| TL;DR 1.Business Imperative: Deliver member experiences that act on insight in real-time, not after the fact. 2.Problem: Member data is available, but intelligence fails to guide interactions when it matters most. 3.Solution: Apply healthcare data intelligence at the experience layer using VIZCare Xperience powered by VIZCare AI to predict intent and guide action. 4.Key Outcome: Proactive engagement, quicker resolution, increased retention, and reduced cost-to-serve. |

Healthcare organizations are no longer constrained by a lack of data. They are constrained by the ability to make that data meaningful, actionable, and experience-driven. As member expectations continue to rise, delivering truly member-first experiences now requires more than digital channels or incremental automation.

Health plans sit on vast volumes of member data spanning claims histories, digital interactions, service records, and engagement logs. Yet despite this abundance, many payer organizations still struggle to understand why members disengage, when dissatisfaction begins, or which early signals point to churn long before it becomes visible.

This visibility gap directly impacts the member experience. Today’s members expect :

- Personalized interactions rather than generic communications

- Immediate, accurate responses across both digital and assisted channels

- Consistency between what they see online and what service teams communicate

Meanwhile, subtle behavioral signals like declining engagement, repeated friction points, and shifting intent often go unnoticed until intervention is no longer effective.

When data intelligence is embedded into healthcare platforms, fragmented information from claims, eligibility, care management, and engagement systems is unified into a single, contextual understanding of the member. This intelligence enables organizations to shift from reactive service models to proactive, personalized engagement anticipating needs, simplifying journeys, and delivering clarity at every interaction.

In this new paradigm, member-first experiences are not built through isolated touchpoints. They are orchestrated through intelligent data foundations that power personalization, automation, interoperability, and trust—at enterprise scale.

The Data Problem Holding Insurers Back

For years, the healthcare industry has attributed engagement challenges to isolated systems. In reality, the deeper issue is a broken member journey, one shaped by fragmented data, missing context, and reactive decision-making. To understand what’s truly holding insurers back, it’s important to look beyond infrastructure and focus on experience continuity.

Disjointed Touchpoints Creating Experience Gaps

When data fails to move seamlessly across channels, members experience the consequences immediately. The absence of shared context results in:

- Inconsistent experiences across digital and assisted touchpoints

- Declining trust and lower member retention

- Operational inefficiencies driven by manual follow-ups and rework

Each disconnected interaction compounds friction, weakening the overall engagement experience.

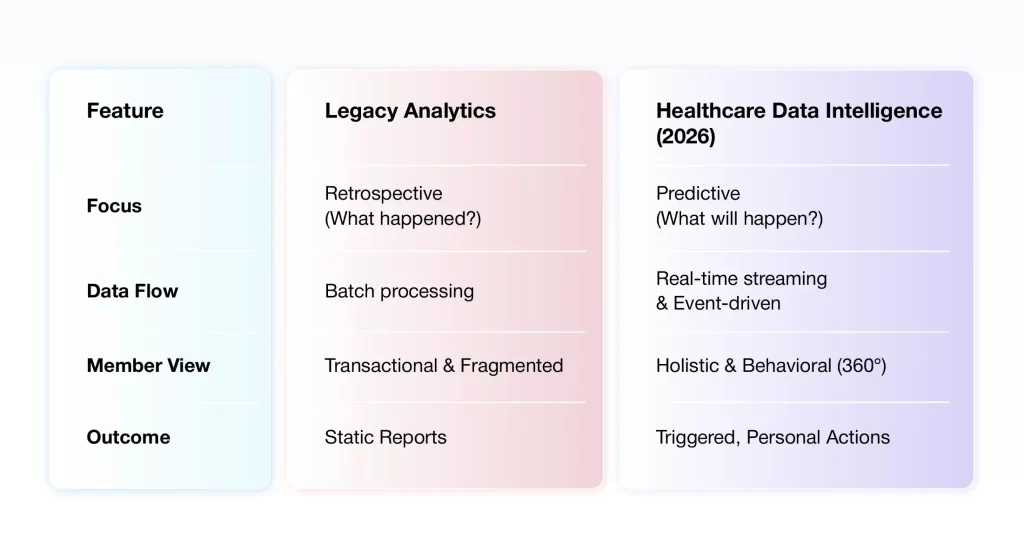

Static Analytics and Reactive Insights

Traditional BI and tools are inherently retrospective. They explain what has already happened such as churn trends or claims processing delays but offer limited visibility into what is likely to happen next.

Reactive organizations wait for members to raise complaints. Proactive organizations leverage real-time member behavior analytics to identify early signals of frustration. For example – repeated portal logins within a short timeframe to check claim status often indicate rising dissatisfaction. Detecting this pattern early allows teams to initiate proactive outreach resolving issues before frustration escalates into grievances or attrition,

Closing this gap requires a shift from static reporting to predictive, behavior-driven intelligence, restoring continuity across the member journey and enabling truly member-first engagement.

What Insurers Actually Need to Fix the Member Journey

Fixing the member journey requires far more than cleaner data or additional reports. It demands a fundamental shift from static, backward-looking analytics to real-time, intelligence-driven decision-making that spans the entire member lifecycle.

What’s needed is clear :

- Real-time intelligence across touchpoints

The ability to recognize issues as they emerge, while a member is still mid-journey, not after frustration has already escalated. This requires continuous data flow across channels and systems, rather than delayed, batch-based updates. - Context-aware visibility into member behavior

A unified, real-time view that connects claims activity, service interactions, digital behaviour and engagement signals ensuring every interaction reflects the member’s current situation, not just their last transaction.

- Predictive insights instead of retrospective reporting

Moving beyond dashboards that explain what already happened towards intelligent models that identify early indicators of churn, dissatisfaction, or confusion before members raise complaints or disengage.

- Proactive intervention at the right moment

The capability to trigger timely outreach, guidance, or support based on observed behavior patterns preventing friction rather than reacting to it after the fact. - Actionable intelligence embedded into workflows

Insights must translate directly into actions. Intelligence should be embedded within operational workflows, enabling teams to prioritize issues, personalise engagement, and resolve problems faster without manual data reconciliation or system hopping.

Together, these capabilities transform healthcare data from a passive record into an active intelligence layer. This intelligence proactively anticipates member needs, reduces friction, and improves satisfaction.

What True Healthcare Data Intelligence Looks Like in 2026

By 2026, leading healthcare insurers will no longer evaluate data success by the number of dashboards produced. The attention will move towards how well data is converted into quick comprehension, forecasting, and decision-making.

Unified Data Fabric for a 360° Member View

By 2026, the leaders in health insurance won’t just be “using AI”; they will be running on a unified data fabric. The system combines structured data, for instance, claims and eligibility, with unstructured inputs like service interactions, digital behavior, and communication history to form a 360-degree view of each member.

When these signals are connected in context, insurers gain:

- A complete view of each member’s journey.

- Visibility into behavior patterns across channels.

- Consistent intelligence shared across digital and human touchpoints.

- Insights from third-party sources, including partner organizations and regulators.

Predictive and Prescriptive Intelligence for Member Intent

In 2026, intelligence platforms won’t just describe member behavior, they will anticipate it.

Advanced AI models can identify patterns that indicate:

- Increased likelihood of churn or disengagement.

- Emerging claim-related confusion or dissatisfaction.

- Changes in benefit usage or engagement preferences.

This is where member behavior analytics becomes a strategic asset. For example, it can identify a “renewal risk” based on a combination of low portal engagement and recent service friction, then prescribe the exact intervention, perhaps a personalized benefit summary to keep them enrolled.

Continuous Learning and Real-Time Adaptation

True intelligence systems don’t remain static. They continuously learn from outcomes and refine recommendations based on what works and what doesn’t.

As member behavior evolves, data intelligence platforms adapt by:

- Updating models based on new interaction patterns.

- Adjusting recommendations in real-time.

- Improving accuracy through feedback loops across journeys.

This shift enables insurers to move from decoding member behaviour in health insurance after the fact to shaping experiences dynamically at scale and with confidence.

How Data Intelligence Transforms Member Experience

When you decode member behavior, you move from generic service to “Member-First” orchestration. Here is how it looks in practice:

Personalized Onboarding and Engagement Journeys

The first few interactions often define how members perceive a health plan. Yet onboarding experiences are still largely standardized, regardless of member needs or behavior.

With healthcare data intelligence platforms like VIZCare AI, insurers can:

- Customize onboarding to match members’ enrollment behaviors and preferences.

- Adjust messaging cadence and channels based on early engagement signals.

- Reveal relevant benefits, tools, and communications points by considering each member’s profile.

Instead of a standard welcome kit, members receive a tailored journey based on their predicted health needs and communication preferences.

Proactive Support for At-Risk Members

Member dissatisfaction rarely appears suddenly. It builds through signals such as repeated service inquiries, stalled claims, or declining digital engagement.

Using data intelligence software, insurers can:

- Flag members at risk of disengagement or churn.

- Trigger targeted outreach before issues escalate.

- Equip service teams with a full behavioral context during interactions.

An early sign of friction can be captured in the system. For instance, damage caused by a provider error has postponed a claim. Immediately after the first indication of trouble, an AI-powered agent can proactively contact the member for an update so the member does not need to make an outbound call.

Smarter Recommendations for Wellness Programs and Benefits Utilization

Most members are unaware of the full range of benefits available to them or when those benefits are most relevant.

Using member behavior analytics, insurers can recommend:

- Relevant wellness programs based on engagement and usage patterns.

- Benefit options aligned with life events or changing needs.

- Educational content that matches member intent, not generic segments.

Data-Informed Outreach That Improves Retention

Traditional outreach strategies rely on static segments and fixed schedules. Data intelligence replaces this with dynamic, behavior-led engagement.

Insurers can improve retention by:

- Timing outreach based on real-time engagement signals.

- Personalizing messages based on recent interactions and intent.

- Coordinating digital and assisted outreach for consistent experiences.

Over time, this approach leads to measurable gains in engagement, NPS, and long-term member loyalty.

Inside VIZCare Intelligence: Powering Data-Driven Member Experience

In a member-first world, data alone doesn’t create better experiences. The real challenge is translating insight into guidance that reaches members in real time.

VIZCare Xperience, powered by VIZCare AI, applies healthcare data intelligence exactly where it matters—across digital and assisted journeys so every interaction is informed by context, intent, and behavior.

Together, they form the experience-execution layer of healthcare data intelligence, where insights don’t remain analytical outputs but actively shape every member interaction.

- Intelligent, Context-Aware Assistance Powered by Data Intelligence

In a truly member-first model, AI does more than respond—it understands why a member is reaching out and what they need next.

VIZCare AI continuously analyzes claims activity, engagement patterns, service interactions, and historical context. These insights power MemberX to deliver:

- Conversational support across chat, voice, and text.

- Plain-language explanations of benefits, claims, and coverage.

- Proactive alerts and next-step guidance triggered by real behavior.

- Responses shaped by the member’s current journey, not static rules.

Every interaction reflects live member context, not generic workflows.

- Self-Service Guided by Predictive Intelligence

Healthcare data intelligence removes friction by anticipating intent before members get stuck. Within MemberX, VIZCare AI helps prioritize and surface what matters most, enabling members to:

- View coverage, benefits, and accumulators in a unified view.

- Track claims and authorizations in real time.

- Access documents with AI-generated summaries.

- Manage dependents and life events digitally.

- Use self-service seamlessly across web and mobile.

Instead of navigating menus, members are guided, reducing effort, confusion, and unnecessary calls.

- Seamless Experiences Across Channels, Powered by Shared Intelligence

Data intelligence only works when insight travels with the member. VIZCare AI ensures behavioral intelligence is shared across channels, allowing MemberX to deliver:

- Consistent experiences across web, mobile, chat, and messaging.

- Smooth transitions from AI-assisted support to live agents.

- Preserved context and conversation history across interactions.

- No repeated explanations or disconnected handoffs.

Members feel recognized at every touchpoint because the intelligence behind the experience is continuous.

- Behavior-Led Campaigns That Adapt in Real Time

Static segments can’t keep up with real member behavior. VIZCare AI enables dynamic, behavior-driven engagement, executed through MemberX. Insurers can:

- Trigger outreach based on real-time engagement and friction signals.

- Craft tailored messages around last actions or ongoing issues.

- Work out a reminder strategy via email, SMS, and in-app messages.

- Continuously refine outreach based on response and outcome data.

Campaigns evolve with member behavior improving relevance, engagement, and retention.

- Clear, Confident Decisions Through Intelligent Guidance

One of the strongest outcomes of healthcare data intelligence is decision clarity. By combining predictive insight with intuitive design, MemberX enables members to:

- Search providers by cost, location, and availability.

- View transparent cost estimates and coverage breakdowns.

- Schedule appointments directly within the portal.

- Access telehealth, medication, and pharmacy information on demand.

VIZCare AI helps translate complex data into clarity, so members move forward with confidence.

- Sustained Engagement Driven by Continuous Learning

A member-first experience only succeeds when it adapts over time. MemberX is designed for long-term adoption through:

- Clean, modern UX built for ease, not education.

- Guided onboarding and contextual assistance.

- Intelligent nudges informed by ongoing usage patterns.

- Integrated AI and human support to prevent dead ends.

As member behavior changes, VIZCare AI continuously learns refining guidance, timing, and interactions automatically.

Extending Member-First Intelligence Across the Ecosystem

Healthcare data intelligence doesn’t stop at the member portal. VIZCare Xperience, along with AI, extends the same intelligence foundation across:

- BrokerX for broker and agency engagement.

- EmployerX for enrollment, billing, and benefit visibility.

- ProviderX for eligibility, claims, and authorization workflows.

Every stakeholder operates on shared intelligence, ensuring consistency, clarity, and continuity across the ecosystem.

Bring truly member-first experiences to life with VIZCare Xperience, powered by VIZCare AI from AVIZVA. Request a demo and see intelligence turn into experience.

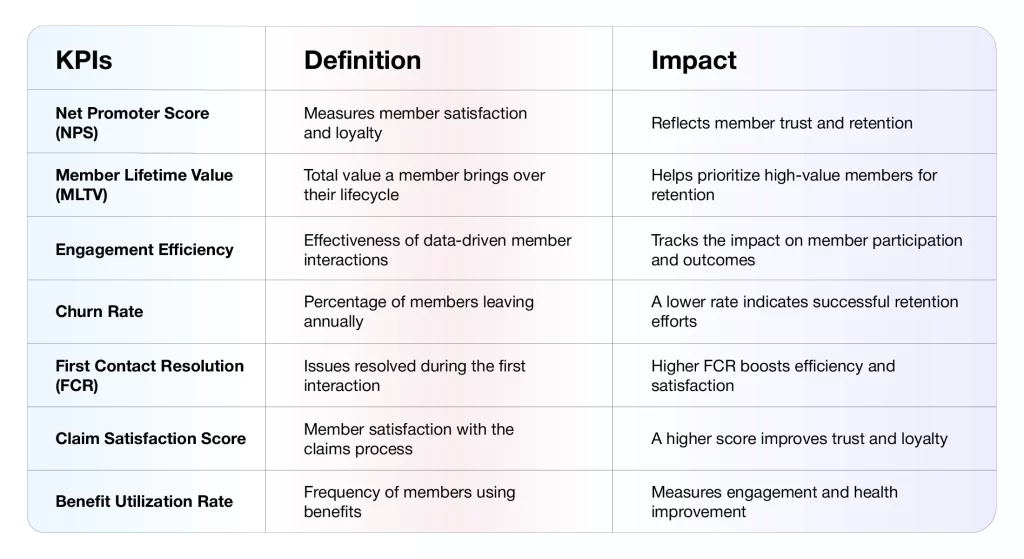

Measuring What Matters : The New KPIs for Member Experience

In the era of data intelligence, traditional metrics like “Average Handle Time” (AHT) have begun to lose relevance. For instance, if a member saves themselves a further call by allowing a 10-minute dialogue to resolve a major issue, since an AI agent handled it, that’s a win, not a loss.

The real question leaders must confront is: Are we truly progressing toward improving member outcomes in ways that are measurable, repeatable, and scalable?

Such an obstacle calls for a totally different set of KPIs; one that measures the performance of intelligence-driven experiences quite accurately.

Key KPIs for Data-Driven Member Experiences

Final Thoughts

The 2026 healthcare landscape will be divided into two camps: those who use data to report on the past, and those who use healthcare data intelligence to own the future.

Healthcare data intelligence makes this shift possible by enabling:

- Higher retention through proactive, personalized engagement.

- Minimized cost-to-serve by addressing issues at the earliest stages.

- Stronger member trust built on consistency, speed, and relevance.

For healthcare insurers, data intelligence is no longer an enhancement; it’s foundational. It’s this intelligence that supports wiser engagement, better decision-making, and gradual growth, even in a highly volatile and competitive market.

Ready to turn member data into actionable intelligence?

Get in touch to see how AVIZVA helps healthcare insurers deliver truly member-first experiences powered by data intelligence.

FAQs

- How can data intelligence decode member behavior?

Data intelligence connects interaction, service, and engagement signals to reveal patterns behind member actions. Instead of looking at isolated events, it identifies intent, friction points, and behavior shifts as they happen. This enables insurers to understand:

- Why engagement drops

- When dissatisfaction begins

- Which signals indicate churn risk early

- What are common use cases of data intelligence for improving member experience?

Healthcare data intelligence helps insurers move from reactive support to proactive engagement by enabling:

- Personalized onboarding and engagement journeys.

- Detecting early signs of members in trouble or disengaging.

- Reaching out proactively for claim delays or repeat inquiries.

- Offering smart suggestions on benefits and programs, based on behavioral models.

- What role does AI / predictive analytics play in healthcare data intelligence?

AI and predictive analytics turn raw data into forward-looking insight. They analyze historical and real-time patterns to anticipate member needs before issues surface. Key roles include:

- Predicting churn or disengagement risk.

- Identifying likely service or claim processing confusion.

- Continuously improving recommendations based on outcomes.

- What are the main challenges of implementing data intelligence in healthcare?

The biggest challenges aren’t technology alone, they’re execution and readiness. Common hurdles include:

- Analytics environments focused on reporting, not action.

- Limited ability to connect behavior signals across touchpoints.

- Lack of real-time insight adoption across teams.

- Difficulty translating insights into consistent member-facing actions.