In today’s high-velocity health insurance landscape, operational excellence is no longer defined by how efficiently an organization can process tasks; it’s defined by how intelligently it can anticipate what comes next. As data volumes surge and customer expectations shift toward instant, personalized service, AI in health insurance operations is emerging as the strategic accelerator reshaping how insurers sense, respond, and evolve.

Artificial intelligence is not just automating workflows; it’s transforming them into dynamic, insight-driven engines that fuel predictive decision-making across the enterprise. From forecasting claims volatility and identifying potential fraud, to proactively managing member inquiries and optimizing provider networks, AI is equipping insurers with a decision advantage once thought out of reach.

Are you ready to step into this future of healthcare insurance? With tightening margins and increasingly complex regulatory demands, can your enterprise afford to rely on outdated processes? If AI and predictive analytics aren’t yet part of your roadmap, you may be missing the next major leap in operational efficiency, cost optimization, and member satisfaction.

In this blog, we’ll explore how AI-powered operational efficiency for health insurers is redefining predictive decision-making, driving down operational costs, and enhancing the overall member experience. We’ll also highlight the transformative impact of predictive analytics and show how VIZCare AI empowers health insurers to stay ahead of the curve.

What’s Holding Back the U.S. Health Insurers?

Healthcare insurers in the US are under growing pressure to improve operational efficiency, reduce costs, and make faster, more accurate decisions. Yet many are held back by fragmented data, siloed systems, and labor-intensive manual workflows. Without predictive analytics integrated within their business operations, insurers struggle to identify emerging trends, mitigate risks proactively, and streamline processes effectively.

Studies show that nearly 70% of healthcare insurance enterprises report improved operational efficiency after implementing AI-based solutions.

As AI becomes an integral part of healthcare insurance operations, the industry is shifting toward more intelligent, proactive, and data-driven decision-making. Insurers that adopt AI-powered predictive analytics for insurance operations will distinguish themselves in fraud detection, risk management, and customer engagement.

The Power of Predictive Analytics in Healthcare Insurance

Predictive analytics for insurance operations is an advanced approach to data analysis that leverages historical data, algorithms, and machine learning to forecast future trends, behaviors, and risks. Unlike traditional analytics, which only explain what has happened, predictive analytics empowers insurers to anticipate what’s coming and take proactive, data-driven actions to mitigate risks, optimize operations, and improve outcomes.

In healthcare insurance, AI-powered predictive analytics can transform operations by flagging potentially fraudulent claims, identifying members at high risk, and streamlining the claims adjudication process. By automating many of the manual tasks that traditionally slow down claim processing, fraud detection, and risk assessment, an AI-driven system allows insurers to operate more efficiently, reduce errors, and deliver a better experience for members.

Business Impact:

For healthcare insurers, predictive analytics offers the opportunity to make smarter, data-driven decisions. By anticipating consumer needs, insurers can streamline processes, reduce manual workloads, and focus more resources on high-value tasks – such as building stronger member relationships and enhancing care delivery.

Ultimately, predictive analytics drives efficiency, improves accuracy, and enables a more proactive, member-centric approach to healthcare insurance operations.

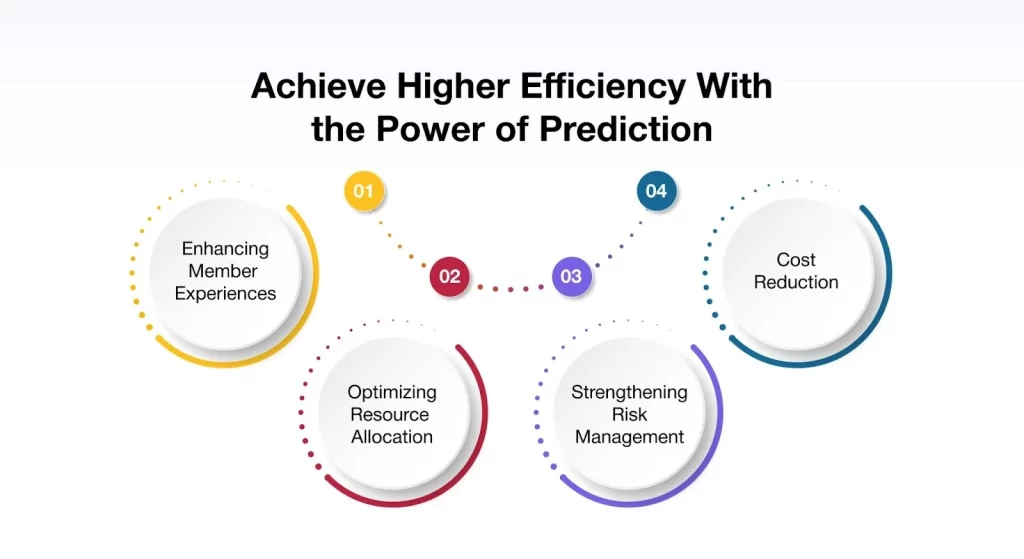

How Predictive Analytics Drives Operational Efficiency

Predictive analytics is more than just a tool – it’s a transformative force for operational efficiency in healthcare insurance. By leveraging data to forecast trends, behaviors, and risks, insurers can streamline processes, reduce manual workloads, and uncover hidden inefficiencies, ultimately enabling smarter, faster, and more proactive decision-making.

Elevating Member Experiences:

AI-powered predictive analytics can enhance the member experience by anticipating when members may need support with a claim or plan update. Insurers can proactively reach out through notifications, reminders, or guided assistance to ensure processes are smooth and timely. This proactive engagement builds trust, reduces frustration, and increases satisfaction – driving higher retention and stronger member relationships.

Optimizing Resource Allocation:

Predictive analytics enables insurers to manage resources more effectively. By forecasting claim volumes and identifying peak demand periods, insurers can adjust workforce and technology resources to prevent overburdening staff and ensure operational efficiency.

Strengthening Risk Management:

Predictive analytics also enhances risk management by analyzing historical claims data to identify members at higher risk for costly or complex future claims. With these insights, insurers can refine underwriting strategies, prioritize care management interventions, and allocate resources more strategically. This data-driven approach reduces uncertainty, improves decision quality, and helps control overall risk exposure.

Driving Cost Reduction:

Predictive analytics significantly contributes to lowering operational costs by streamlining claims processing, accelerating fraud detection, and optimizing resource allocation. By enabling faster, more accurate, and automated decision-making, insurers reduce manual effort, minimize errors, and improve throughput.

How VIZCare AI Unlocks The Full Potential Of Predictive Analytics For Healthcare Insurers

Healthcare insurers are rapidly adopting AI-powered predictive analytics to transform business operations and care delivery. These systems help insurers enhance operational efficiency, elevate consumer experiences, and enable smarter, data-driven decisions.

However, this paradigm shift brings significant challenges, particularly around data security, regulatory compliance, and ensuring that AI systems can accurately interpret complex, domain-specific healthcare data in a meaningful and reliable way.

This is where VIZCare AI comes in. Built by AVIZVA, VIZCare AI is a healthcare AI platform with ready-to-deploy agents and the freedom to build your own applications. The platform is purpose-built for healthcare enterprises, combining context-aware, terminology-savvy intelligence with pre-training on real-world payer operations.

Deeply embedded across key entities – members, providers, claims, benefits, prior authorizations, and clinical codes – it serves as an innovation turf, empowering teams to craft tailored AI-driven experiences while providing all the tools needed to accelerate enterprise-wide AI adoption.

The following are the key capabilities of the platform:

Infused With Deep Healthcare Insurance Intelligence: This healthcare AI is engineered for the entire healthcare ecosystem – members, providers, brokers, employers, and enterprise organizations like payers, TPAs, and PBMs. Infused with deep knowledge of claims, benefits, plans, and dependents, along with industry-leading business logic, it adapts seamlessly to every stakeholder’s needs and use cases.

From coverage navigation and care coordination to claims processing and benefits management, the AI delivers precise, context-aware support at every step. Its ability to manage both direct and layered relationships ensures that conversations are intelligent, seamless, and always relevant. With real-time guidance, proactive workflows, and built-in accuracy, healthcare organizations can unlock transformative, high-value experiences that drive satisfaction, trust, and measurable outcomes.

Private, Secure & Compliant By Design: This healthcare AI platform is engineered with privacy and security at its core, deployed securely within each your own environment to ensure complete data control and confidentiality. Built on enterprise-grade architecture, it enforces strict authorization and compliance with HIPAA, SOC 2, and GDPR standards, safeguarding sensitive health data without compromise.

Data never leaves the infrastructure, and the AI models operate in isolated environments with no external data training or sharing. By combining robust security measures with privacy-by-design principles, this solution guarantees that only authorized users access critical information – delivering trust and peace of mind across the healthcare ecosystem.

Agentic Architecture With Full Functional Coverage: At the core of VIZCare AI is the Presentation Context Protocol (PCP) – fully compliant with MCP standards and enhanced to deliver comprehensive coverage for both actions and conversations. By embedding context-awareness into every interaction, PCP enables the AI to not only understand complex requests but also take actions on behalf of the user, ensuring workflows move forward seamlessly.

Through its conversational intelligence, PCP makes every dialogue precise, detailed, and naturally aligned to healthcare use cases. Combined with the Agentic model, it powers orchestration across all VIZCare products, giving payer-facing workflows a new level of reliability and scale. With structured data ingestion, PCP minimizes hallucinations, keeping the model focused, actionable, and accurate.

Guaranteed Data Accuracy With Granular Access Control: VIZCare AI helps deliver the right data to the right person – every time. Powered by both RBAC and ABAC authorization models, the platform guarantees that every piece of information is accurate, compliant, and contextually correct.

No incorrect data. No unauthorized access. Access control is enforced at the record and attribute level, giving payers and healthcare organizations full precision over who sees what, when, and why.

With this dual-layer approach, the AI ensures trustworthy, role-based data delivery while maintaining flexibility for complex, real-world healthcare scenarios. By embedding fine-grained authorization and contextual intelligence directly into the AI’s core, AVIZVA ensures not only accuracy at scale but also total compliance, traceability, and audit readiness.

Selecting The Best AI-Powered Predictive Analytics Solution For Healthcare Insurers

When evaluating an AI-powered predictive analytics solution for healthcare insurance operations, insurers must choose platforms that deliver immediate value while supporting long-term scalability. Here are some key features to consider:

- Ease of Integration: The platform should seamlessly integrate with existing claims, CRM, and other core systems, ensuring minimal disruption to ongoing operations.

- Scalability: The platform must scale as data volumes and operational demands increase, supporting millions of members without compromising speed or performance.

- Security & Compliance: The platform should meet all industry regulations, including HIPAA, to ensure sensitive member data remains secure, protected, and fully compliant.

Why VIZCare AI Is the Ideal Choice?

As the healthcare insurance landscape continues to evolve, VIZCare AI is designed to grow and adapt with it. Its future-ready architecture effortlessly scales to support expanding data volumes, increasing transaction demands, and new regulatory requirements – ensuring consistent, dependable performance as the industry advances.

Security is embedded at every layer of the platform. With advanced encryption protocols and granular access controls, VIZCare AI provides true end-to-end protection across both operational and member-facing applications. This uncompromising focus on security enables insurers to confidently leverage AI throughout their health insurance operations while maintaining strict compliance.

The result is a trusted, resilient platform that empowers smarter, data-driven decision-making in health insurance with AI.

Conclusion

AI-driven predictive analytics open new possibilities for insurers to elevate operational efficiency, strengthen fraud detection, and enhance strategic decision-making. By embracing the power of AI in health insurance operations, enterprises can stay competitive, streamline costs, and deliver a more satisfying experience to their members. AI-driven predictive analytics is no longer an emerging trend – it is the cornerstone of the future of health insurance operations.

At AVIZVA, we’re proud to offer VIZCare AI, a cutting-edge platform that empowers health insurers to excel in a rapidly evolving, data-first environment.

Are you ready to take your operational capabilities to the next level? Contact us today to learn how VIZCare AI can transform your predictive decision-making and drive measurable improvements across your healthcare insurance operations.

FAQs

1. What is AI in health insurance operations, and how does it work?

Artificial intelligence in health insurance operations uses advanced models—such as machine learning models, NLP, predictive analytics models, and rules-based automation systems – to streamline complex workflows. These models automate tasks, analyse vast amounts of data, and predict future trends.

The approach is carried forward by using historical data, an algorithm, and real-time analytics, consequently aiding companies in making data-based decisions, achieving operational excellence, and offering personalized support to the members concerned. The said technology helps streamline processes, recognize risks, and customize workflows in the health insurance ecosystem.

2. How can predictive analytics improve operational efficiency in health insurance?

The goal of predictive analytics is to assist insurers in predicting events or trends, such as delays in claims or members that may be at risk. From past data, predictive models are analyzed with machine learning models to speed up claims, prevent fraud, and allocate resources appropriately. This consequently leads to quick decision-making, reduction in operational costs, improvement in claims workflow, service delivery, and, lastly, member satisfaction.

3. What are the benefits of using AI for decision-making in health insurance?

AI offers several advantages for decision-making in health insurance, including quicker and more accurate assessments, improved risk management, and enhanced operational efficiency. It analyzes colossal datasets in real-time, dissecting patterns iteratively, predicting trends that may manifest in the future, and taking timely, scientifically backed proactive measures. This might enable member engagement, cost reduction, and service delivery organization, all within the purview of compliance standards.

4. How does AI transform health insurance workflows and processes?

AI has transformed traditional healthcare insurance workflows by automating routine tasks, including claims adjudication, data entry, and handling member inquiries. It also fine-tunes more intricate processes, such as risk assessment and fraud detection, by predicting potential issues before they occur. Using AI across day-to-day operations helps insurers streamline processes, reduce human errors, and generally build better efficiency, all whilst freeing up staff to attend to higher-value tasks and driving member satisfaction at a lower cost.