

AVIZVA’s healthcare automation solutions, including VIZCare Connect, enable insurers to overcome these challenges by centralizing data, optimizing workflows, and ensuring continuous regulatory compliance – all within a unified, intelligent platform.

With over 14 years of experience, AVIZVA is a trusted partner in healthcare technology. Their solutions empower insurers to address complex business challenges head-on, boost operational efficiency, and enhance the experience for members, providers, and brokers alike.

Get in touch to discover how AVIZVA can help transform your business.

FAQs

- What are common automation solutions used by healthcare insurers?

Slow responses and unclear updates are the biggest frustrations for insurance consumers, automation directly addresses both. Some of the common automation solutions used by insurers include:

- AI-enabled prior authorization workflows to reduce delays and manual follow-ups.

- Intelligent workflow orchestration that shortens turnaround times across consumer requests.

- AI-assisted support tools that help service teams resolve inquiries more accurately.

- Real-time eligibility and coverage verification for faster, clearer consumer responses.

- Automated data synchronization to ensure consistent information across all service touchpoints.

Solutions like AVIZVA’s VIZCare suite support these automation initiatives by combining AI-driven workflows with interoperable data foundations, helping insurers modernize operations while improving consumer experience.

- How can health insurance companies use automation to improve efficiency?

The biggest efficiency challenge in health insurance isn’t workload, it’s how work flows across systems and teams. Automation addresses this by restructuring how information and actions move across the organization.

- Processes move smoothly from start to finish without any handoffs.

- Data stays consistent across systems, reducing errors and rework.

- Decisions happen faster with built-in, AI-supported guidance.

- Operations handle higher volumes without adding extra effort or teams.

- Teams focus only on exceptions instead of routine coordination.